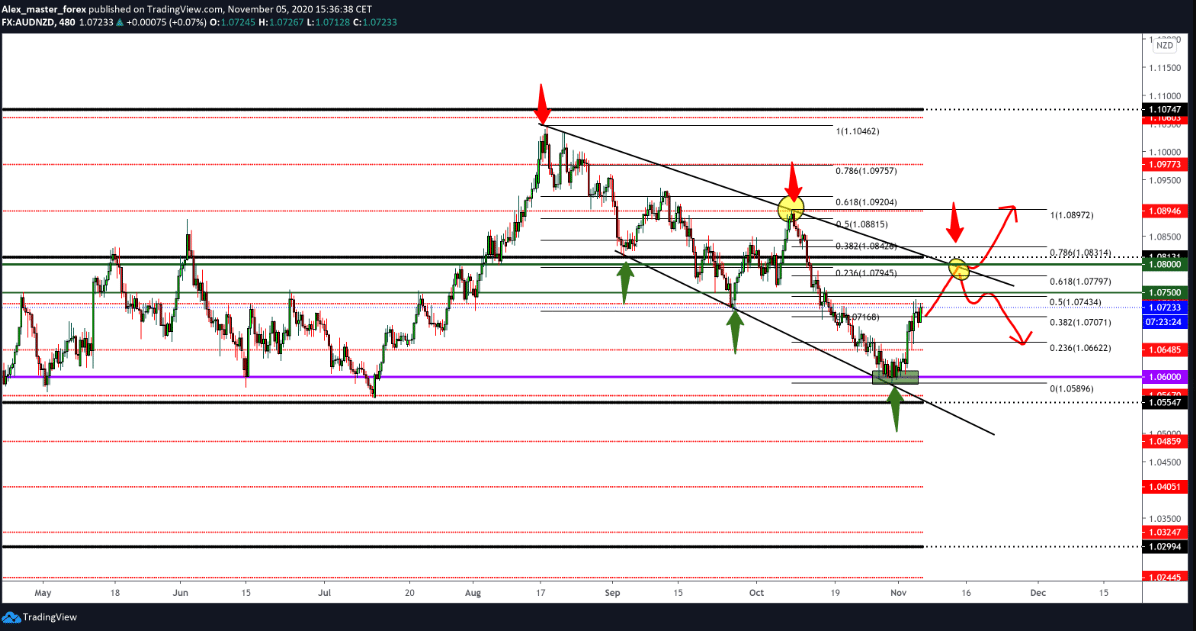

AUD/NZD forecast for November 05.

The last few days the AUD/NZD pair manages to stay above 1.06000 and move up, it has currently broken the level to 1.07000, and it is possible to go up to 1.08000. The chart made a descending channel with inevitable pullbacks that climb to a Fibonacci level of 61.8%. At that level, the AUD/NZD declined.

Despite the reduction of the interest rate to 0.10% by the Reserve Bank of Australia, the Australian dollar managed to gain strength. The Australian dollar was generally expected to weaken, but this was not due to global developments.

As the first U.S. election that is still ongoing, ballot counts are still continuous. Investors are standing aside and waiting for it all to end to continue investing. The overall situation has led to the dollar losing its value. Thus other currencies in correlation with it have gained in strength, mostly smaller currencies such as AUD, NZD, CAD.

Economic news from Australia this week was all above average despite the country being lockdown due to the coronavirus. The number of newly infected is single-digit and under control, so that the regions in Australia are slowly easing their measures against coronavirus.

From the news for the New Zealand dollar, we will single out: Employment Change, The Unemployment Rate, The ANZ Commodity Price Index, all these reports were better than forecast, and tomorrow our expected Inflation Expectations, the previous figure was 1.4%. Here, too, we can expect a positive result based on other reports this week.

We have a meeting of the Reserve Bank of New Zealand next week, and it is not excluded that they will also reduce interest rates to match the Australian dollar. The Prime Minister of the new government, Ardern, announces financial measures to help small employers, workers.

Corona cases are under control in New Zealand; only 2 cases of new infections were recorded yesterday

-

Support

-

Platform

-

Spread

-

Trading Instrument