AUD/USD analysis for March 29, 2021

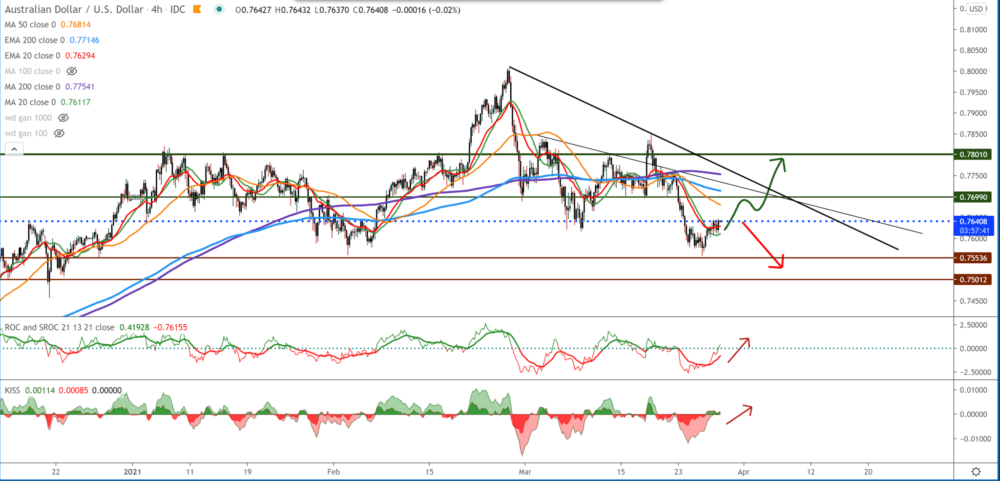

Looking at the chart on the four-hour time frame, we see that the AUD/USD pair finds support at 0.75500, making a turn upwards with the current support of the moving averages MA20 and EMA20. Above our first hurdle is the MA50 at 0.76000 and then the MA200 and EMA200 in the 0.77000-0.77300 zone. From above, we can set the trend line by connecting the previous highs, and it can be a potential resistance for us to continue the bullish trend. If we see a deviation from that line, then we return to the bearish trend directing us again towards the 0.75000 psychological zones for investors.

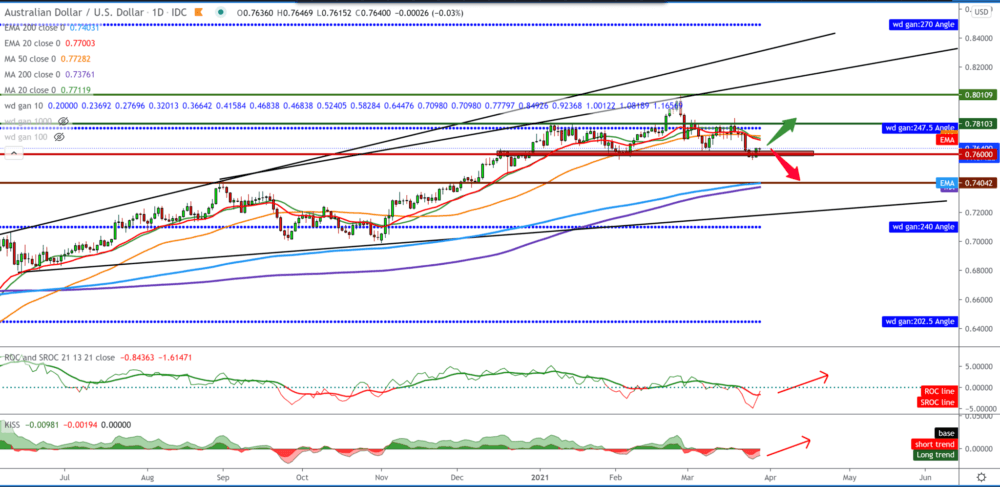

We see how the AUD/USD pair finds support in the 0.75500-0.76000 zone on the daily time frame. The AUD/USD pair is under pressure from the upper side with moving averages MA20, EMA20, and MA50, while from the lower side, we have support for MA200 and EMA200 at 0.74000. We can expect the AUD/USD pair to stretch again to 0.78000 already a week to test that zone which is an obstacle for us to continue the bulls trend.

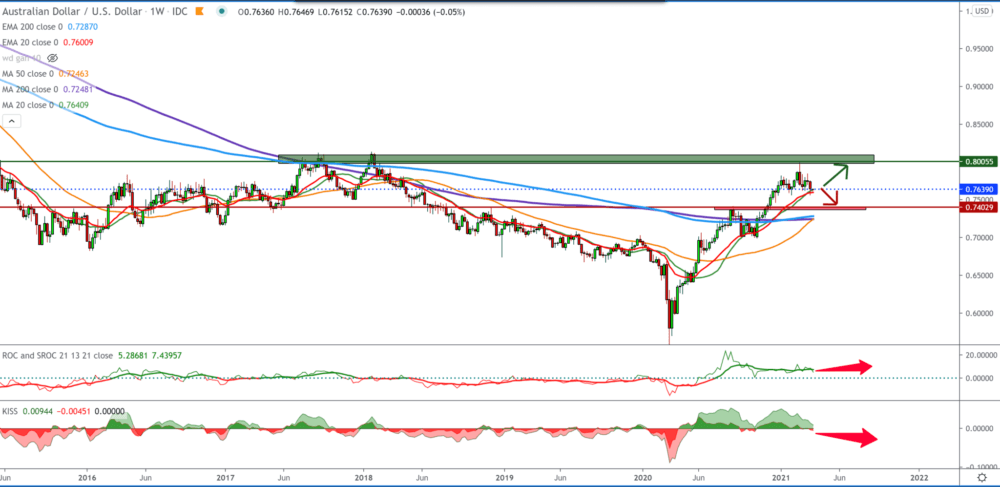

On the weekly time frame, the AUD/USD pair tests the moving averages of the MA20 and EMA20, which were good support and an obstacle to the bearish trend in the previous pullback. The probability of a bullish trend is higher, and based on that, we expect the AUD/USD pair to test their previous high again at 0.80000. Otherwise, if this short-term bearish trend continues, support will be sought in zone 0.74000-0.75000.

From the news for the AUD/USD currency pair, we can single out the following:

The Australian dollar spent most of last week trading lower, as the decline in relatively stretched stock markets boosted the dynamics of “risk” trading.

China is Australia’s largest trading partner, so economic development in the former can often breakthrough to the latter. So, if the second-largest economy in the world is slowly trying to slow down its economy to prevent the rise of inflation, that too can dominate from the outside. AUD will monitor Australian credit, trade, and retail data in advance.

Persistently soft inflation in the United States could give life to the Australian dollar. Last week, the Fed’s preferred measure of inflation, the PCE core deflator, reached 1.4% y / y versus 1.5% projected. This could tame the growth of long-term Treasury yields. But a relatively solid report on non-payroll could risk raising bond rates next year as well.

-

Support

-

Platform

-

Spread

-

Trading Instrument