Bitcoin and Ethereum: Solid bullish trend

- Last night, the price of Bitcoin managed to make a more concrete breakthrough above $20000.

- During today’s day, Ethereum’s price is consolidating between $1100-1200.

- The Coinbase Institute published a blog on cryptocurrency prices, stating that experts believe crypto assets will become further connected to the existing financial system.

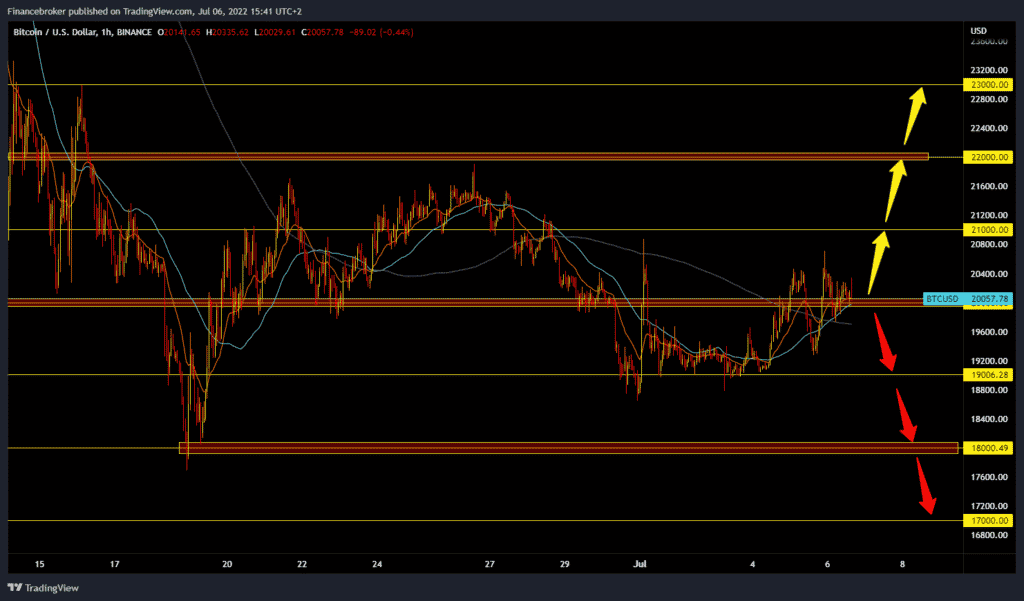

Bitcoin chart analysis

Last night, the price of Bitcoin managed to make a more concrete breakthrough above $20000. Last nights high was at $20710. After that, the price ranged from $19,800 to $20,400. The moving averages are on the bullish side for now, and now we are all waiting for a bullish impulse that would push the price above $21000. After that, if bitcoin manages to hold at that level, we could try to climb that $22000 resistance zone. For a bearish option, we need a price pullback below $20000 and below the moving averages. After that, we expect the price to drop to the lower support zone around the $19,000 level with negative consolidation. Potential lower targets are the $18,500 and $18,000 support zones.

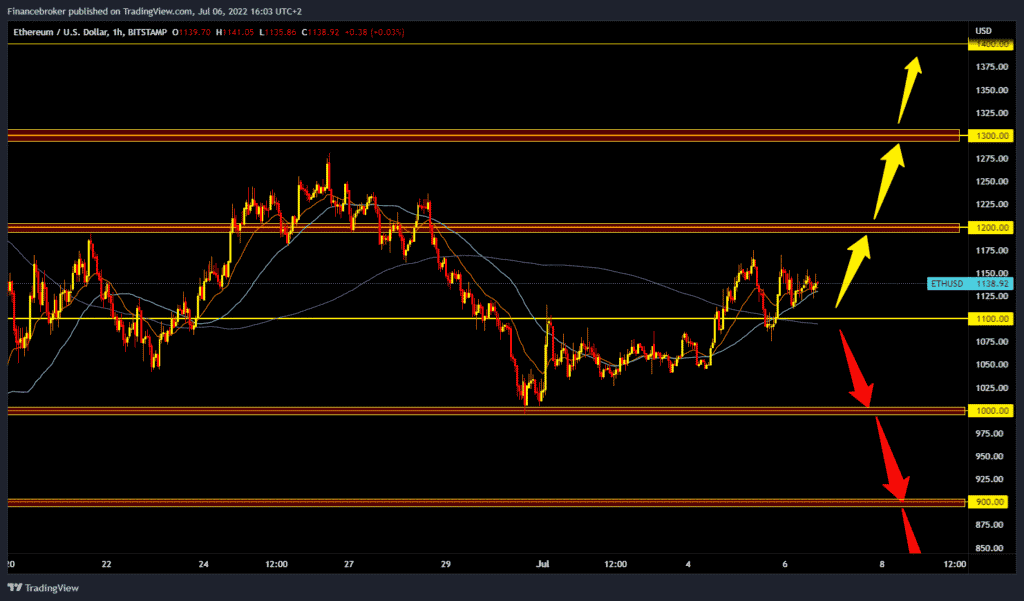

Ethereum chart analysis

During today’s day, Ethereum’s price is consolidating between $1100-1200. We can say that we are in a solid bullish trend after the price dropped to the $1000 level on June 30. We have support in the moving average, and we need a stronger bullish impulse to move us away from the critical zone. Our next target is the $1200 level, and there we are very close to the previous high at $1237. If we manage to hold above the $1200 zone, Ethereum could more easily continue its recovery. Our potential higher target is the $1300 level. For a bearish option, we must first pull back below $1100 and the moving averages. Then they would be looking towards the $1000 support zone.

Market overview

The Coinbase Institute published a blog on cryptocurrency prices, stating that experts believe crypto assets will become further connected to the existing financial system. It also noted that the crypto risk profile is similar to oil prices and tech stocks and that macroeconomic factors caused 2-thirds of the decline in cryptocurrencies. In contrast, the other third was caused by a weakening outlook for cryptocurrencies in general. In the current macroeconomic conditions, cryptocurrencies are expected to continue to fall as long as the stock market does the same because the Federal Reserve will continue to raise interest rates.

While experts believe that the bottom of the crypto market may finally come, another crypto lender Voyager Digital has gone bankrupt. The cryptocurrency lender joined a long list of firms that collapsed in the bear market. The crypto lender’s fall is linked to Three Arrows Capital and Samuel Bankman Fried’s Alameda Research. Digital asset brokerage Voyager Digital filed for bankruptcy on July 5. In Chapter 11, a plan is to pay off all or part of the debt to creditors. Based on information from the filings, Voyager Digital owes more than 100,000 creditors.