Bitcoin and Ethereum Will Come Under More Pressure

- Yesterday, the price of Bitcoin failed to consolidate and move above the $20,000 level.

- The price of Ethereum managed to move from the minimum to $1420 yesterday.

- JPMorgan’s David Kelly believes cryptocurrencies will come under more pressure after the Fed signaled a continuation of its aggressive rate hike policy.

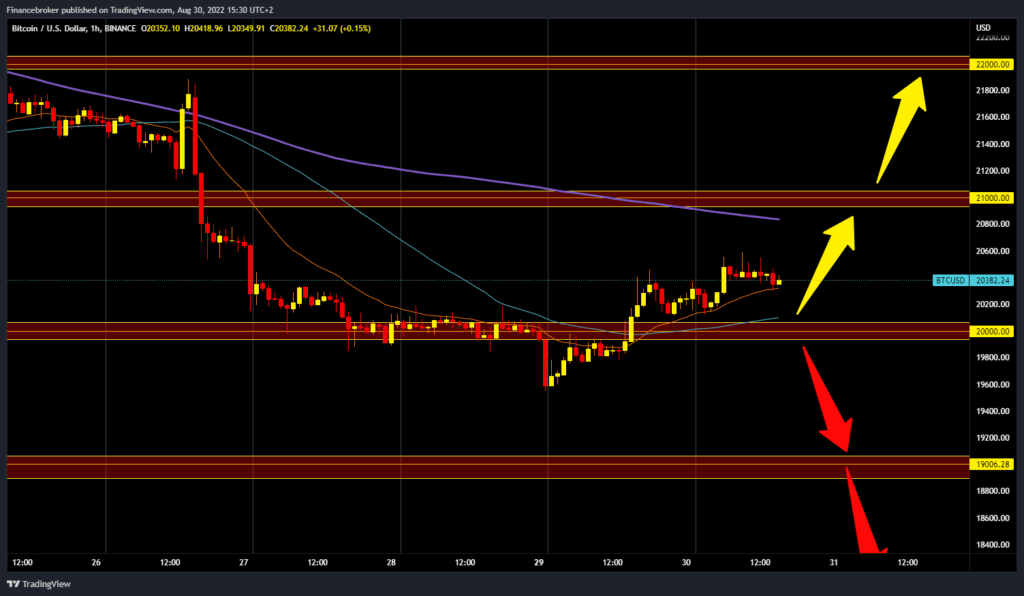

Bitcoin chart analysis

Yesterday, the price of Bitcoin failed to consolidate and move above the $20,000 level. Today we continue on the bullish side, and the maximum was at the $20600 level. The MA20 and MA50 moving averages are on the bullish side and could now push the price up to the $21000 level. Additional resistance at that level is in the MA200 moving average. For a bullish option, we need a break above the $21000 level, and we must try to stay above that. After that, we need a continuation of positive consolidation, and the targets are $21500 and $22000. For a bearish option, we need a price pullback to support at $20,000. A break below would introduce new uncertainty into the price of Bitcoin, and we could see further declines. Potential lower targets are $19,500 and $19,000 levels.

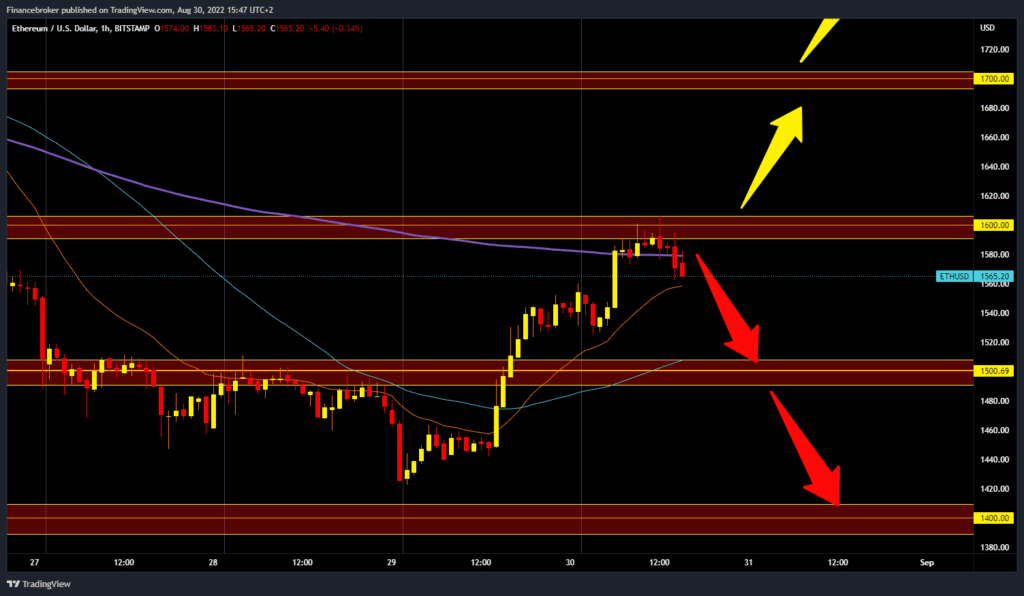

Ethereum chart analysis

The price of Ethereum managed to move from the minimum to $1420 yesterday. After a couple of hours of consolidation, a bullish impulse followed that moved us above the $1500 level, and now we are already testing the $1600 resistance level. Additional pressure at this point can be in the MA200 moving average. For a bullish option, we need a break above and try to consolidate above. After that, Ethereum could try to continue towards $1650, then to $1700, the next resistance level. For a bearish option, we need a negative consolidation from this level. We then move below the MA20 moving average, which would add further pressure on the volatile Ethereum price. Potential lower targets are the $1550 and $1500 levels, and additional support at that level is in the MA50 moving average.

Market Overview

JPMorgan’s David Kelly believes cryptocurrencies will come under more pressure after the Fed signaled a continuation of its aggressive rate hike policy. David Kelly, the chief global strategist at JPMorgan Asset Management, argues that investors should abandon the cryptocurrency, a statement to Bloomberg. Kelly is convinced that the consistent hawkish policy of the US Federal Reserve will bring more problems for digital assets.