AUD/NZD Forecast for March 9, 2021

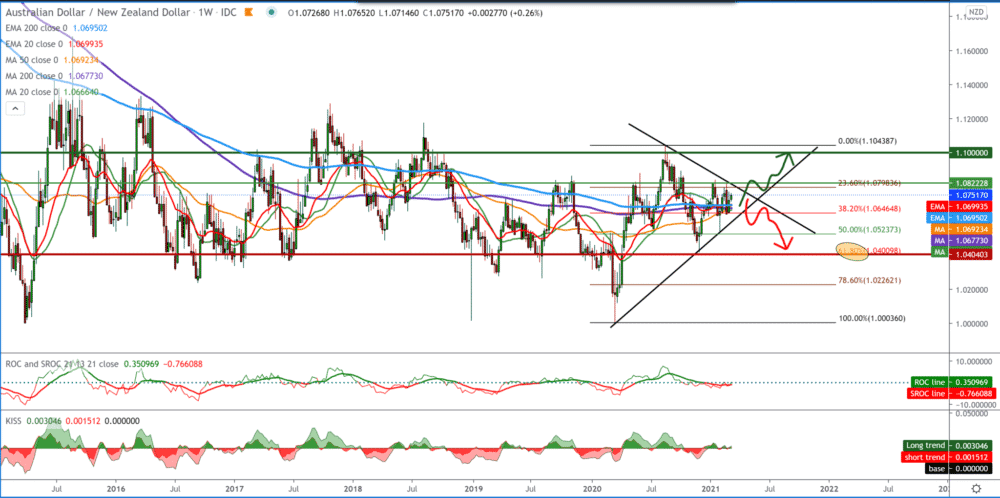

Looking at the chart on the weekly time frame, we see that the AUD/NZD pair is still stuck in the big triangle corner but moving slightly towards the higher levels on the chart. The pair managed to climb above all moving averages, and based on that. We expect the bullish trend to continue. By setting the Fibonacci retracement level, we see that the AUD/NZD pair bounced back from 61.8% level and moved up and is now testing the 23.6% level and the upper trend line, which is very close. Overall the AUD/NZD pair is in a bullish trend and higher resistance, and we are looking up at 1.10000.

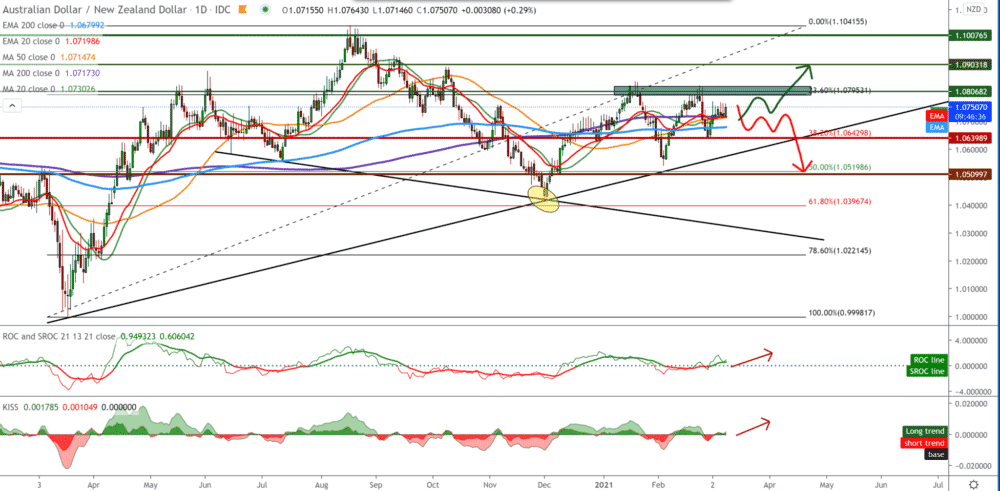

We see the AUD/NZD pair following the bottom trend line bouncing off of it on the daily time frame. We see a rejection of 61.8% level with the Fibonacci setting, and later from 50.0% then 38.2%, and now we are testing 23.6% Fibonacci level. Our resistance above is at 1.08000, where we have transitional highs, and they are our first targets towards the continuation of the bullish trend. Moving averages are currently on the bullish side or not as strong support as the market has been more volatile since the beginning of the year.

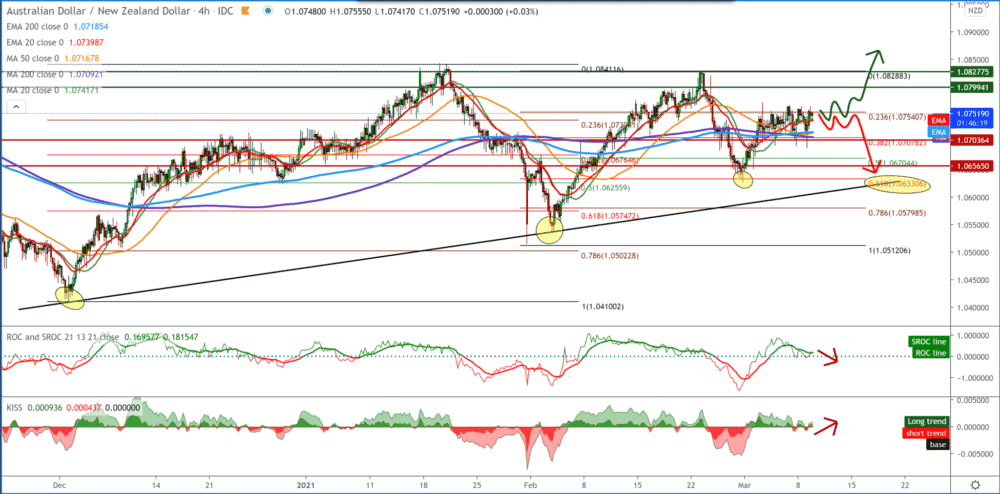

In the four-hour time frame, we see that when we set the Fibonacci retracement level, we notice that the pair bounces off 61.8% of the level twice. After that, the AUD/NZD pair goes above the moving averages and gets their support and tests 23.6% Fibonacci levels. So we can expect to see the AUD/NZD pair at 1.08000 soon, looking at the previous high at 1.08277. We need a rejection of Fibonacci 23.6% level for the bearish scenario with a drop below the moving average to 1.07000 on Fibonacci 38.2% level.

Due to the lack of main data in the series for publication, global investors are not taking their eyes off the American coronavirus’s title incentives (COVID-19), which will be crucial to watch. It is worth noting that vaccinations in the Asia-Pacific region have recently started and that, therefore, the same could increase market instability.

-

Support

-

Platform

-

Spread

-

Trading Instrument