AUD/USD forecast for December 28, 2020

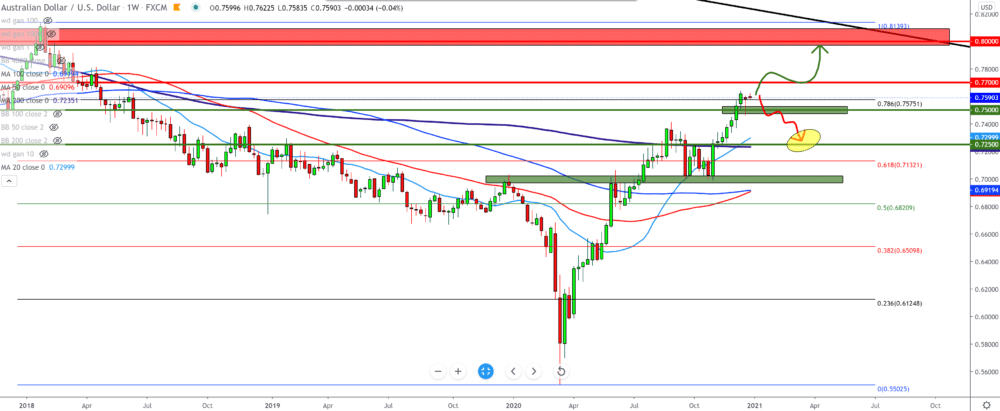

Looking at the chart on the weekly time frame bullish scenario is still very likely. At the end of the year, the markets are closing due to the New Year’s holidays, and we can expect a continuation in the next year. By setting the Fibonacci level, the AUD/USD pair is currently testing the level of 78.6% at 0.75750, and now we can expect consolidation at that level. We can watch the bearish scenario if the AUD/USD pair falls below 0.72500-0.73000 and if we see a break below the moving average of the MA200.

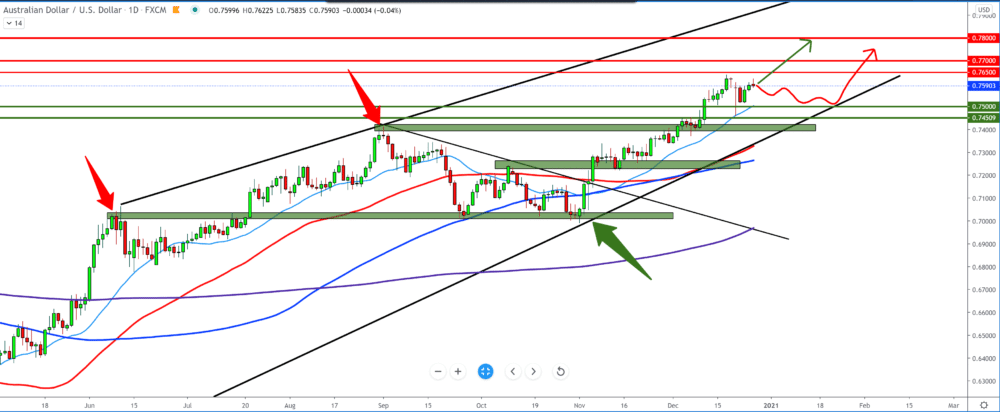

On the daily time frame, we see that the AUD/USD pair is still on the bullish side. During the last week, we had a pullback to 0.74500 and tested a zone around 0.75000. The AUD/USD pair still has good support from the bottom with moving averages. From the bottom, we also have a trend line that is also big support and the MA100.

On the four-hour time frame, we have one big upward parallel channel, but now the Australian dollar is losing strength towards the end of the year, and we can see a pullback to the bottom line of the channel. The first obstacle to this is 0.75500. Of the moving averages, the first hurdle is the MA50, while the MA100 was better supported in the previous period.

EUR/USD forecast for December 28, 2020

The U.S. dollar advanced more in its early session but reversed those gains after President Trump signed the U.S. Omnibus Act, announcing fiscal incentives and U.S. government funding until 2021. Last week, Trump shocked Capitol Hill when they threatened to veto the account if there were no incentive checks were increased, but eventually gave approval, which avoided a partial shutdown of the government. This led to a wave of risky mood with the Australian and New Zealand dollars, which rose over 0.40%. However, it should be noted that, although both have a high beta version, both markets are closed today, and the gains could relate to liquidity as much as to the US stimulus

-

Support

-

Platform

-

Spread

-

Trading Instrument