AUD/USD on the trend line

Australia’s significant budget and its low level of debt also provide further support for the Australian dollar. Strong domestic foundations and a well-supported global background should support the AUD against the dollar. Australia’s account balance continued to improve, and the surplus increased even more in recent quarters. Much of this strength could be attributed to rising commodity prices. As the global recovery further consolidates, demand for commodities is likely to remain strong, supporting Australian trade conditions and the current account balance. We can also mention that the Australian government has announced a rather large budget, which predicts that net debt will increase from 30% of GDP in 2020/21 to 40.9% of GDP in 2024/25. This would support growth and is likely to further support AUD, especially given the relatively low level of debt that Australia has compared to many of its G10 peers. So we expect the AUD to continue to strengthen against the US dollar this year.

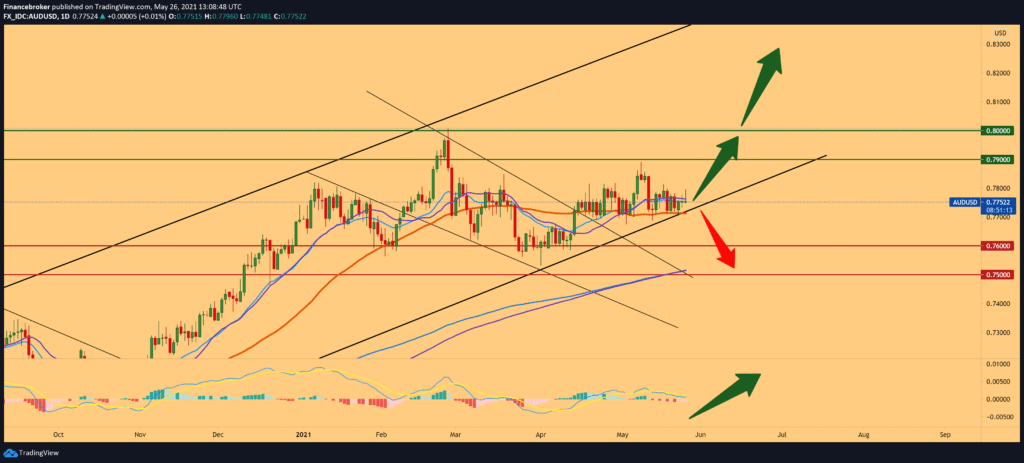

Looking at the graph of the daily time frame, we can do the following technical analysis. The AUD/USD currency pair is moving in one big growing channel, and we are currently testing the channel’s bottom line, looking for that support. Moving averages are on the bullish side, providing additional support. If the AUD/USD currency pair bounces and goes up, our first target is the previous high at 0.79000, and after it this year’s high at 0.80000. We will probably see the strengthening of the dollar in the American session, but in Asia, we can expect the domination of the Australian dollar to continue. Following the MACD indicator, we see that the bearish signal is fading and that we can expect the bullish signal to pass soon. If all this does not happen, and the AUD/USD currency pair slips below the support line, we are looking for the next support in the zone around 0.76000.

-

Support

-

Platform

-

Spread

-

Trading Instrument