Bitcoin and Ethereum: Weekly low

- The price of Bitcoin continues to fall, descending ever closer to the $23,000 support zone.

- Yesterday, the price of Ethereum fell to its weekly low at the $1825 level.

- Concerns about a deeper pullback in risk assets became widespread during the week, with Bitcoin and Ethereum unable to break through long-term resistance levels.

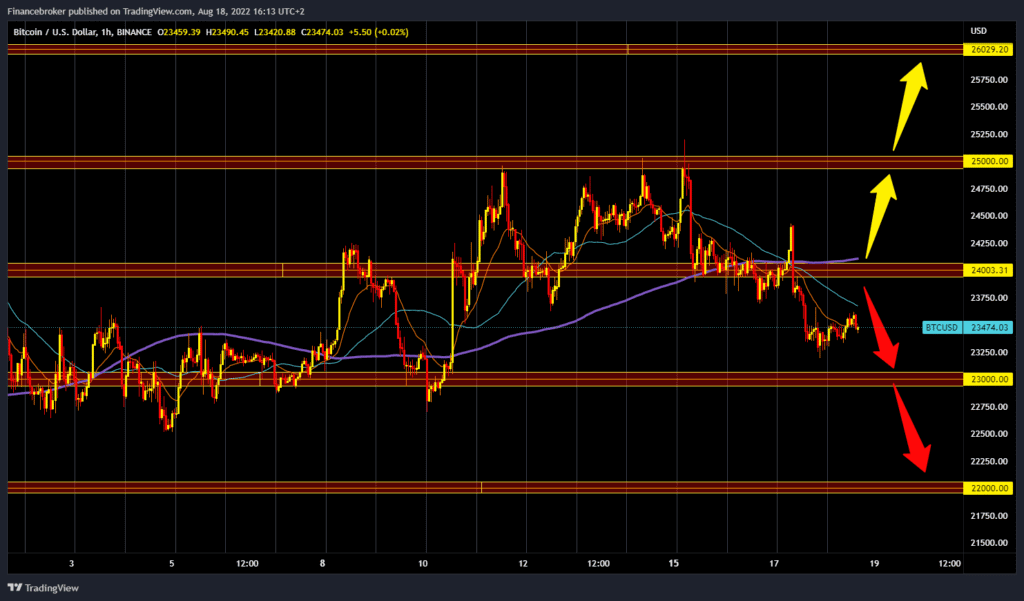

Bitcoin chart analysis

The price of Bitcoin continues to fall, descending ever closer to the $23,000 support zone. Yesterday’s low was at $23185. Since then, we have slightly recovered to the $23600 level. We can say that the price is calm and without sudden movements today. The MA20 and MA50 moving averages are in the zone around the $23,600 level, while the MA200 is at the $24,000 level. We need bullish consolidation to take us up to the upper resistance. Then we could try to break above and hold there. After that, the price could increase, and potential targets are $24500 and $25000. We need a negative consolidation and a pullback to the $23000 support zone for a bearish option. Potential lower targets are $22500 and $22000 levels. The general movement of Bitcoin in August is between the $23000-$25000 level.

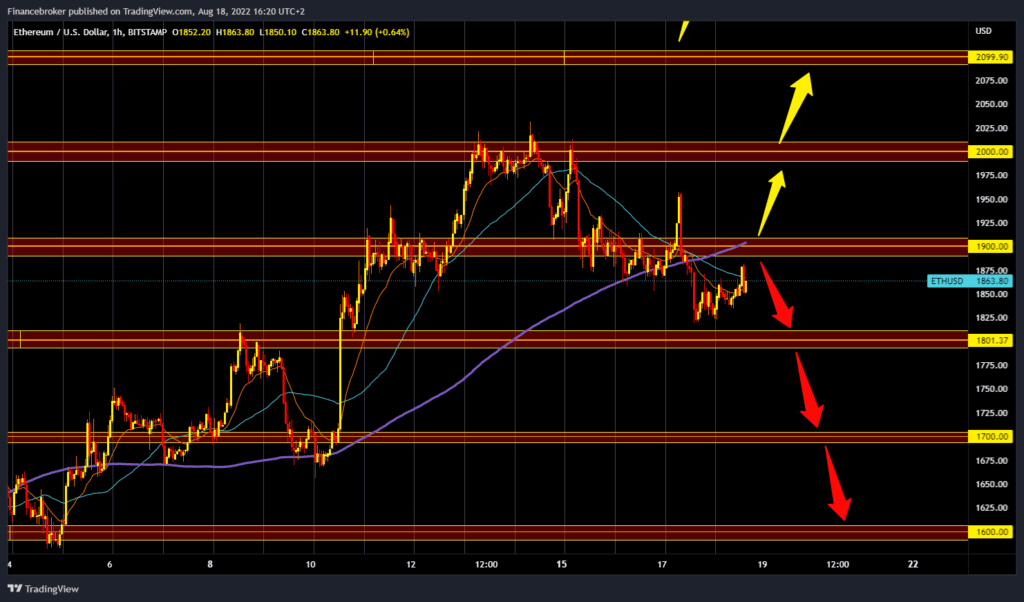

Ethereum chart analysis

Yesterday, the price of Ethereum fell to its weekly low at the $1825 level. After that, we see a short recovery to $1875, then a new pullback to the $1850 level. Today’s consolidation is narrow but with bullish indications. For a bullish option, we need a continuation of this positive consolidation and a price rally to the $19,000 level. Additional resistance at that point is in the MA200 moving average. A break above would give us a chance to try to continue upwards. Potential higher targets are the $1950 and $2000 levels. For a bearish option, we need a negative consolidation and a fall in the price of Ethereum to the $1800 support zone. A price break below would increase the bearish pressure so that we could continue even lower. Potential lower targets are $1750 and $1700 levels.

Market overview

Concerns about a deeper pullback in risk assets became widespread during the week, with Bitcoin and Ethereum unable to break through long-term resistance levels. In today’s interview, Isabelle Schnabel, a member of the ECB Executive Board, could not say with certainty that inflation has reached its peak. The EU data came a day after the UK recorded 10.0% inflation, the highest since the 1982s.