AUD/USD analysis for April 21, 2021

Looking at the graph on the four-hour time frame, we see that we are moving in a descending channel. After finding support at 0.75280, the AUD/USD pair made a pullback to the upper channel line to 0.78000 by going above the moving averages of the MA200 and EMA200, after which we go down again, finding now support at 0.77000. This is part of a larger consolidation. Also, on the chart, we can draw a smaller trend line of support which can be an obstacle to the bearish trend, but we can expect the AUD/USD pair to get closer to it as part of this consolidation. The MACD indicator is on the bearish option and signals us a further pullback down as part of this consolidation.

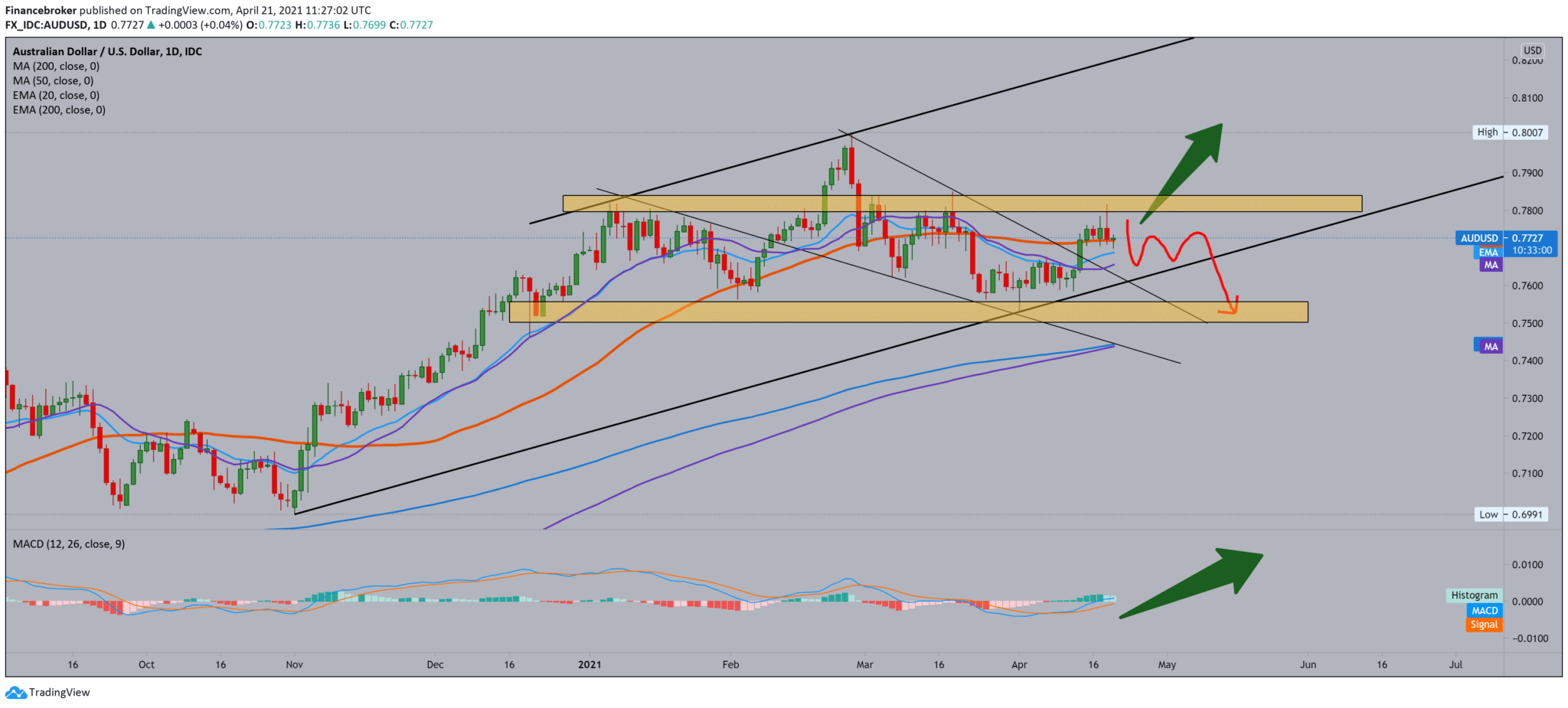

On the daily time frame, we see that the AUD/USD pair encounters resistance at 0.78000. The AUD/USD pair has been consolidating the last five days at the same level with the support of moving averages below. The dollar has consolidated slightly over the past few days and slowed the growth of the Australian dollar. So we can expect the AUD/USD pair to come down testing and seek support on the big bottom support line with the help of moving averages MA200 and EMA200. The MACD indicator is also in some consolidation around the middle, slightly focused on the potential weaknesses of the Australian dollar directing us to a slightly bearish trend.

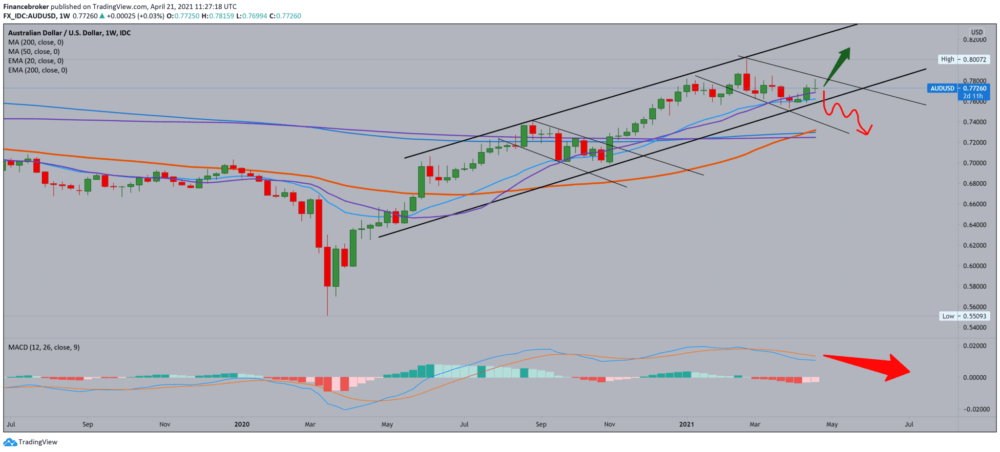

On the weekly time frame, we see a longer warming channel. The AUD/USD pair after bottom line testing and rejection, the resistance finds at 0.78000. We are also currently testing moving averages MA20 and EMA20, which have been good support for a year, and we will probably see in the next few weeks whether they will continue to do so. The MACD indicator is in a slightly bearish trend and, as such, can tell us that there is a chance that we will see a weakening Australian dollar for some time to come, but within this current consolidation around the lower line of support.

-

Support

-

Platform

-

Spread

-

Trading Instrument