Bitcoin analysis for May 5, 2021

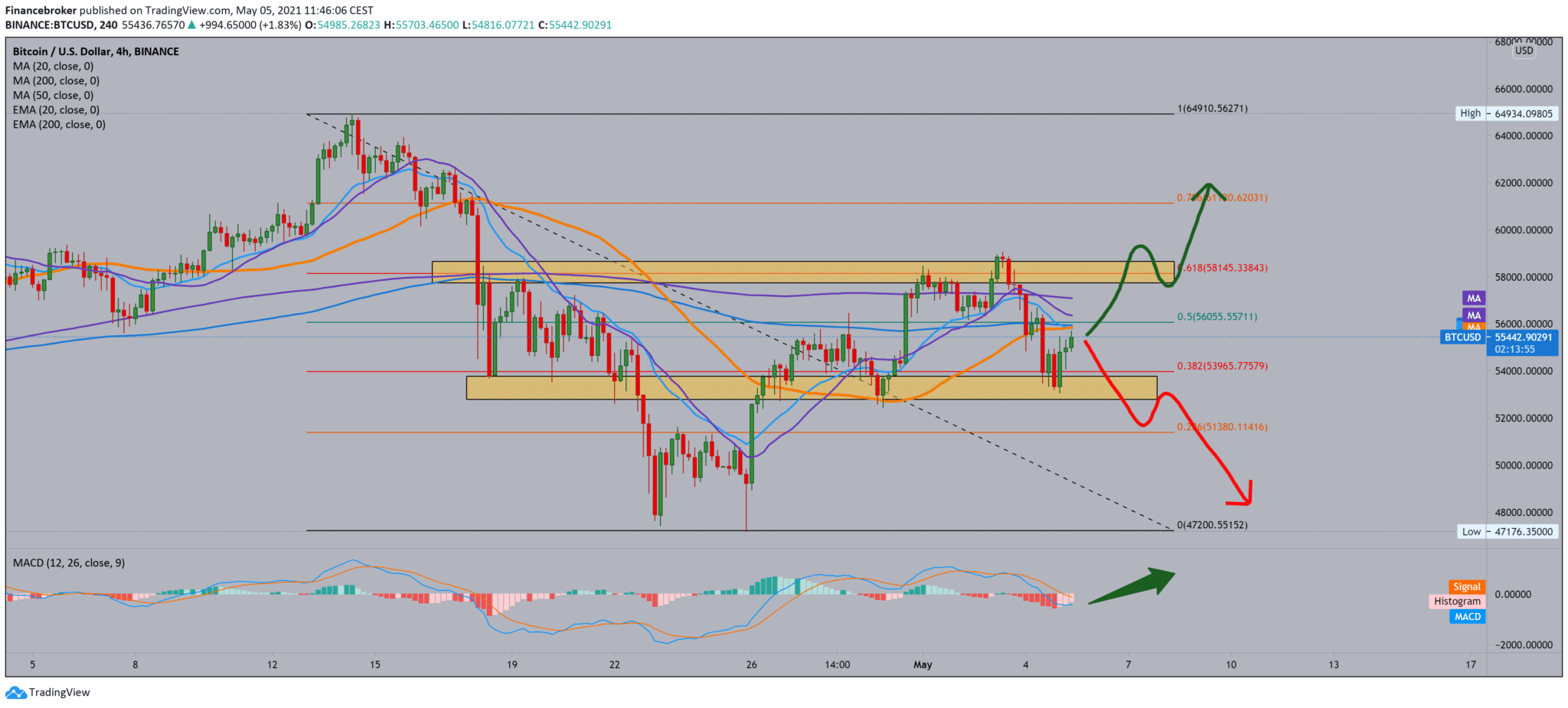

Looking at the chart on the four-hour time frame, we see that Bitcoin has found support at $ 54,000, and that again, we will probably see Bitcoin around $ 58,000. We are currently below the moving averages on the bearish side, but that can change very quickly because only one stronger momentum and positive consolidation of about 61.8% Fibonacci levels can climb Bitcoin to targets above $ 58,000. The first above is our target 60000 $.

For a possible bearish scenario, we expect a pull further below moving averages and a drop below the 38.2% Fibonacci level, below the $ 54,000 price. Looking further at $ 51,380 at 23.6% Fibonacci level. Looking at the MACD indicator, we see that the bearish scenario is fading and that the blue MACD line is directed towards the bullish side. At the same time, the last three histograms also indicate a weakening of the bearish trend and a possible reversal and transition to the bullish trend.

Betterment, a large financial advisory company that provides Robo consulting and cash management services, has not yet decided whether to introduce cryptocurrencies on its platform. Betterment is still exploring the potential expansion of its services to digital resources such as Bitcoin (BTC), said CEO Sarah Levy.

Founded back in 2008, Betterment is a popular platform in the United States, helping clients invest in a globally diversified portfolio of stocks and bonds, spread over an “appropriate level of risk” for a given time frame. The data show that professional traders are largely accumulating the current drop in Bitcoin price, while retail investors are busy trading in altcoins.

Bitcoin (BTC) has been struggling to maintain a support level of $ 55,000 over the past 16 days, or basically since the liquidation of the contract with a record $ 5 billion as of April 17. The decline, which occurred after a maximum of 64,900 US dollars, had a devastating effect on the mood of retailers, measured by a significant drop in the rate of permanent futures financing.

-

Support

-

Platform

-

Spread

-

Trading Instrument