Bitcoin and Ethereum: Pressure on all Cryptocurrencies

- The bitcoin price is moving in the range of $21,000 to $22,000 for the fourth day.

- Today, the price of Ethereum was in the range of $1550-$1650.

- Bitcoin is starting to lose investor confidence as a potential hedge against inflation.

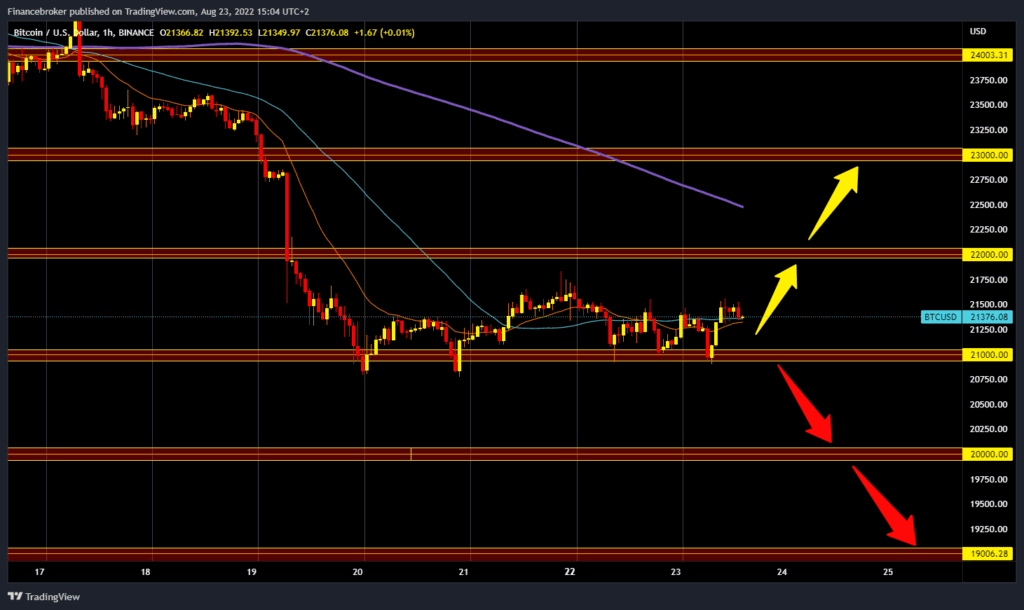

Bitcoin chart analysis

The bitcoin price is moving in the range of $21,000 to $22,000 for the fourth day. The movement is closer to the lower support zone because we have seen a break below it a couple of times, but we have always gone back to the original position. Today’s price high was at the $21500 level, and the MA20 and MA50 have slowly moved to the bullish side and could help the price move closer to the upper resistance zone. For a bullish option, we need a positive consolidation and a move towards the $22000 level. Then we would have to make a break above and try to hold above the $22000 level. Potential higher targets are $22500 and $23000 levels. For a bearish option, we need a negative consolidation and a new price pressure on the $21000 support level. A break below this level would increase the bearish pressure. Potential lower targets are $20,500 and $20,000.

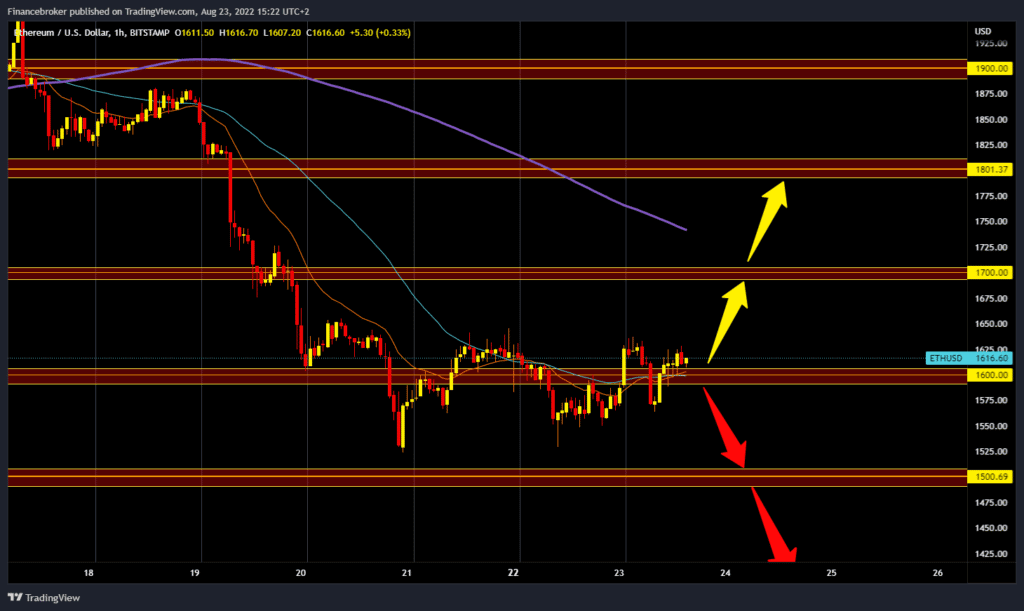

Ethereum chart analysis

Today, the price of Ethereum was in the range of $1550-$1650. And now we are in the middle of the $1600 level. A strong dollar continues to put pressure on all cryptocurrencies, so the recovery is very slow and uncertain. MA20 and MA50 are at the $1600 level and provide immediate price support. For a bullish option, we need a new positive consolidation that would move beyond this support. Potential higher targets are $1650 and $1700 levels. We need a negative consolidation and a further drop below the $1600 level for a bearish option. After that, the moving averages move to the bearish side. Potential lower targets are $1550 and $1500 levels. The August low is $1525, and we could expect the following support and price fluctuations.

Market Overview

Bitcoin is starting to lose investor confidence as a potential hedge against inflation. BTC has been touted as a safe haven from the economic effects of macroeconomic conditions, but Bitcoin seems to have failed to shake off this status of late. SkyBridge Capital CEO Scaramucci gave his views on the current conditions in the crypto market on CNBC’s Squawk Box on Monday. He believes that Bitcoin is not yet a serious and stable enough asset to be considered a potential hedge against inflation. Bitcoin, once immune to inflation, especially during the COVID-19 pandemic, now seems to be collapsing with traditional stocks.