AUD/NZD forecast for January 28, 2021

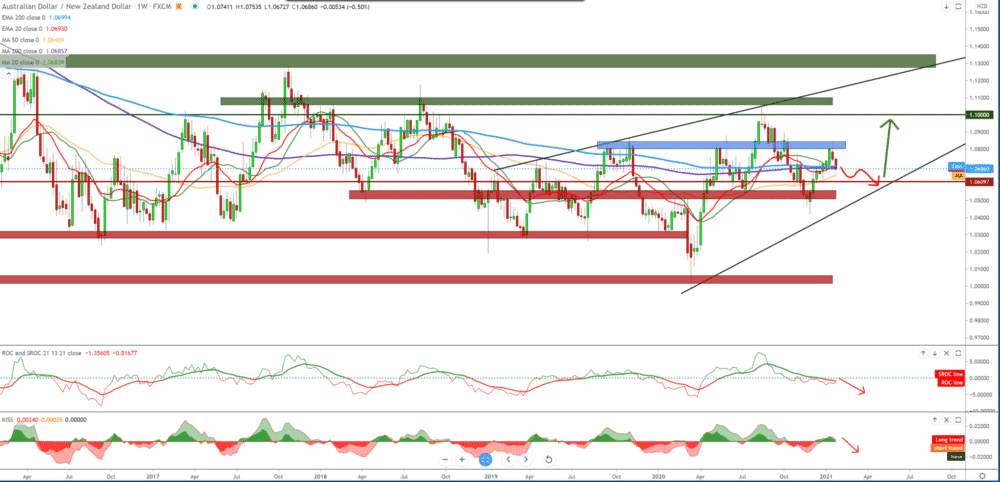

The chart on the weekly time frame shows a pullback from 1.08440 to the current 1.06880 . The AUD/NZD pair is currently at some 50.0%, and based on moving averages, we cannot conclude the next potential movement on the chart. Technically, based on the last two candlesticks, we can conclude that it is not a short-term bearish trend and that our maximum bearish target is 1.06000.

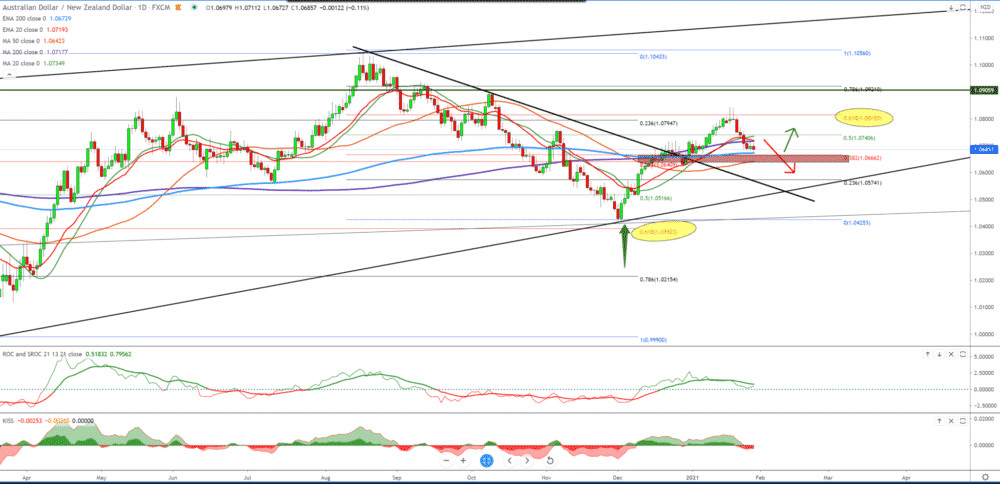

On the daily time frame, we can follow the Fibonacci retracement level. What we can notice is a pullback with a Fibonacci level of 61.8% at 1,08150. And moving averages make a downward turn pushing the AUD/NZD pair towards the Fibonacci level of 38.2% at 1,06660. Some maximum pair we can expect up to 1,057,000, which coincides with the trend’s bottom line. The rejection of Fibonacci levels of 38.2% upwards leads us to continue bullish trends towards higher levels.

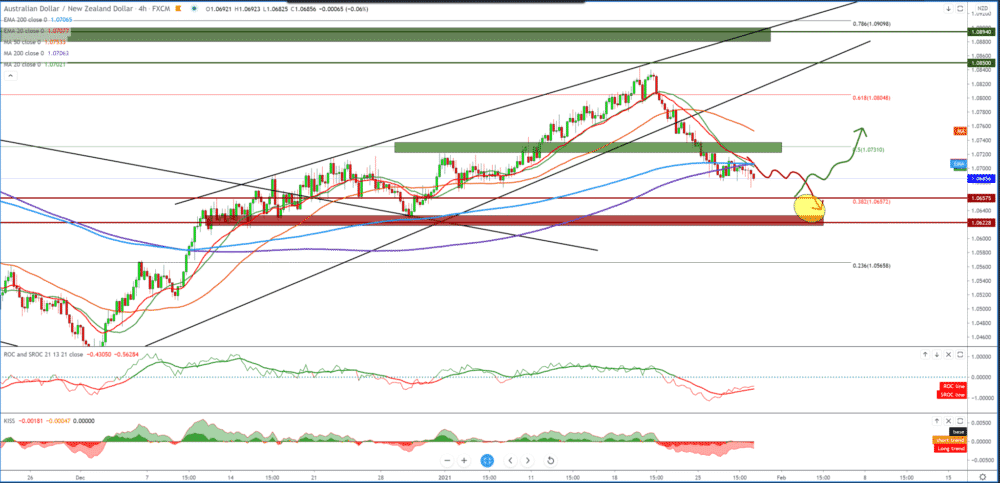

We see that the AUD/NZD pair dropped out of the rising channel on the four-hour time frame, making a break of 1.07700 and continuing down to the current 1.06840. The AUD/NZD pair also fell below the very important moving average indicators MA200 and EMA 200; the other above indicators are also worse on the bearish side. Support can be sought at 1.06500 Fibonacci level 38.2%, and even a decline to better support at 1.06200 places of the previous higher low place of previous support.

From the news for the AUD/NZD pair, we can single out the following: Export prices in Australia rose 5.5 percent compared to the quarter in the fourth quarter of 2020, the Australian Bureau of Statistics said, refuting forecasts for a decline of 1.3 percent after falling from 5.1 percent in K3. Import prices sank 1.0 percent in the quarter against expectations of a decline of 2.4 percent after dropping 3.5 percent in the previous three months.

Check-out FinanceBrokerage’s Comprehensive Review on Spreadex

New Zealand recorded a surplus in trade in goods of 17 million New Zealand dollars in December; New Zealand statistics announced on Thursday – after a surplus of 252 million New Zealand dollars in November. Also, very important news for the NZD is that Total milk exports to China in December fell by 194 million New Zealand dollars (21 percent) to 740 million New Zealand dollars. This was due to a drop in milk powder, by NZ 113 million.

-

Support

-

Platform

-

Spread

-

Trading Instrument