Bitcoin and Ethereum: The Up Trend You’ve been Waiting For

- The price of Bitcoin is slowly managing to consolidate above the $20,000 level and move out of the uncomfortable zone.

- The price of Ethereum is currently in the upper zone of $1350-1400.

- Russia has finally decided to allow the international trading of bitcoins and cryptocurrencies for any industry without restrictions.

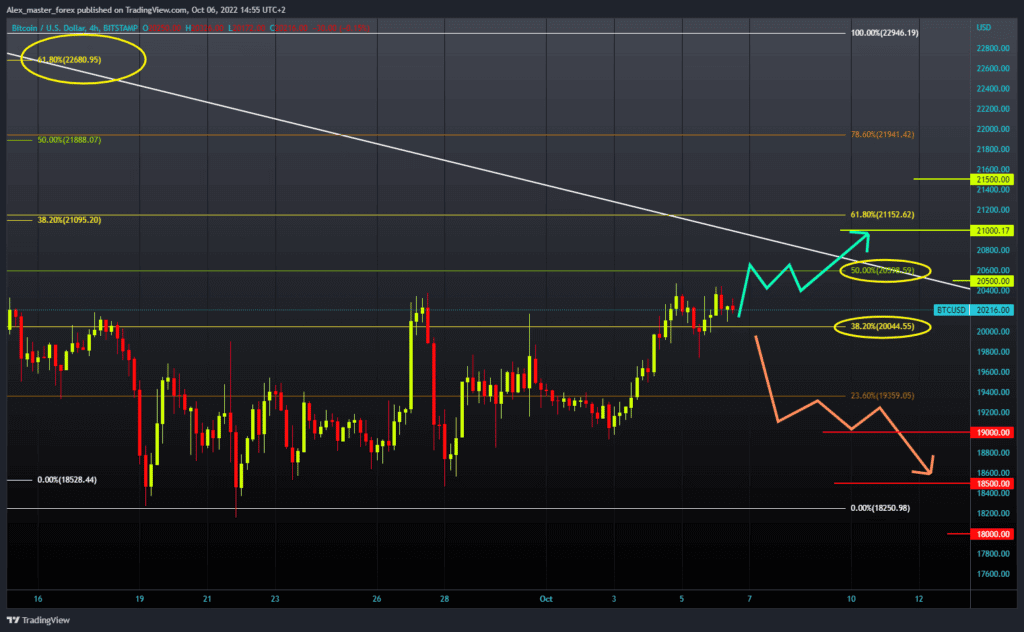

Bitcoin chart analysis

The price of Bitcoin is slowly managing to consolidate above the $20,000 level and move out of the uncomfortable zone. For a bullish option, we now need a positive consolidation and a move toward $20500 at the 50.0% Fibonacci level. Then we need to hold on there and try with a new bullish impulse to continue the recovery to the $21000 level. For a bearish option, we need a negative consolidation, a fall in the price of Bitcoin below the $20000 level. Then we have to hold below there, and that would put more pressure on Bitcoin, and we would see further price pullback. Potential lower targets are $19500 and $19000 levels.

Ethereum chart analysis

The price of Ethereum is currently in the upper zone of $1350-1400, and we are now following a consolidation pattern that could push the price of ETH toward the $1440 level at the 38.2% Fibonacci level. Together we would form a new higher high and move the movement zone to a higher level. A potential higher target is the $1500 level. We need a negative consolidation and a return below the $1350 level for a bearish option. With increased bearish pressure, the price should continue to slide to the lower support zone. Potential lower targets are $1250 and $1200 levels.

Market Overview

Russia has finally decided to allow the international trading of bitcoins and cryptocurrencies for any industry without restrictions. With the invasion of Ukraine and the sanctions of many countries that disabled Russia’s access to the world banking system, the country changed its attitude towards adopting Bitcoin and cryptocurrency for transactions. Now Moscow is turning to cryptocurrency and plans to introduce a digital ruble early next year. In this way, it would modernize its financial system and increase its influence in the global financial system.