AUD/USD analysis for April 9

Looking at the chart on the four-hour time frame, we see that the pair is finding support at 0.76000; we are currently consolidating just above that level. From the top, we can draw one trend line: our resistance to the bullish trend. We need to pay attention to the Fibonacci level, and we see that the previous pullback was up to 61.8% Fibonacci level, and then the descent down to 0.75290. After that, we have this pullback which now seeks support at 23.6% Fibonacci level. We are waiting for a break above 38.2% at 0.76500 and resistance lines to climb to 61.8% level at 0.77280. Following the moving averages, our target is the zone above EMA200 to MA200, the middle of the area between 50.0-61.8% Fibonacci levels.

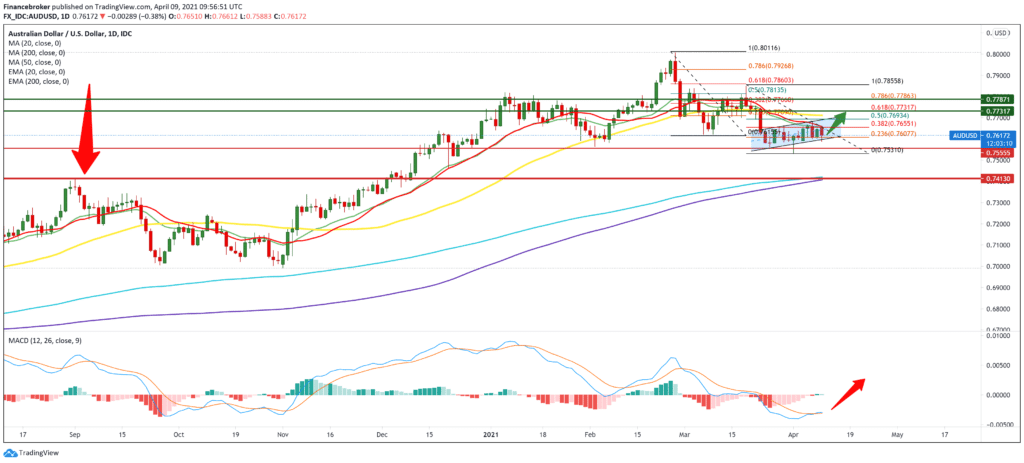

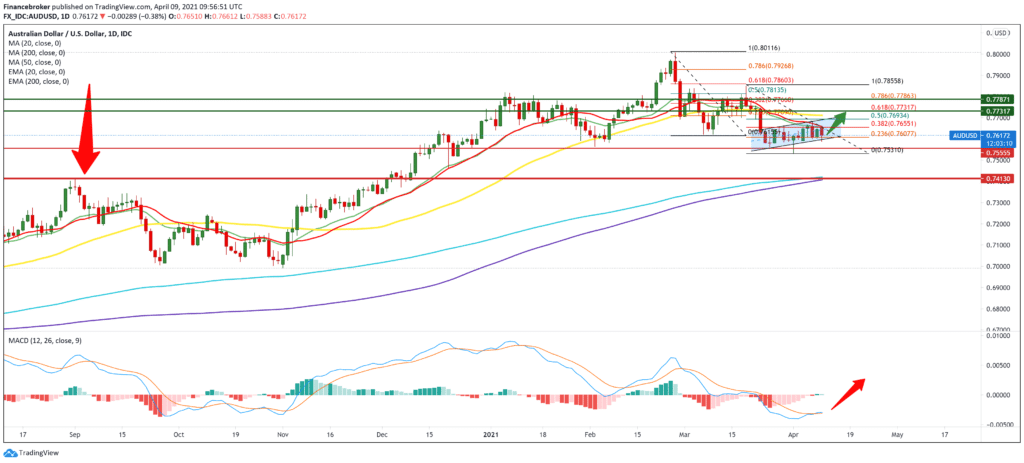

On the daily time frame, we see that the pair is now moving in a downward trend with a certain pullback and that the moving averages MA20, EMA20, and MA50 have moved to the bearish side. By setting smaller Fibonacci retracement levels, we can expect a smaller pullback up to 61.8% of the level at 0.77300. We expect the next resistance and a possible continuation of the bearish trend to MA200 and EMA200 in the zone around 0.75000. And if we break the 61.8% level bullish target, our zone is at 0.78500 previous high. The MACD indicator is sideways on the bearish side, but we see that a possible reversal of the trend is slowing down, as the blue MACD line crossed the signal line, giving us reason to believe that we will see a pair at slightly higher levels in the short term.

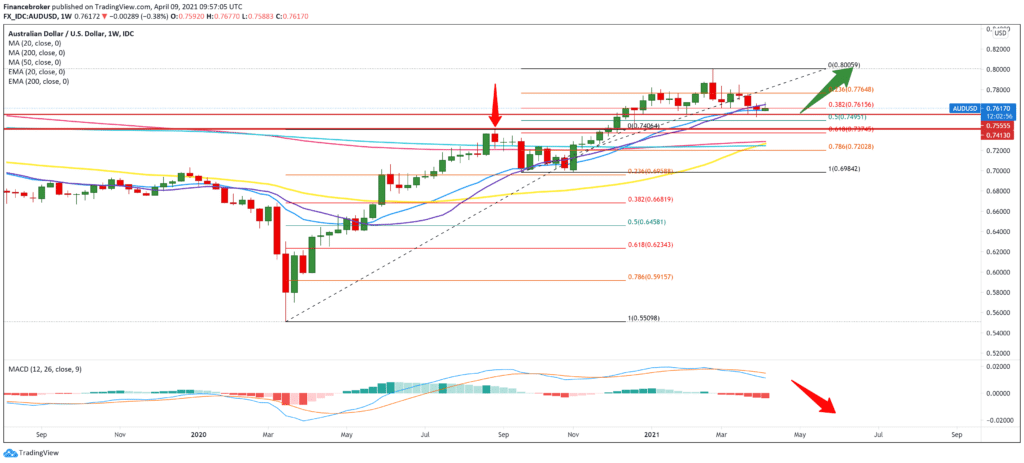

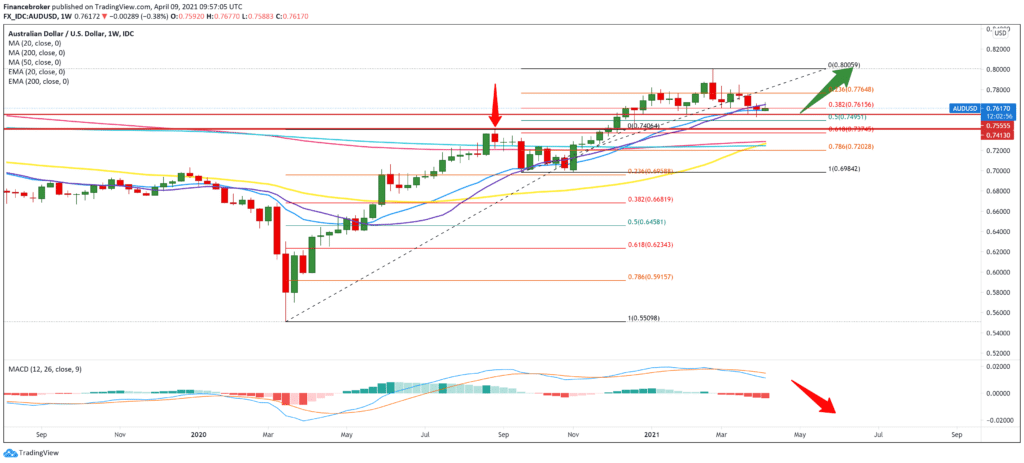

On the weekly time frame, we see the pair testing moving averages of MA20 and EMA20 with support at 0.75550. Around 0.75000, we could expect some stronger support because it is a psychological level for investors. By setting the Fibonacci level, we see that the pair tested the 38.2% level at 0.76100, while on the previous Fibonacci level, the pullback was up to 23.6% level. The long-term pair is very bullish, and the end of the pullback is probably near.

-

Support

-

Platform

-

Spread

-

Trading Instrument