Bitcoin and Ethereum Daily Charts Analysis for July 29, 2021

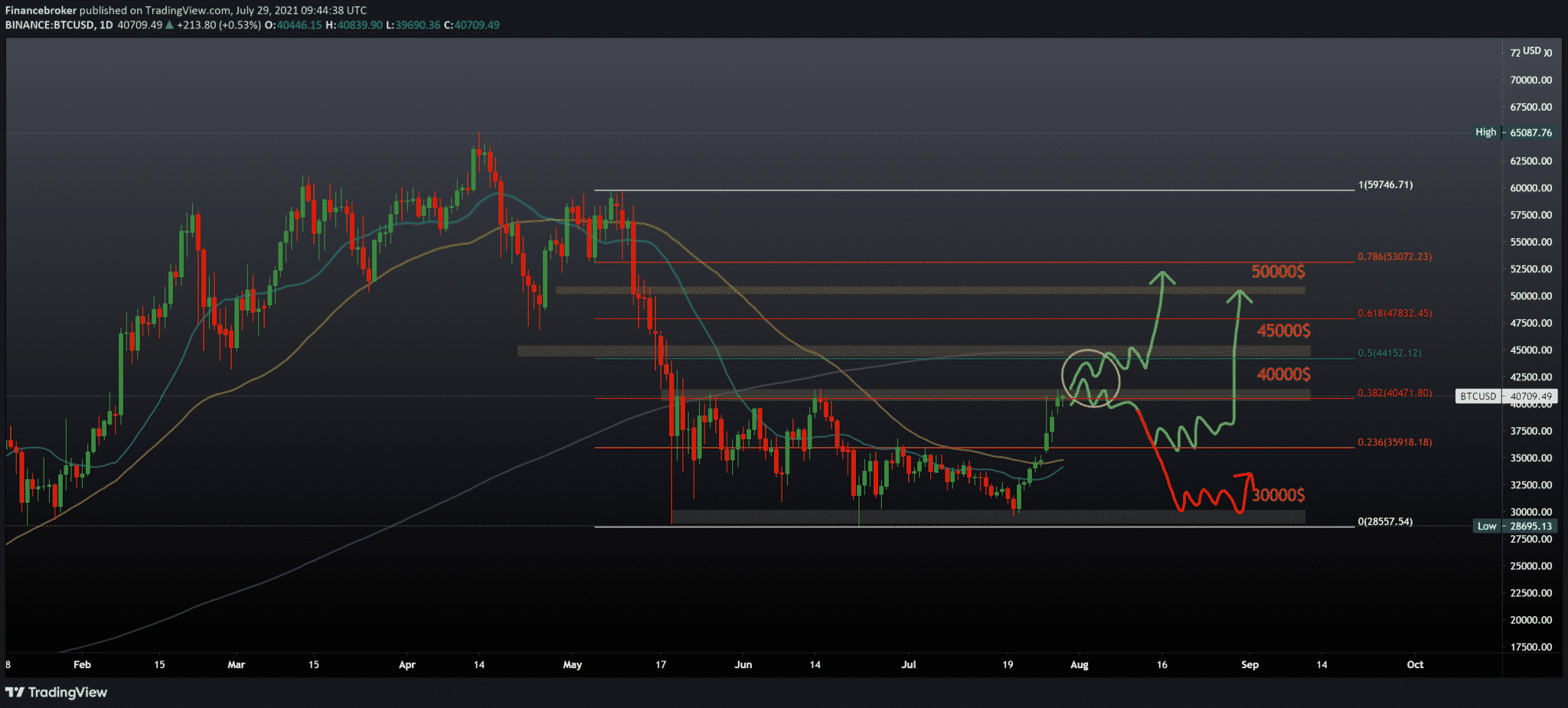

Following the Bitcoin chart on the daily time frame, we see that Bitcoin encounters the first resistance at $ 40,000. This resistance matches the 38.2% Fibonacci level. If we see a further break above $ 42,500, we can expect a further continuation towards the 50.0% Fibonacci level at $ 44,150, which coincides with the moving average of the MA200. The opposite scenario is that the price of Bitcoin encounters stronger resistance at this current level. After that, we can see a retreat towards 23.6% Fibonacci level at $ 35,920, seeking support in the moving averages of MA20 and MA50.

Ethereum

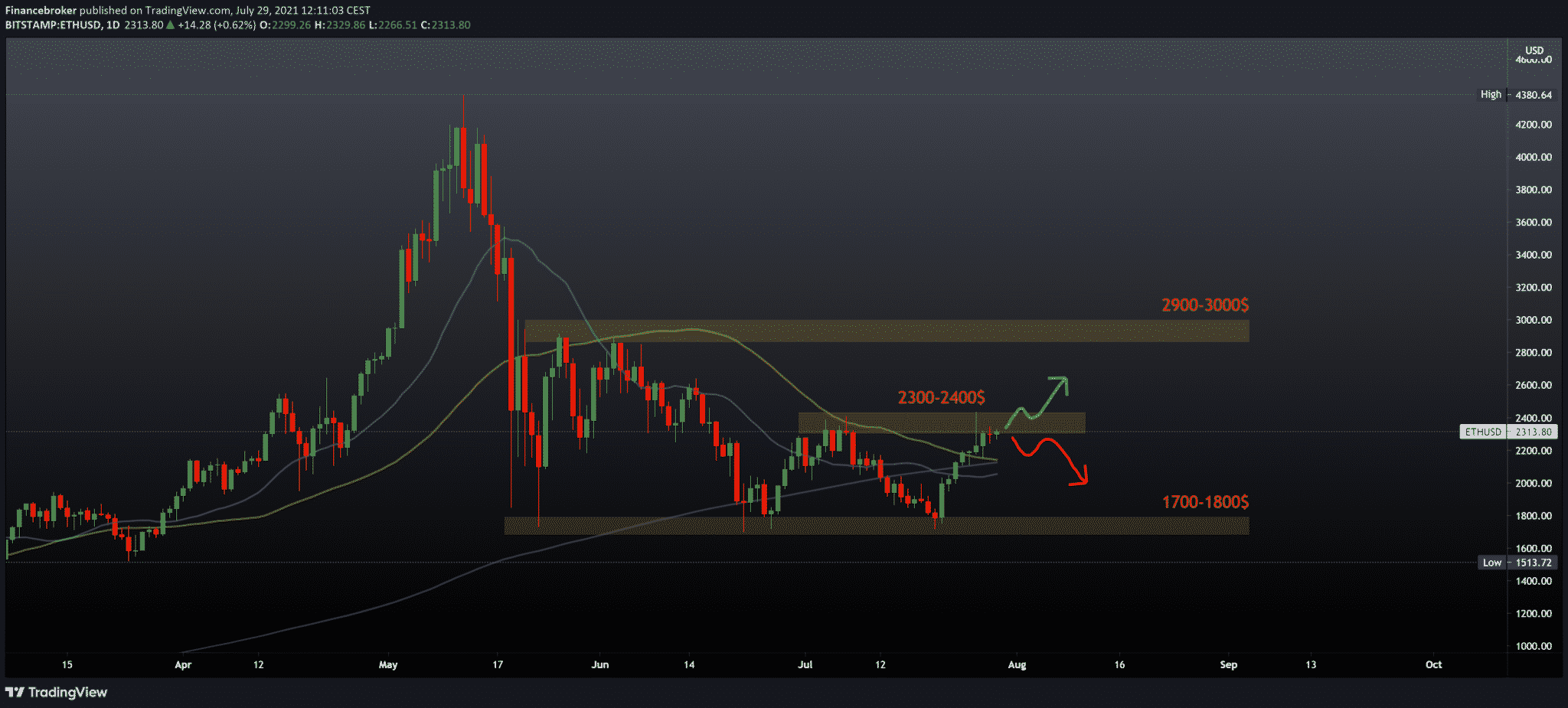

Looking at Ethereum on the daily time frame, we see that we are still in this bullish trend, currently testing the $ 2300-2400 zone. What matters is that we have climbed above all moving averages, and now they are on the bullish side. If the price continues to rise, the first next resistance is at $ 2,600 from mid-June. If Ethereum manages to climb above that level, our next target is the $ 2900-3000 zone. Contrary to this, Ethereum would fall into a negative consolidation that would direct the price to lower levels on the chart. Then we have to pay attention to the moving averages that defend the $ 2000-2100 zone. A further drop below this zone will lower us once again to test the previous lows zone of 1700-1800 $, and we have already tested this zone three times, and another lowering would increase such large bearish pressure.

Amid concerns over the strength of this week’s rally, data on Thursday, however, indicated an increase in demand for BTC at higher prices. Data shared by Bibt and CryptoQuant show the largest one-day outflow in at least a year. A total of 57,000 BTCs left the exchange in 24 hours.

Foreign exchange balances returned to the level last seen in mid-May, just before a large price correction after Bitcoin began to reverse from historical highs of $ 64,500.

The Vice President of Ghana accepts digital currencies

Ghana’s Vice President, Dr. Mahamudu Bavumia, believes that African governments must accept digital currencies to facilitate trade on the entire continent.

As reported by Ghanaveb, Bavumia presented her argument during the Fifth International Conference on Trade and Finance in Ghana, which dealt with the topic “Trade Facilitation and Trade Finance in the AfCFTA; The role of the financial services sector. It is argued that trade between African countries required a “single central payment” system. At present, moving goods across African borders is expensive and time-consuming. Dr. Bavumia believes a digital payment system would address these issues.

“Digitalization has also become one of the most sequential policies of the Nana Akufo-Addo government,” said Dr. Bavumia.

“When the scourge of the COVID-19 pandemic hit and forced many economies into partial and complete blockades, it heightened the need to continue digitization.”

The Bank of Ghana

The vice president discussed Ghana’s recent payment processes, such as mobile money interoperability. Dr. Bavumia notes that these services “have shown that more people can be financially involved, and this needs to be expanded across Africa to ensure the growth of the AfCFTA vision.”

Earlier this year, the Bank of Ghana revealed that it has a digital central bank currency in development. Dr. Bavumia noticed the bank’s intention and believes that it will bring the country’s credibility in the digital space.

African countries have long been exploring crypto and other forms of digital currency. Tanzania, which banned cryptocurrencies back in 2019, plans to reverse its course and implement crypto-positive regulations after its president Samia Suluhu Hassan spoke positively about bitcoin. Nigeria is planning its own CBDC named GIANT, which should be launched this October, even after its central bank banned financial institutions from operating with crypto exchanges.

-

Support

-

Platform

-

Spread

-

Trading Instrument