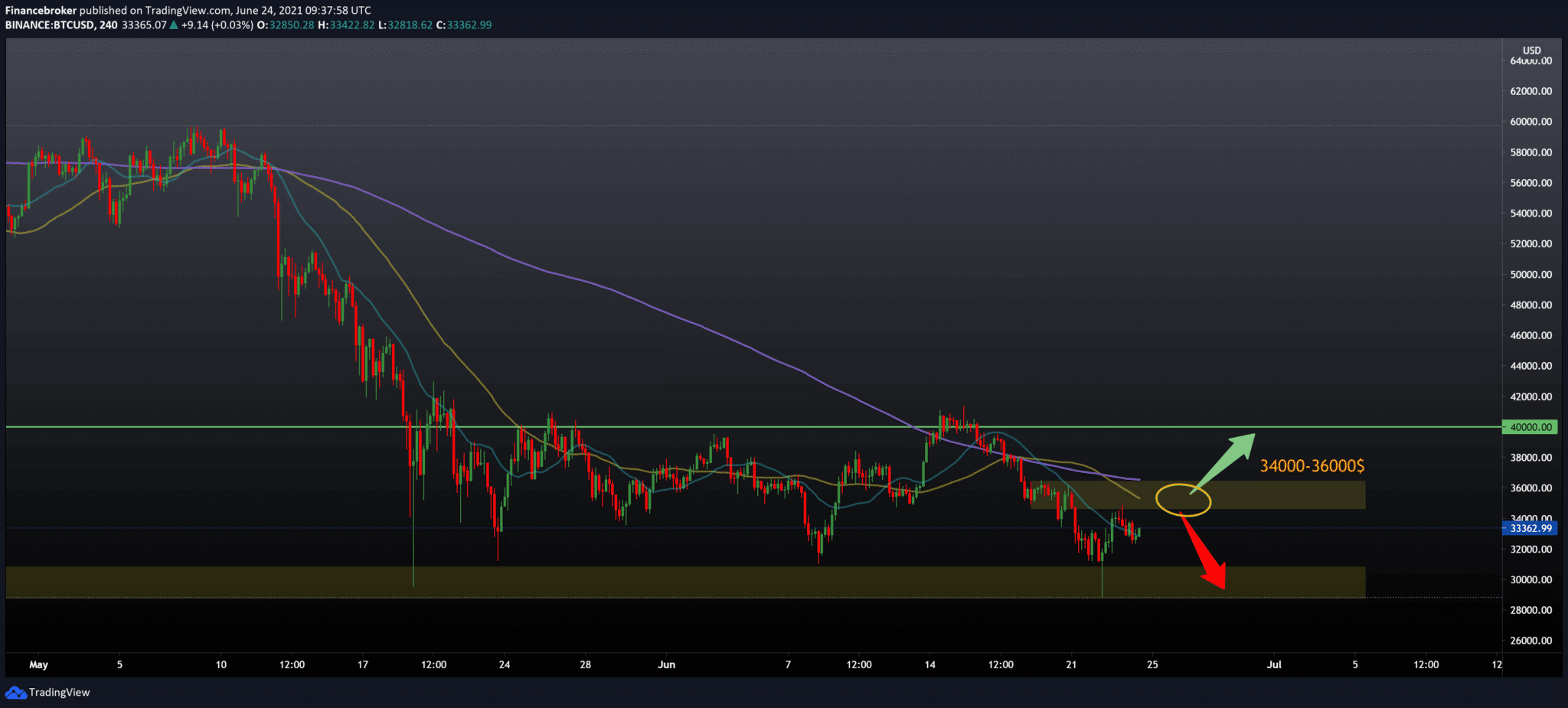

Bitcoin Chart Analysis: $34,000 as an Obstacle

Cryptocurrency traders received a debugging of the bearish scenario on June 23, after Bitcoin’s short recovery to $ 34,880.

According to CoinMarketCap, the total market capitalization of cryptocurrencies fell by nearly $ 230 billion between June 20 and June 22. They managed to recover to $ 76 billion on June 23. Now Bitcoin stands at $ 1.365 trillion as some traders adjust considered the possibility of buying a dip. The market capitalization for Bitcoin fell by $ 68 billion, or about 11% of its total value, on June 22, but has since recovered all losses and is actually now higher than it was before yesterday’s crash, and currently stands at $ 630 billion.

Bitcoin Sales

Private cryptocurrencies such as Bitcoin may attract attention. Still, the role of regulators and policymakers as key gatekeepers is likely to limit their potential to catalyze true transformational change, “JPMorgan wrote in a research note released Monday.

Broadly speaking, Bitcoin sales have coincided with a wider distance from risky assets. Particularly for stocks and cryptocurrencies in the last two months. As a result, the $ 30,000 support is critical for Bitcoins, although the resistance is strong at $ 40,000.

The fall in global interest rates has boosted the search for profit. Especially as central banks remain committed to flexible monetary policy, these easy money policies have favored risky assets. Mainly for assets such as corporate bonds, debt in new markets, and more recently, cryptocurrencies. Therefore, any evidence that easy money ends up holding a stronger central bank stance is likely to move for speculative assets.

The dominance rate of Bitcoin, but it still has the largest share of cryptocurrency in the total crypto-market. It dropped below 40% in May, which preceded the price drop of close to 30%. However, since then, the rate of dominance has stabilized, suggesting that Bitcoin regains its luster.

-

Support

-

Platform

-

Spread

-

Trading Instrument