Bitcoin as real estate

A large increase in financial advisors who add crypto assets to their client’s portfolios. The Association for Financial Planning report, published on June 1, dealt with the change in the attitude of its clients towards crypto assets. A survey on investment trends in 2021 found that more financial advisors than ever before recommending their clients to have some cryptocurrencies in their portfolio, and clients are increasingly inquiring about investing in cryptocurrencies.

The survey, conducted in March and received 529 responses from professional financial advisors who offer clients investment advice and recommendations.

He states that 14% of financial advisors have already added crypto assets to their clients’ portfolios or recommended it to them. They plan to do so even more over the next year. The research revealed that this number is significantly higher than the previous year when less than 1% of advisors recommended exposure to cryptocurrencies.

Less than half of the financial advisors claimed to read news about cryptocurrencies occasionally and are somewhat comfortable talking about them. A third of advisors are actively educating about digital assets.

Clients are less worried this year about market volatility than last year, the survey found. More than half of financial advisors said their clients inquired about market volatility in the last six months, compared to 76% for the previous year. Crypto assets may attract investors as protection against inflation, which has deteriorated during the pandemic and ongoing fiscal stimulus packages.

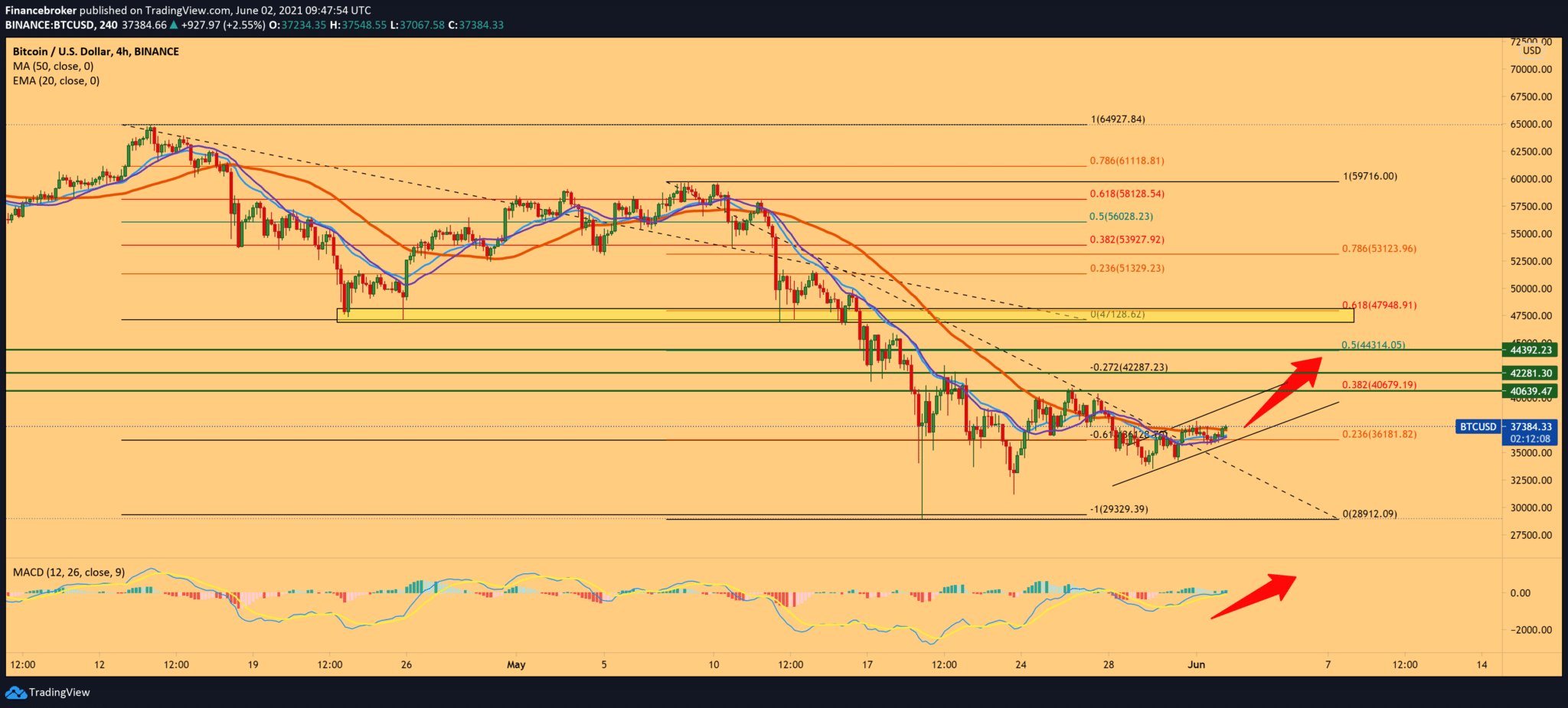

Looking at the chart on the four-hour time frame, we see that Bitcoin finds support at 23.6% at $ 36,180 and has current support for moving averages MA20, EMA20, and now we expect to get MA50 support for a stronger bullish momentum as well. As the next bullish target, we look at the 38.2% Fibonacci level at $ 40,600. Looking at the MACD indicator, we have a solid bullish signal that currently supports the price of Bitcoin. We need a pull below 23.6% Fibonacci level for the bearish scenario to look towards the lower levels on the chart.

-

Support

-

Platform

-

Spread

-

Trading Instrument