BDSwiss Review 2020

| General Information | |

|---|---|

| Broker Name: | BDSwiss |

| Broker Type: | Crypto |

| Country: | Mauritius |

| Operating since year: | 2014 |

| Regulation: | NFA, CySEC, FSC, BaFin, FSA |

| Address: | 6th Floor, Nexteracom Building, Ebene, Mauritius |

| Broker status: | Active |

| Customer Service | |

| Phone: | +44 2036705890 |

| Email: | [email protected] |

| Languages: | English |

| Availability: | 24/5 |

| Trading | |

| The Trading platforms: | Proprietary, MT4, MT5 |

| Trading platform Time zone: | - |

| Demo account: | YES |

| Mobile trading: | YES |

| Web-based trading: | YES |

| Bonuses: | NO |

| Other trading instruments: | YES |

| Account | |

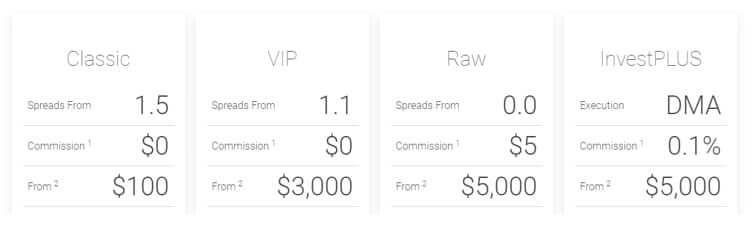

| Minimum deposit ($): | $100 |

| Maximal leverage: | 1:500 |

| Spread: | Variable |

| Scalping allowed: | YES |

-

Support

-

Platform

-

Spread

-

Trading Instrument

Comments Rating

0

(0 reviews)