Bitcoin and Ethereum: Potential bullish recovery

- Early this morning, the price of Bitcoin found support at $22,700 and has been in a bullish trend ever since.

- Ethereum’s price dropped to $1560 yesterday and has been in a bullish trend since then.

- Institutions increase their crypto assets in July.

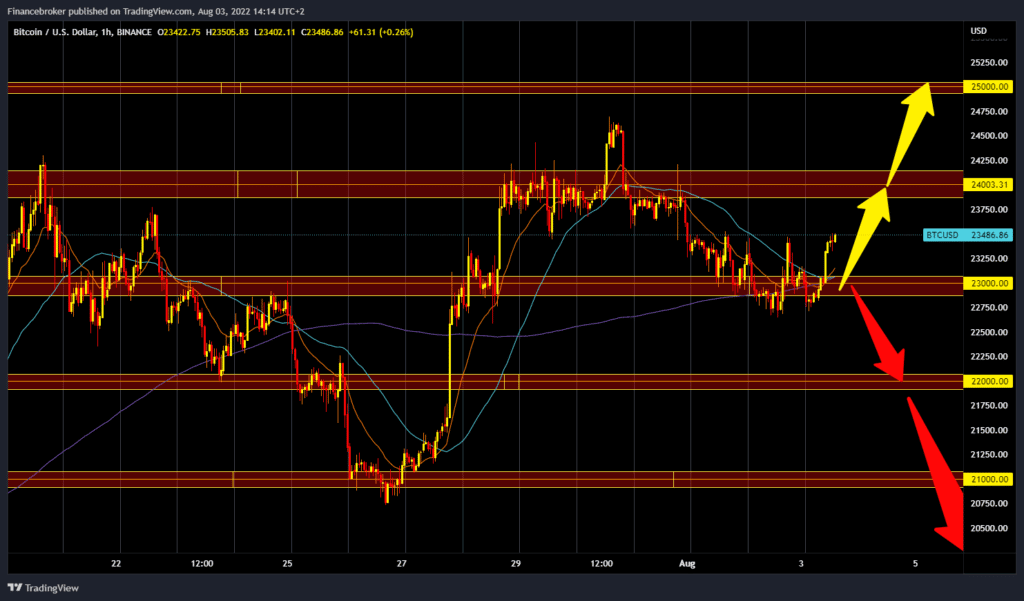

Bitcoin chart analysis

Early this morning, the price of Bitcoin found support at $22,700 and has been in a bullish trend ever since. We are currently at $23,445, which represents a 1.98% increase from the start of trading last night. The moving averages are again bullish, and we could expect another recovery to $24,000. Above, we are already entering the critical zone because, in the previous few attempts, it represented an obstacle to a potential bullish recovery. We need a negative consolidation and a return below the $23,000 level for a bearish option. We are again breaking below the MA200 moving average. The formation of a new lower low is a sign that we can expect a further price drop to the $22,000 level. If that level does not provide us with adequate support, the price could continue to last week’s minimum at the $21,000 level.

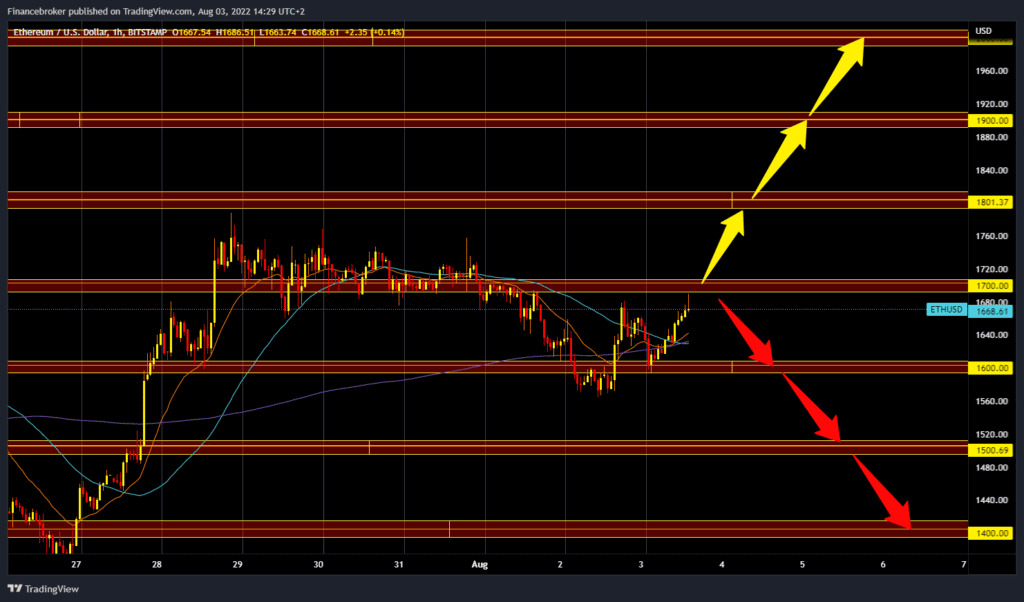

Ethereum chart analysis

Ethereum’s price dropped to $1560 yesterday and has been in a bullish trend since then. Yesterday’s attempt to climb above the $1700 level was unsuccessful, as we saw a new pullback to the $1600 level. There we find new support and form a new higher low. Since then, a new bullish impulse started, and the price of Ethereum again attacked the $1700 resistance zone. A break above would open a potential space towards the $1800 level. The last time we were at that level was at the beginning of June. For a bearish option, we need a negative consolidation from this level. Again, my target is the $1600 level. A break below would increase bearish pressure so that we could see a further price decline. Potential lower targets are $1500 and $1400 levels.

Market overview

Institutions increase their crypto assets in July

Institutions decided to buy cryptocurrencies during July, according to leading digital asset manager CoinShares. Digital asset investment products witnessed total inflows worth $474 million during July, the highest total for any month in 2022. The monthly total almost matched June’s $484 million worth of outflows, with the last week of July recorded inflows worth $81 million, the fifth consecutive week of inflows. Last week, nearly $85 million poured into Bitcoin investment products.

However, according to CoinShares, it’s not all bullish signs. Despite more bullish sentiment in the digital asset, trading activity remains very low, with last week’s volume totaling $1.3 billion compared to this year’s weekly average of $2.4 billion.