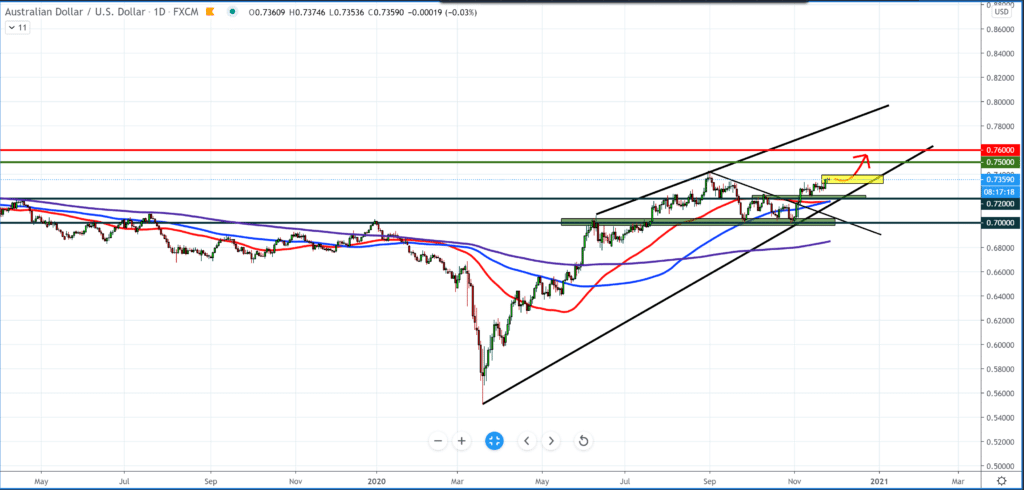

AUD/USD forecast for November 26, 2020

If we look at the chart on the weekly time frame, we will see that the AUD/USD pair made a break above the running average of the MA 200 and that it has good support for the MA 50 and MA 100, making a retest on both indicators.

Our Bollinger bands 200 match the MA 200 indicator, and we can expect a continuation of up to higher targets. Our first serious obstacle is 0.75000, which is a psychological zone for investors to consolidate. If the dollar is under pressure in the coming period, we can expect heights closer to 0.8000.

On the daily time frame, we see that we have support for all three moving averages MA50, MA100, and MA200. The pullback can be expected to the trend line where it will probably meet the MA50 and MA100; the break was successfully made above 0.72000.

And since today is a holiday in the US, we can expect weak volatility in the market and a milder pullback because there will be various statements by political officials regarding the holiday, so is expecting consolidation in the range of 0.73200 – 0.74000. This currency pair still looks very bullish.

GBP/NZD forecast for November 26, 2020

On the four-hour chart, we can see how we are approaching the American session that the AUD/USD pair is slowing down to 0.73700, making a turn towards better support for the next bullish momentum. 0.73200 is the first support zone as well as a smaller trend line where it will meet the MA100, while the MA 200 is at 0.72000.

This year’s main trend line from the bottom is also close to us, where we should pay attention to how the currency pair will behave if it goes down to it.

The bullish scenario is also dominant on the four-hour chart. From the news, we can point out that: Australian capital expenditures fell more than expected in Q3, data from the Australian Bureau of Statistics showed on Thursday.

Total new capital expenditures fell by 3 percent in September, which was higher than the expected decline of 1.5 percent. However, the rate of decline slowed from -6.4 percent in the second quarter.

Ben Udi, an economist at Capital Economist, said private investment fell 1.2 percent in a third-quarter row. Companies’ expectations of future capital spending suggest they may be nearing the bottom, essentially waiting for better opportunities.

-

Support

-

Platform

-

Spread

-

Trading Instrument