Bitcoin analysis for May 11, 2021

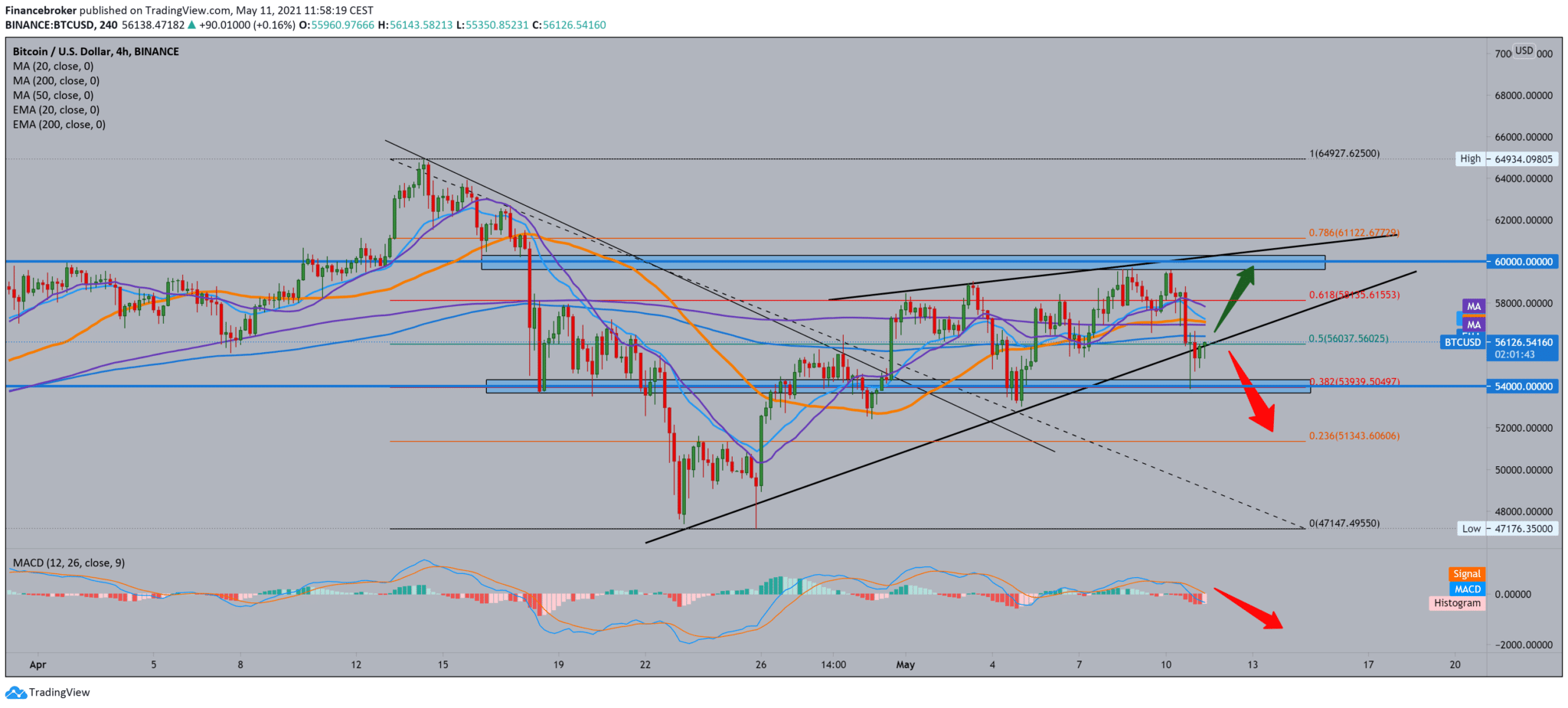

Looking at the graph on the four-hour time frame, we can perform the following technical analysis. First of all, we see that Bitcoin continues to consolidate around the lower support line at $ 56,000, and for now, it still fails to rise above moving averages to give a sign that we are leaning towards the bullish trend again. For something like that, we need a jump above 50.0% Fibonacci levels and a continuation above moving averages again. Upstairs we are again waiting for resistance at 61.8% Fibonacci level at $ 58,150. The break above it pushes us further towards the $ 60,000 price tag.

Otherwise, if we see a further price increase, then we need to pay attention to the zone around 38.2% Fibonacci level around $ 54,000. Each break below sends us a much bigger bearish scenario with a view below the psychological price of $ 50,000. If we follow the MACD indicator, we see that we are in a bearish trend but that there was a weakening in the last histogram, making a potential turn to the bully side. Bearish is currently prevalent.

Until the MACD blue line passes the signal line, we will not have a strong enough signal for a bullish trend. Dissolving support at $ 50,000 opens the way to levels not seen in months, warns Delta Exchange CEO Pankaj Balani.

Bitcoin (BTC) could see a price drop of as much as 40,000 US dollars if a higher level of support is not maintained, says the CEO of the industry. Speaking to Bloomberg on May 11, Pankaj Balani, CEO of Delta Exchange’s digital derivatives exchange, warned that there was a danger of new significant losses for BTC / USD. For Balani, $ 50,000 now forms a significant line for bulls, and if they don’t stay, a new $ 40,000 lower trading bottom will open.

According to such a scenario, cryptocurrencies “should move lower.” The large cluster of whale support – 120,000 BTC to $ 58,000 – still failed to stop short-term losses, leaving a question mark on the ability of smaller clusters to do the same. Cointelegraph further noted that support for exchange order books starts at just $ 50,000, with several bids between that limit and a high of $ 64,500. We can expect a very turbulent chart for Bitcoin later this month.

-

Support

-

Platform

-

Spread

-

Trading Instrument