Bitcoin analysis for March 29, 2021

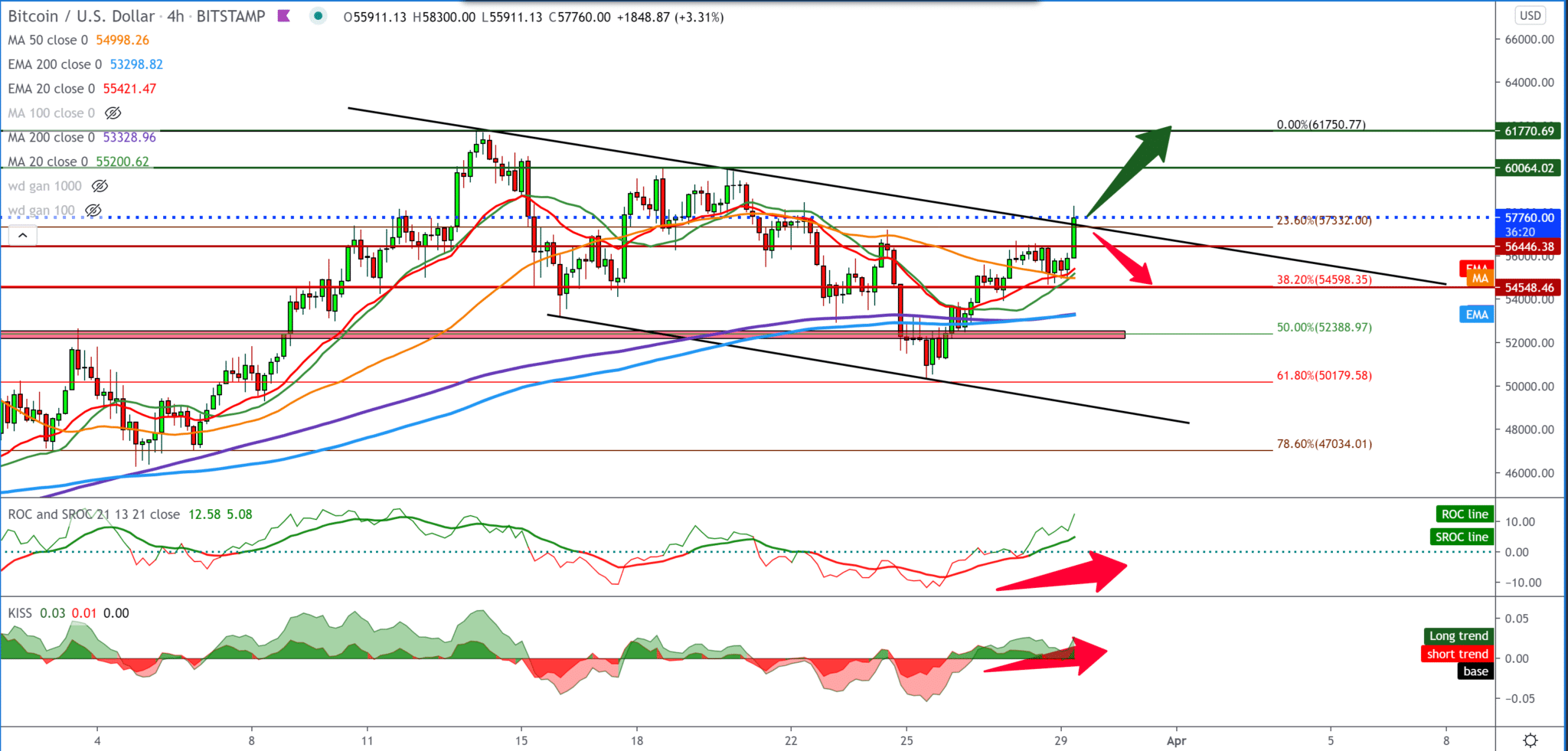

Looking at Bitcoin in the four-hour time frame, we see that there has been a break in the upper trend line after consolidation around the price at $ 56,000. With the Fibonacci setup, we see that Bitcoin found support at the 38.2% level, and with the support of moving averages, it went up by 23.6% to $ 57,300.

We will likely test the previous high at $ 59900, and we are getting closer to achieving a new maximum. Retreating below the trend line brings us back to the channel and introduces us to a shorter-term bearish trend to some better support.

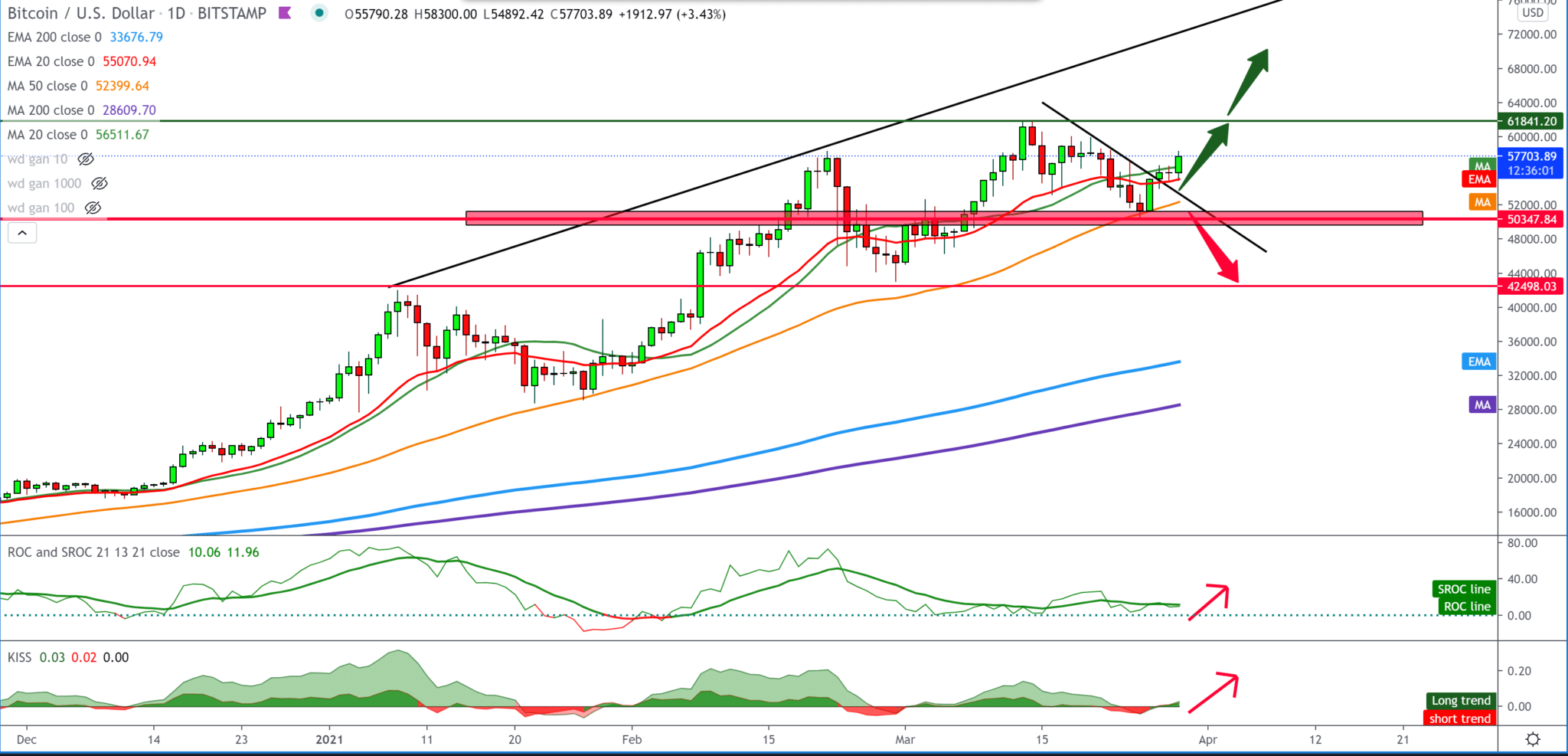

On the daily time frame, we clearly see Bitcoin after consolidation making a break above the upper resistance line and looking towards the previous high at $ 61,800. The bullish scenario is still in place, and there are no indications of a potential larger pullback.

April was the fastest month for Bitcoin in history. Although the pioneering cryptocurrency recorded new highs of all time in 2021, BTC was hit by double-digit losses in March. Based on historical data on Bitcoin, April was an extremely bullish month for digital currency.

Price data over the last ten years revealed 51% of the average profit for Bitcoin in April, according to Danny Scott, CEO of the crypto exchange CoinCorner. State wealth funds have already started investing in Bitcoin. Interestingly, Singapore’s Temasek government fund bought virgin BTC from miners. Robert Gutmann of NIDIG further revealed last week that the company had talked to state funds about how to step in the door with Bitcoin. In April, Bitcoin price forecasts were set higher, as most investors bet on a hit price of $ 80,000 for BTC call options.

-

Support

-

Platform

-

Spread

-

Trading Instrument