Bitcoin and Ethereum – Financial stability

- The price of Bitcoin is still unchanged in the range of 29000-31000 dollars.

- The price of Ethereum is in a similar situation. She failed to stay above $ 2,000 this morning.

- A meeting of G7 finance chiefs in Germany late last week cited crypto turmoil and called on its Financial Stability Board.

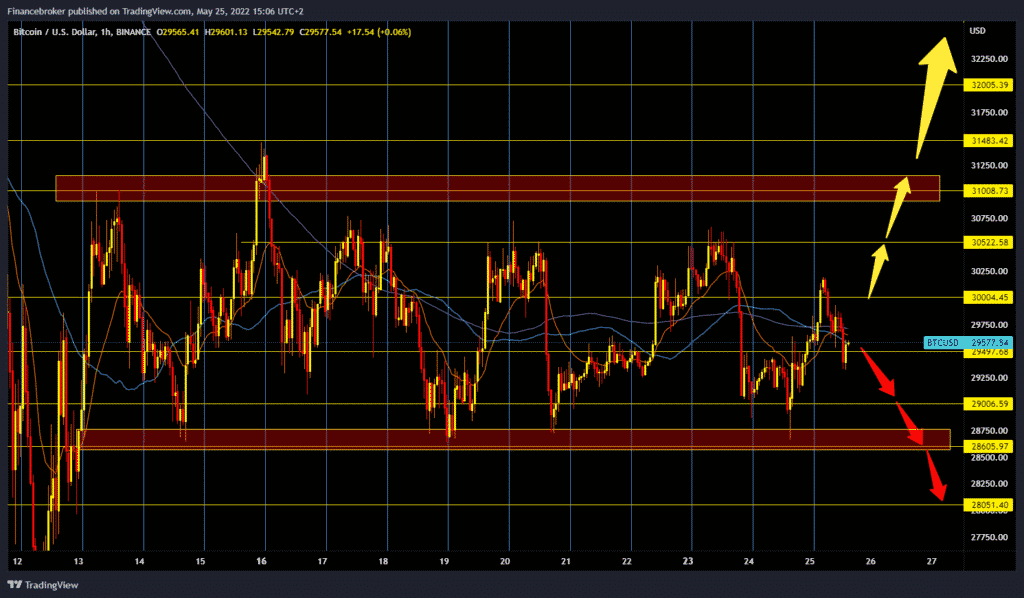

Bitcoin chart analysis

The price of Bitcoin is still unchanged in the range of 29000-31000 dollars. This morning, another attempt to climb to the upper resistance zone was stopped, and the price stopped to 30,200 dollars. After that, we have a pullback below $ 30,000. We have support at $ 29,300, and since then, the price has recovered. Bearish pressure is still present and could break below $ 29,000 and send the price of bitcoin into the zone around $ 25,000. We need to go back up to the lower zone for the bullish option and break the price above $ 31,000. After that, the price must remain above that level and consolidate for the next bullish impulse. Our potential bullish targets are $ 31,500, $ 32,000.

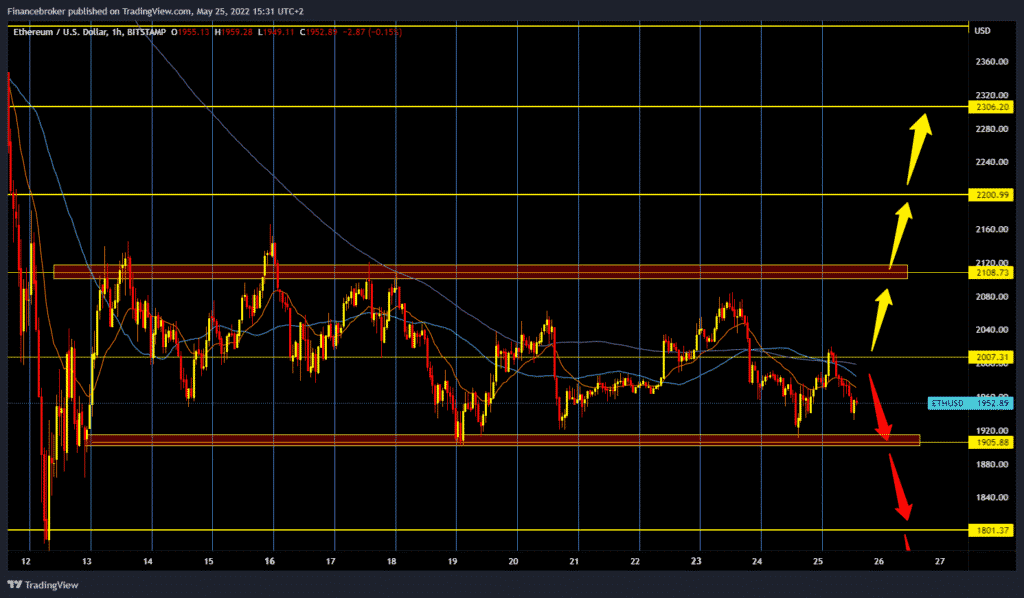

Ethereum chart analysis

The price of Ethereum is in a similar situation. She failed to stay above $ 2,000 this morning. We saw another withdrawal, and the price stopped at $ 1930. Bearish pressure seems to be getting stronger and could bring us down to $ 1,900 on another test. Then there could be a break below, which would lower the price to support $ 1,800. For the bullish option, we need a new price jump above $ 2,000. After that, we would again try to endanger the upper zone of resistance with bullish consolidation. A price break above would form a new higher high, which would be a sign of a price recovery and a potential continuation on the bullish side. Potential targets above are $ 2,200, then $ 2,300 levels.

Market overview

G7, Davos, crypto regulations

A meeting of G7 finance chiefs in Germany late last week cited crypto turmoil and called on its Financial Stability Board “to promote the rapid development and implementation of consistent and comprehensive cryptocurrency regulations.”

This week, the head of the French central bank, Francois Villeroy de Gallo, strengthened the message and increased the urgency at the World Economic Forum in Davos, warning of weak investment protection as well as the risks of money laundering.

Although still relatively small compared to stocks, bonds or real estate, two surveys released this week by the US Federal Reserve and the European Central Bank show that at least 10% of all households in both regions have tried cryptocurrencies as investments in 2021.