Bitcoin and Ethereum: Static Support or Dynamic Resistance!

- The bitcoin price fell to the $19,000 level this morning, where it found support and managed to increase to the $19,200 level.

- The price of Ethereum fell again this morning to the support zone at the $1265 level.

- Investments in crypto funds fell last week after three weeks of small inflows, according to CoinShares. Outflows amounted to 5 million dollars.

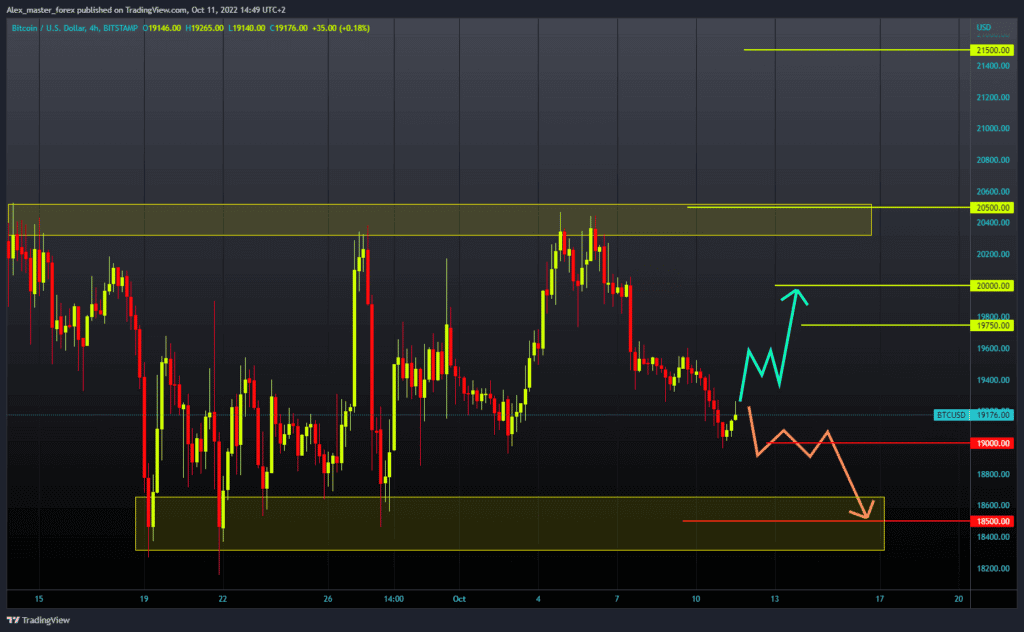

Bitcoin chart analysis

The bitcoin price fell to the $19,000 level this morning, where it found support and managed to increase to the $19,200 level. To continue the bullish option, we need a new positive consolidation and a move to the $19500 level. After that, we would find ourselves in the place of the previous consolidation. From here, the price could continue towards $19750 and $20000 levels with a new bullish impulse. For a bearish option, we need a continuation of the negative consolidation and a retest of the support at the $19000 level. A price break below would increase the bearish pressure, which would further lower the price. A potential lower target is the $18400-$18600 support zone.

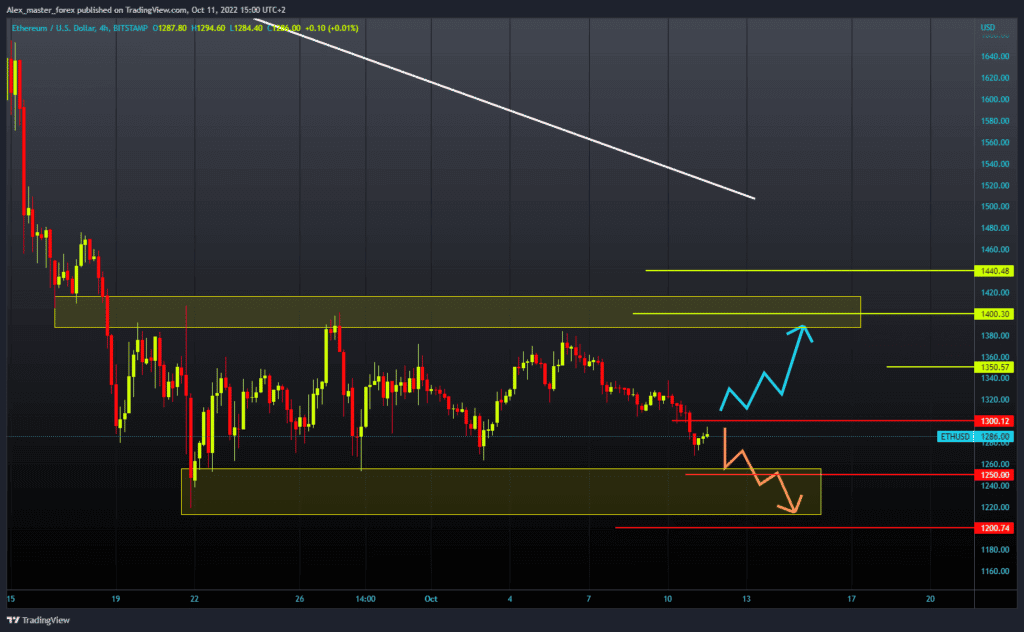

Ethereum chart analysis

The price of Ethereum fell again this morning to the support zone at the $1265 level. After that, it finds support at that point and recovers to the $1295 level. To continue the bullish option, we need a new growing impulse that would further move us up to the $1350 level. If we could manage to stay up there, we would have a new chance to continue toward the $1400 resistance level. We need a negative consolidation and a price drop to the $1250 support level for a bearish option. We would then again find ourselves in the critical zone, and the price could fall further due to the pressure and form a new lower low. Potential lower targets are $1225 and $1200 levels.

Market Overview

Investments in crypto funds fell last week after three weeks of small inflows, according to CoinShares. Outflows amounted to 5 million dollars. Trade volume remains historically low; investors are waiting for signals from the Fed whether it is ready to reconsider its hawkish monetary policy.