AUD/USD forecast for February 9, 2021

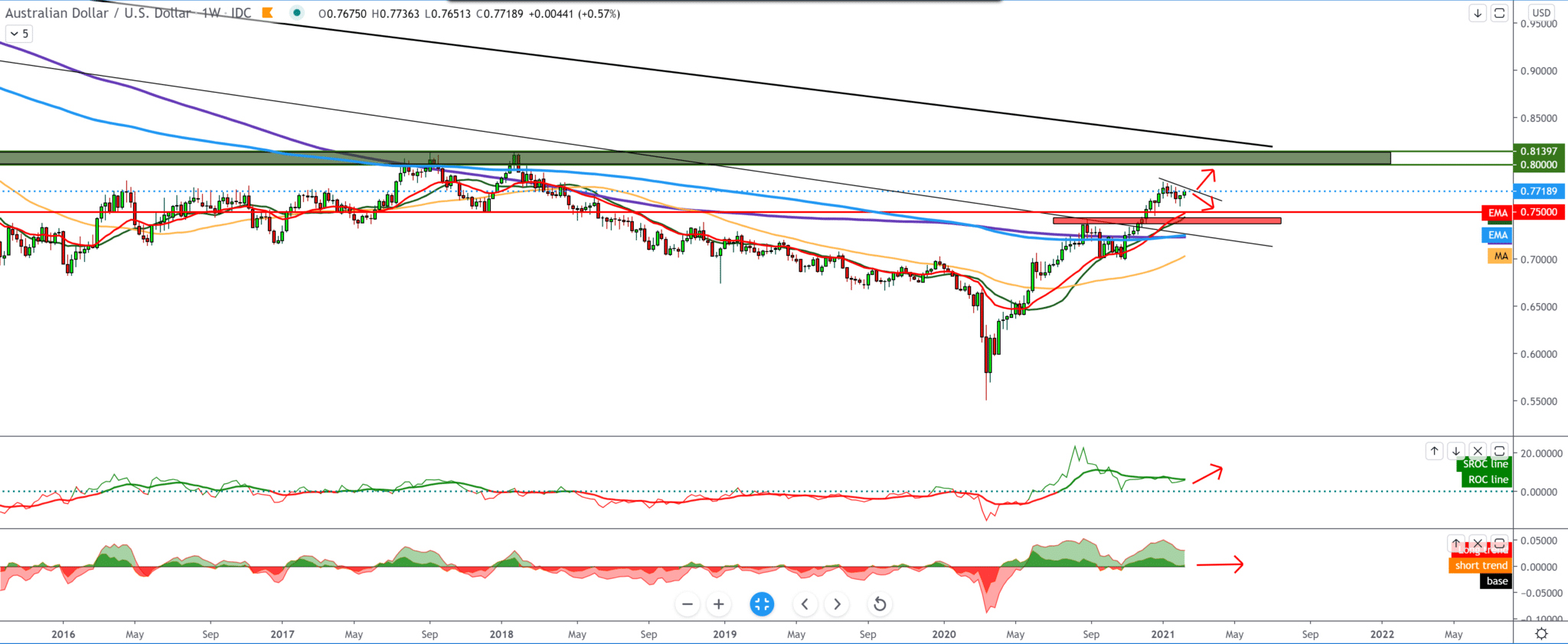

Looking at the chart on the weekly time frame, we see that the AUD/USD pair is still in a strong bullish trend with the current resistance at 0.78000, where the AUD/USD pair makes an instant consolidation before the next major move on the chart.

We see that the AUD/USD pair made a pullback to 0.75700 and bounced upwards; this candlestick formation makes a FLAG pattern, and we need a break above the smaller trend line to give us confirmation to continue the bullish trend.

If the AUD/USD pair fails, we will see a continuation of the pullback to the moving averages MA20 and EMA20, searching for their support.

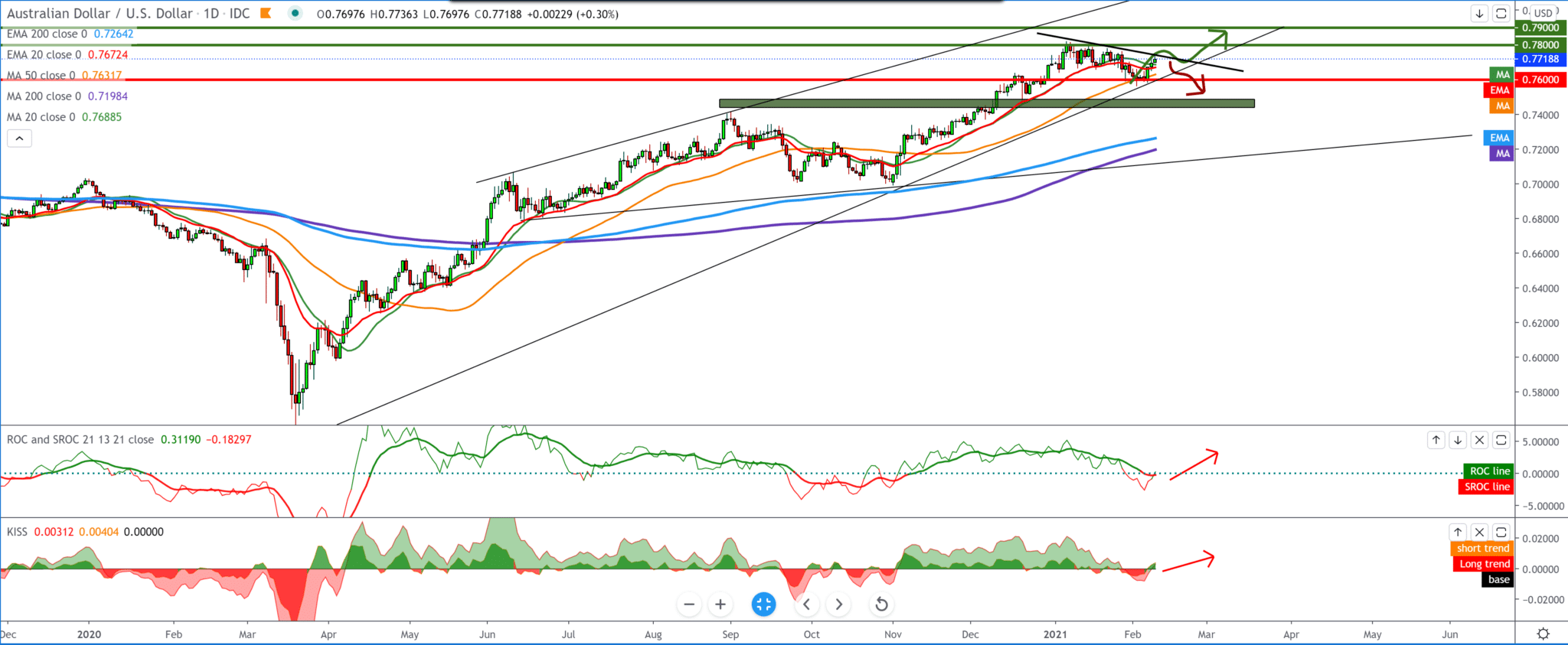

On the daily time frame, we see movement in the uplink channel and that the pair is currently on the bottom line of the channel at 0.76000. The AUD/USD pair is currently testing the MA20, EMA20, and MA50, and for now, the AUD/USD pair is a little above them but not enough to make sure we see a continuation of the bullish trend.

We need a break above 0.78000 to continue up towards 0.80000. If we look at bearish, we need a break below 0.76000 to test the 0.75000 psychological level.

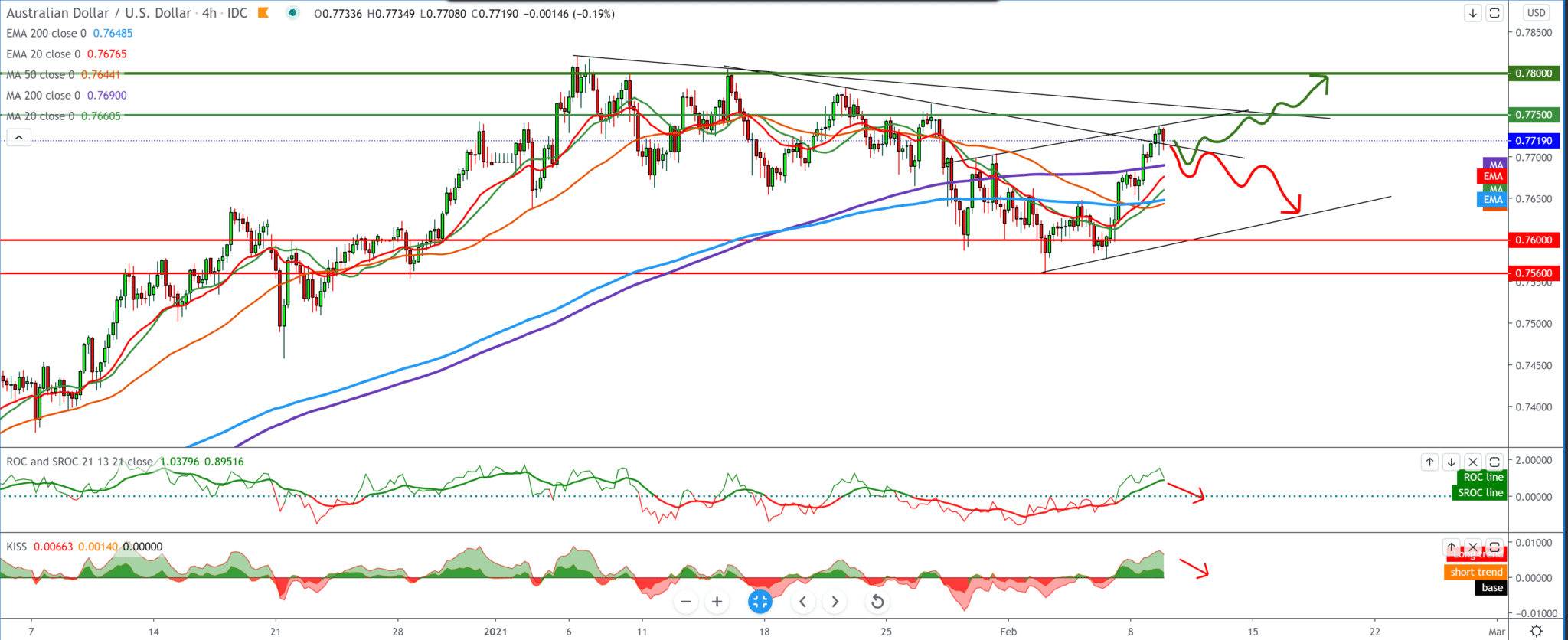

On the four-hour time frame for the bullish scenario, the chart should make us a new higher high to continue towards the upper targets. The AUD/USD pair is also again above the MA200 and EMA200, and we need a breakout and other moving averages for better bullish confirmation.

If we do not see a new higher high, we return below the MA200 and EMA200, putting pressure on the Australian dollar again, pushing it towards lower levels at 0.76000 and even lower.

From the news for these two currencies, we can single out the following: Australian business conditions weakened from the highest in December, while business confidence strengthened in January, the results of a survey by the National Bank of Australia showed on Tuesday. The index of business conditions in January fell by 9 points, to 7.

However, the result was above average and returned around November. The Australian Reserve Bank (RBA) has barely hampered AUD, as yield differences are stable and positive global drivers outweigh domestic monetary stocks.

With market expectations of a global economic recovery, HSBC economists expect the AUD to strengthen against the USD this year. Larger global drivers overshadow individual monetary policy actions.

Market expectations of global economic recovery are undoubtedly strong for the AUD. They are increasingly proving to boost Australian commodity export prices, which have risen 18% in USD in the past two months alone.

-

Support

-

Platform

-

Spread

-

Trading Instrument