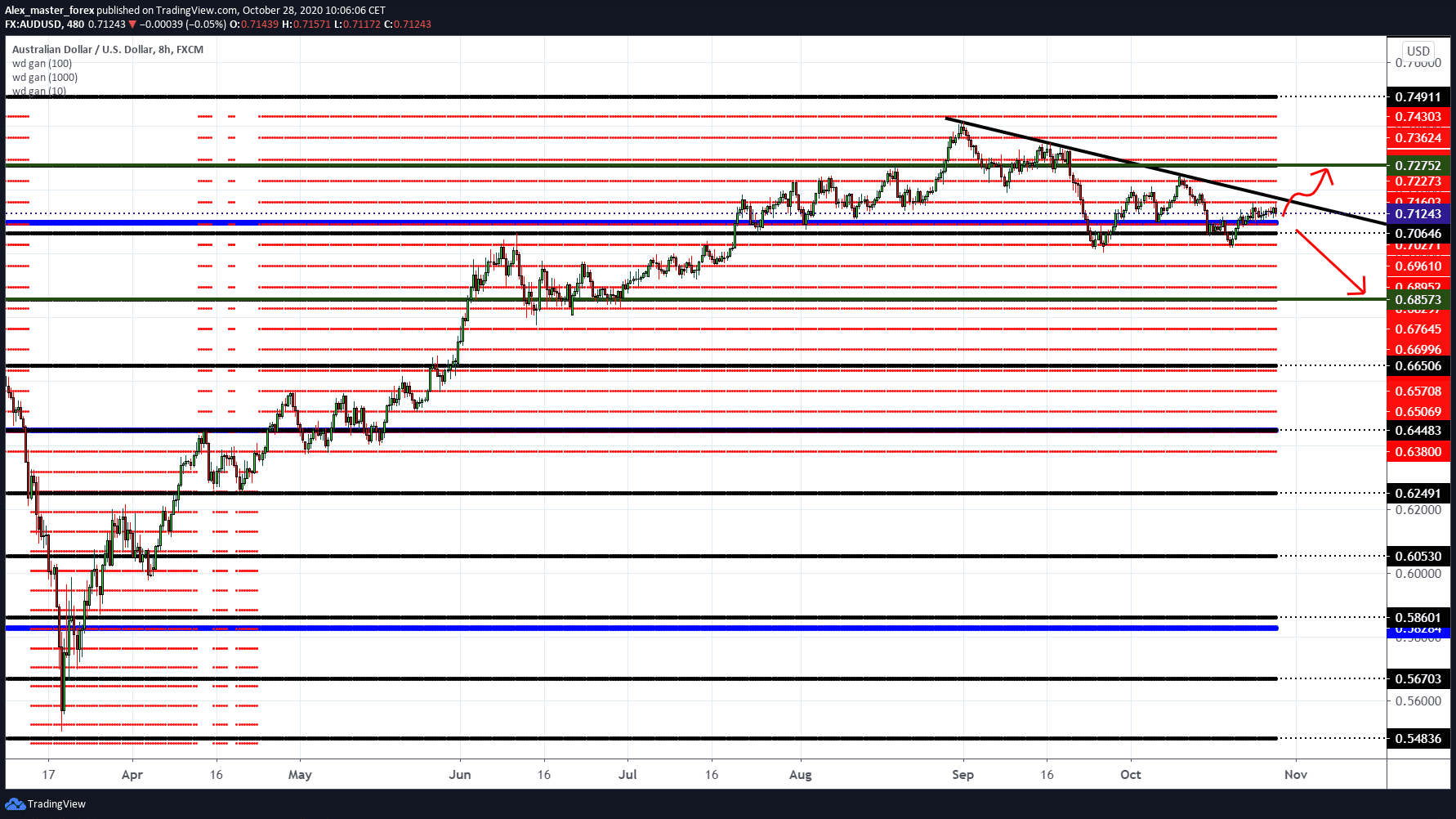

AUD / USD level testing, 0.71000

Fear of the coronavirus, risk-taking, risked a secure dollar and could limit profits. Strengthening market expectations that the RBA will be further eased at the upcoming November 3 policy meeting could prevent any aggressive betting. This, together with the prevailing risky environment, could further cooperate in limiting the perception of the riskier Australian dollar. Growing market concerns about the potential economic impact of growing coronavirus cases, coupled with a lack of progress in U.S. stimulus negotiations, continued to apply to investor sentiment. Uncertainty about the actual outcome of the US presidential election could limit large currency movements.

Upcoming polls suggest Democrat candidate Joe Biden is ahead of President Donald Trump, although the gap is minimal in certain key states. The dollar managed to break above 93.00 the whole Asian session, and to stay above, from the news during the American session, we have The goods trade balance, but there is no stronger news. The number of newly infected with coronavirus in America is still above 70,000 a day, while it is at a minimum in Australia.

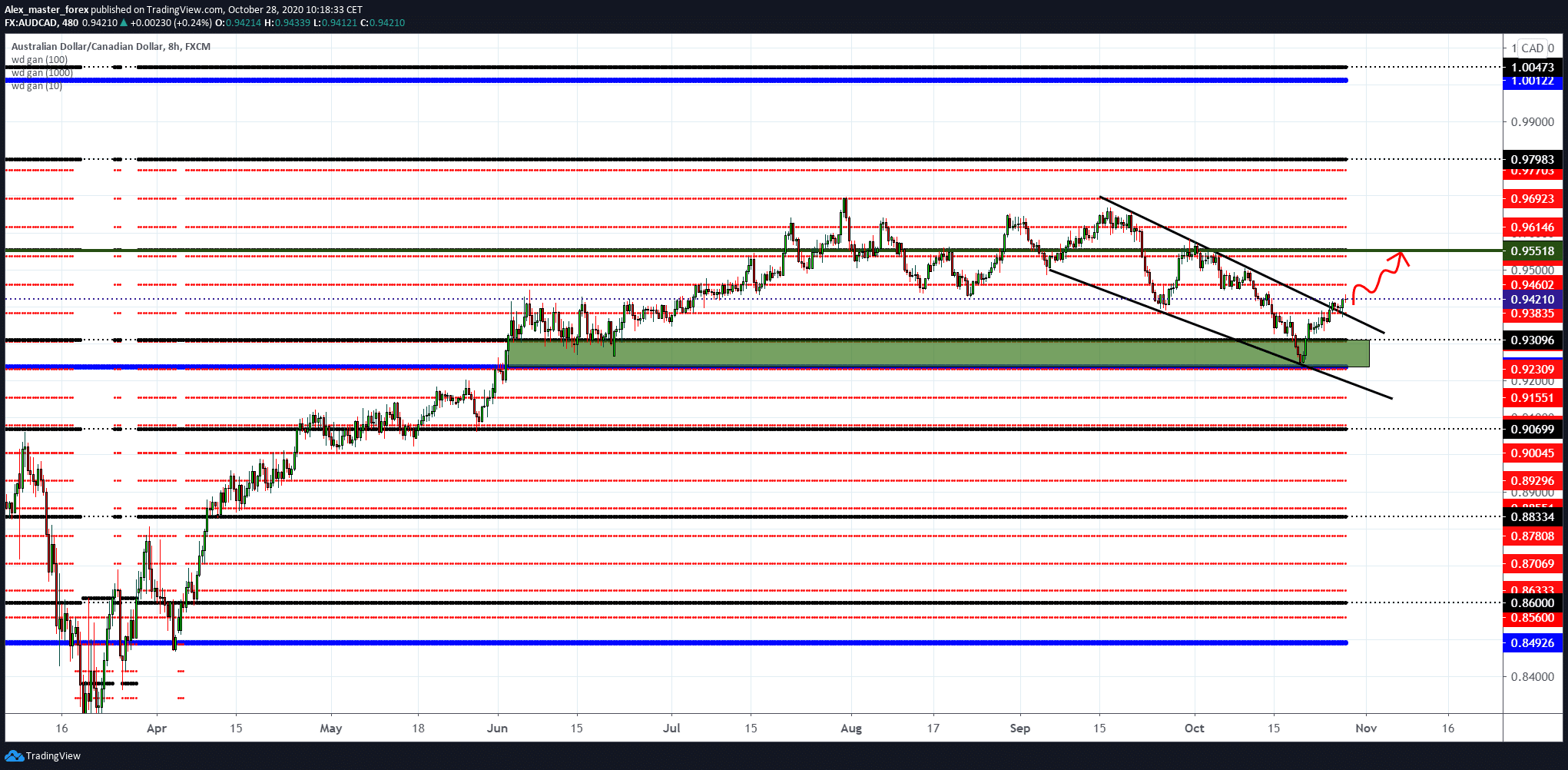

AUD / CAD current break trend line Looking at the graph

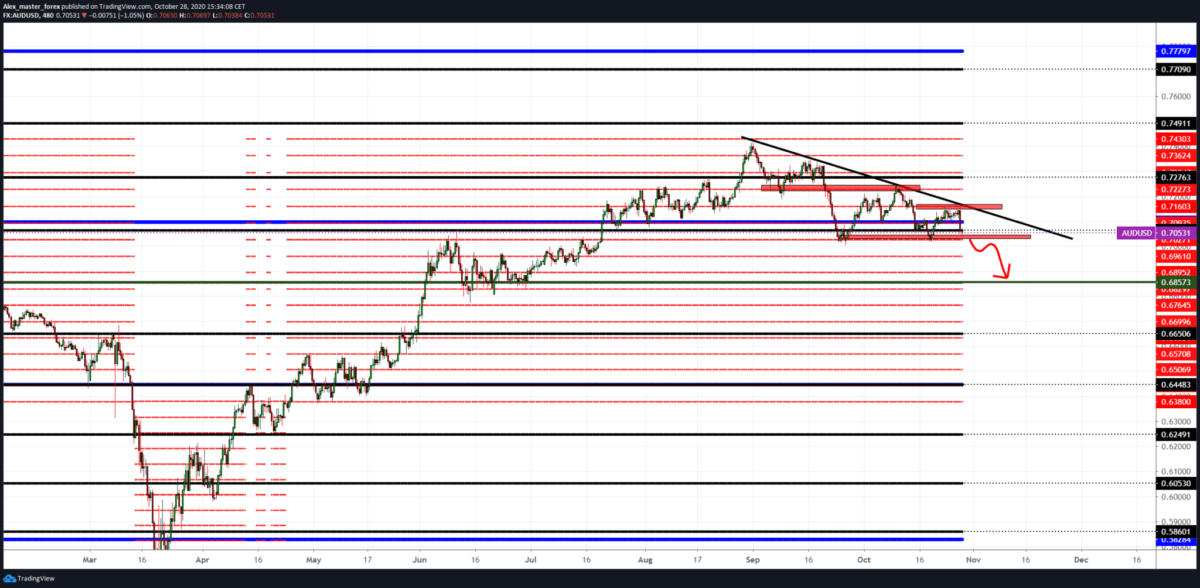

AUD / USD looking lower targets

The pair AUD / USD rose above 0.7150 earlier in the day but made a sharp turnaround ahead of the US session and fell to its lowest level today at 0.70500. The Australian dollar simply fails to break above the trend line and move to the bullish side. Even with a good report on the Consumer Price Index (CPI) in the third quarter rose to 0.4% quarterly from -0.1% fails to break up and continue up. With growing fears of a global pandemic and a growing number of new cases worldwide, delaying the release of financial aid packages to the economy to recover from the coronavirus, the dollar has been rising for the third day in a row as investors see the security of their capital. If AUD / USD falls below 0.70200, we will probably see it at 0.69600, and maybe even lower.

-

Support

-

Platform

-

Spread

-

Trading Instrument