Bitcoin analysis for April 21, 2021

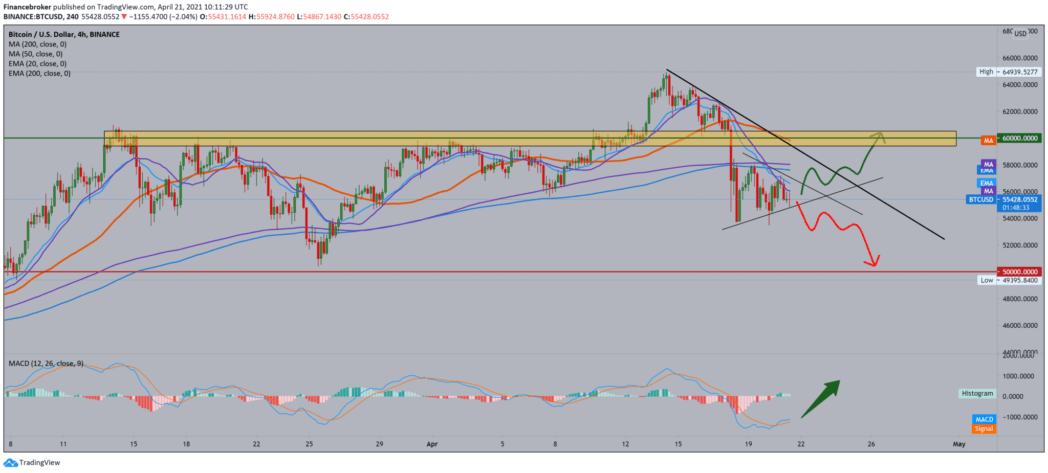

Looking at the chart on the four-hour time frame, we see that Bitcoin has fallen below the moving averages of the MA200 and EMA200, and for now, we are consolidating below them. We found support in the $ 54,000 zone, now we’ve climbed to $ 55,700. To move into the bullish trend, we need a break above the zone at $ 58,000 and moving averages to get to the position to test the psychological level at $ 60,000.

For the bearish option and a stronger continuation of the bearish trend, we need a break below $ 54,000 so that we can turn our gaze to the lower psychological level at $ 50,000.

The MACD indicator gives us a clean bullish signal; by crossing the blue MACD line above the signal line, we see that we are finding support because Bitcoin fails to make a lower low and breaks this zone around $ 54,000.

The past few days have been crucial for cryptocurrencies, as Bitcoin (BTC) has suffered a drop in hashing speeds in mining due to the looming power outage in Xinjiang. The result was a reduction in cryptocurrency prices, dragging the entire crypto market to a massive decline. $ 1.55 billion in bitcoin options is due to expire on April 23, and the recent drop in BTC to $ 51,000 gave the bears an advantage of $ 340 million.

The price of bitcoin (BTC) is slowly recovering after facing a sharp correction of 16%. Arbitration tables require routing, which means they do not bet directly on the BTC moving in any particular direction. However, to neutralize the exposure of options, dynamic protection is usually required, which means that the positions must be adjusted following the price of Bitcoin.

Risk adjustment of these arbitrage tables usually involves the sale of BTC when the market falls. As a result, it adds additional pressure to long liquidations. It, therefore, makes sense to understand the current level of risk as the April 23 option approaches. We will try to dissect whether the bears will benefit from a BTC price of $ 50,000.

-

Support

-

Platform

-

Spread

-

Trading Instrument