Bitcoin and Ethereum: Price instability

- The excellent results of the NFP pushed the dollar, and such a move stopped the rally of Bitcoin.

- The price of Ethereum started the day at the $1,600 level.

- The United States Senator Cynthia Loomis’ staff believes that the US Congress will have to step in and resolve the dispute between the Securities and Exchange Commission.

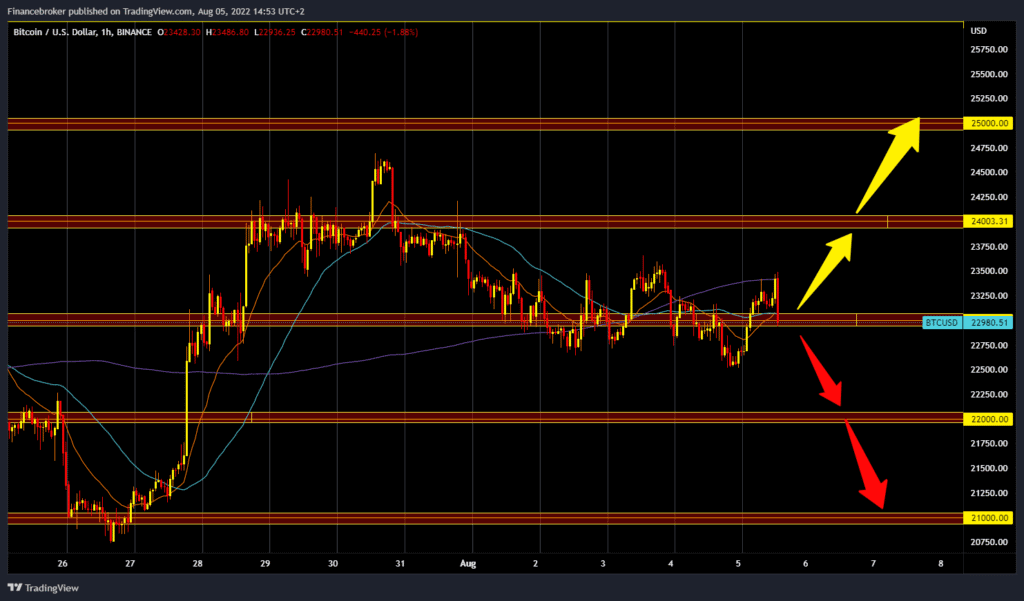

Bitcoin chart analysis

The excellent results of the NFP pushed the dollar, and such a move stopped the rally of Bitcoin. The price stopped at $23400 and retreated to the $23090 level. We are now looking to see if the price will manage to hold above or if it will buckle and fall below. Our first target is yesterday’s low at $22500. Our potential lower target supports at the $22,000 level. Fear could creep into bitcoin again, and that would further lower the already shaky price. We must go back above the $23000-23500 zone for a bullish option again. After that, with a positive consolidation, the price could go up to the $24000 resistance zone. And if it manages to stay above, then it will continue towards the $25000 level.

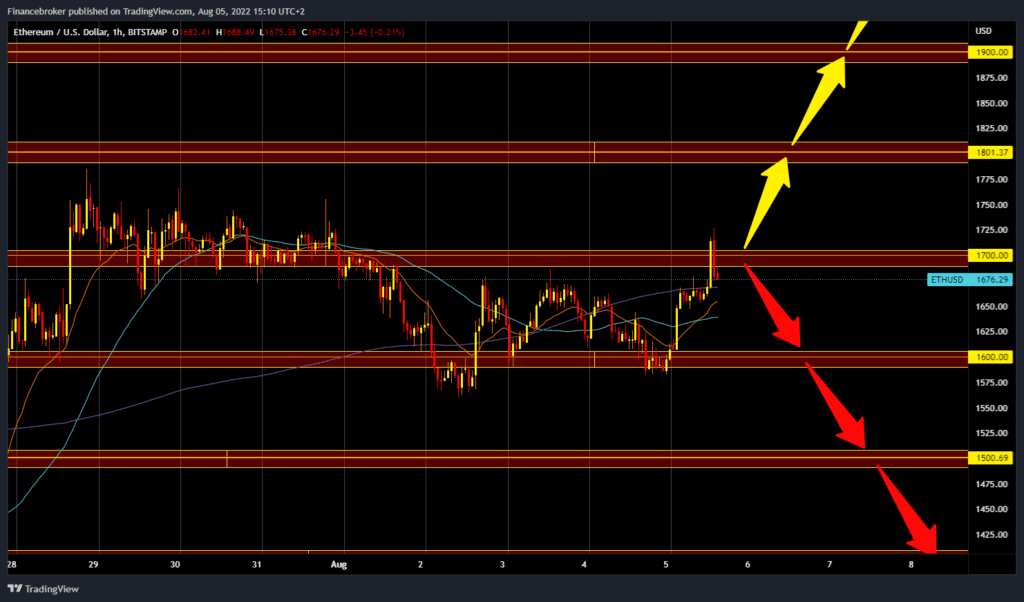

Ethereum chart analysis

The price of Ethereum started the day at the $1,600 level. Then followed a bullish impulse and a positive consolidation that pushed the price above $1,700. Today’s high was stopped at $1,725, followed by a new price pullback below the $1,700 level. Positive news from the US market strengthened the dollar index, which led to a drop in the value of ETH. For a bullish option, we need a new positive consolidation and a return to the resistance zone at $1,750. A break above the price could send us up to the $1800 level. We expect a continuation of negative consolidation and a retreat towards this morning’s support zone for the bearish option. If it does not provide us with sufficient support, a further drop in the price could be expected during the weekend. Potential targets are $1,550 and $1,500 levels.

Market Overview

The United States Senator Cynthia Loomis’ staff believes that the US Congress will have to step in and resolve the dispute between the Securities and Exchange Commission and the Commodity Futures Trading Commission over who regulates cryptocurrencies if the matter cannot be resolved internally.

The problem dates back to 2014 when the CFTC first asserted jurisdiction over virtual currencies. This was later confirmed by a US Federal Court ruling in 2018, which stated that the CFTC has jurisdiction to prosecute criminals in fraud cases involving virtual currencies. However, the SEC has investigated chiefly crypto exchanges and crypto assets in the US to date.

On August 3, Senators Debbie Stabenow and John Boozman introduced the Digital Products Consumer Protection Act of 2022. If the US Legislature passes the bill, the CFTC will gain the rights to regulate digital goods.