Bitcoin and Ethereum: Bullish correction

- Price Bitcoin visited $ 20,000 support yesterday.

- Ethereum found its support at $ 1040 yesterday, and we have been in a bullish correction since then.

- Shares of Coinbase and Robinhood Markets fell on Wednesday after announcing that Binance.

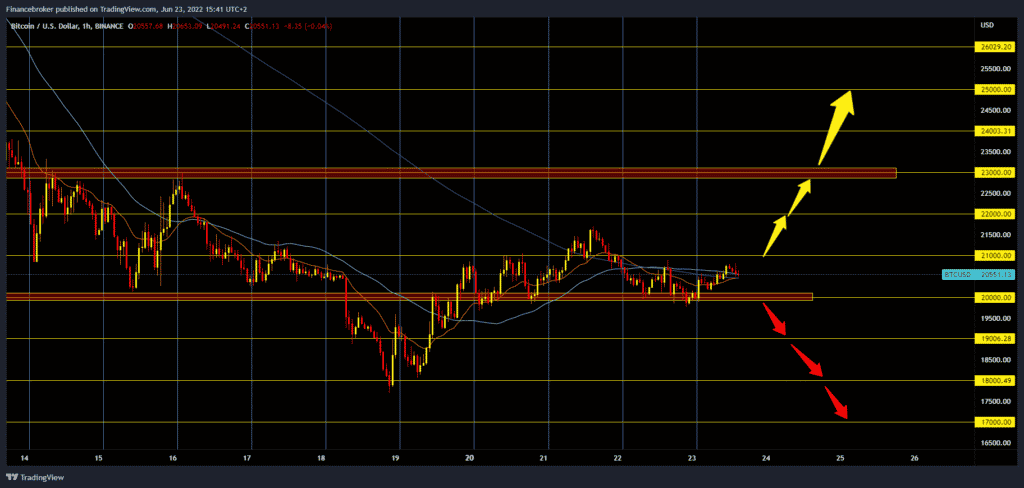

Bitcoin chart analysis

Price Bitcoin visited $ 20,000 support yesterday. After that, we have a shorter price recovery of up to $ 20,830. Bitcoin fails to build a better momentum and starts a bullish recovery. Our first hurdle is the $ 21,000 level, and we have to climb above it if we want to move on. Potential higher resistance targets are $ 22,000 and $ 23,000 levels. We need continued negative consolidation and new $ 20,000 level testing for the bearish option. A price break below would signify to us that we can expect a continued pullback to lower levels of support. Potential targets are $ 19,000 and $ 18,000 levels.

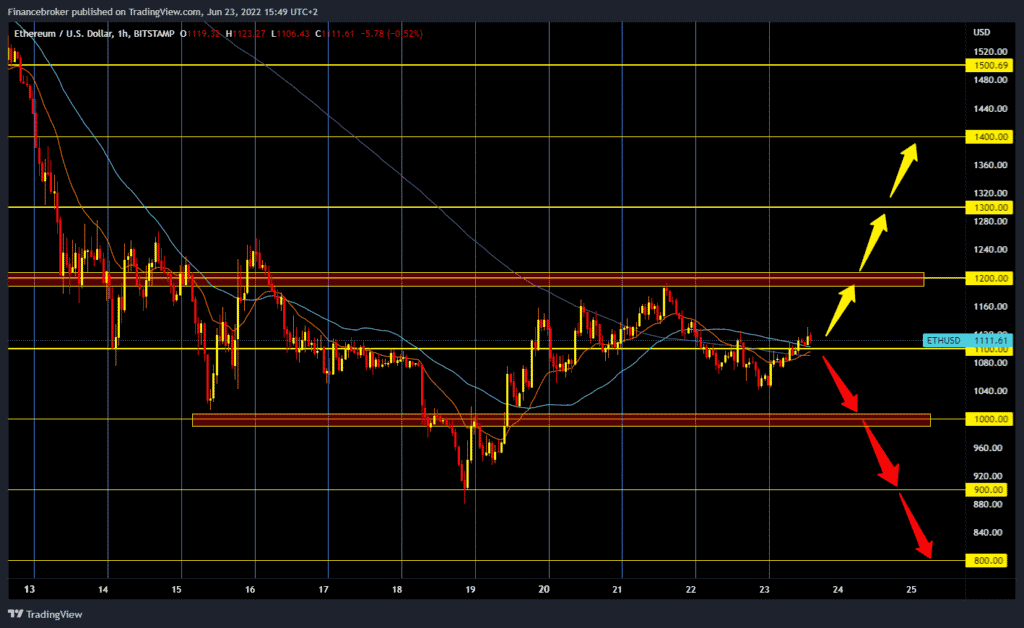

Ethereum chart analysis

Ethereum found its support at $ 1040 yesterday, and we have been in a bullish correction since then. The current price of Ethereum is $ 1115. On the positive side, we are now above all moving averages, and based on that, we can expect further growth towards $ 1,200. On Tuesday, we tried to climb above $ 1,200, but without success, the price dropped to $ 1,190. For the bearish option, we need a new negative consolidation and a pullback below $ 1100. After that, we could revisit the $ 1,000 support zone. If she doesn’t support us either, we’re going down to a $ 900 minimum this year.

Market overview

Shares of Coinbase and Robinhood Markets fell on Wednesday after announcing that Binance.US will offer to trade for specific bitcoin pairs free of charge. This comes after Binance.US, the American subsidiary of the prominent crypto exchange Binance, announced that it had reduced the fees for bitcoin trading to zero for selected couples. As of today, all new and existing users of Binance.US will not pay any fees when trading bitcoin in relation to the US dollar, USDT, USDC or Binance USD.

The announcement comes when crypto exchanges face severe economic barriers amid a broader market downturn. Last week, Coinbase announced it was laying off 18% of its staff to prepare for the upcoming harsh market conditions.