AUD/NZD forecast for January 21, 2021

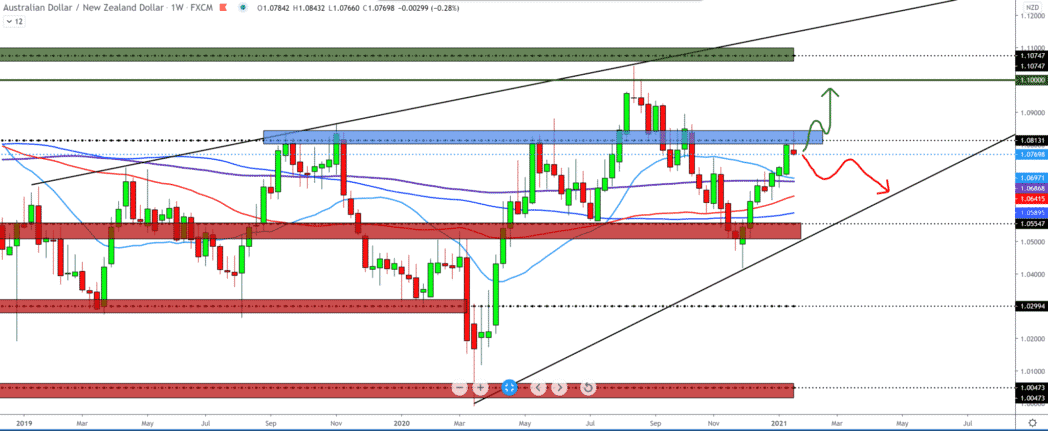

Looking at the AUD/NZD pair chart on the weekly time frame, we see that the Australian dollar loses strength and fails to stay at 1.08000, retreating down towards lower support levels. Bearish scenario is currently in force, and we can expect it in the next week or two, with a drop to moving averages asking for that customer support. The first support is at 1.06800, and if we see a break below that level, the next is at 1.05550. To continue in the bullish scenario, we will probably wait for this consolidation to be completed.

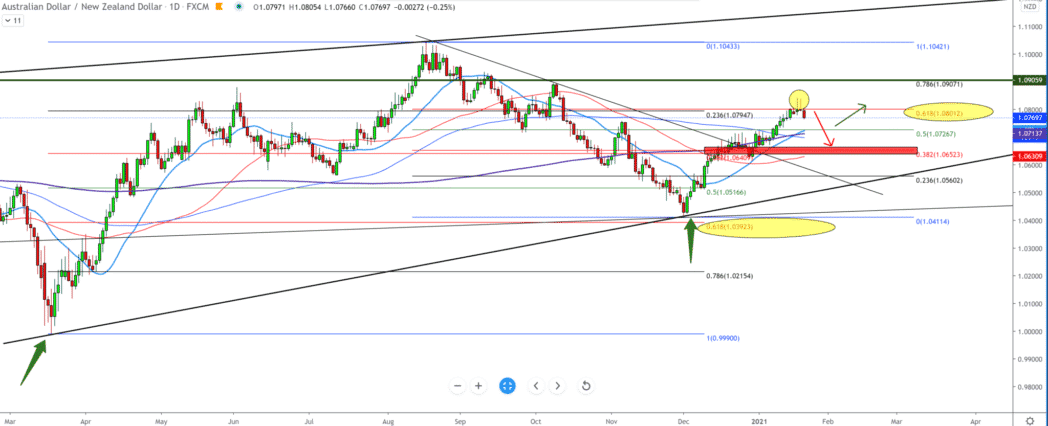

On the daily time frame, we see a pullback below the Fibonacci retracement level of 61.8%, compared to the analysis from two days ago when the bullish candle was at its maximum. Thus, we now see a solid resistance to 1.80000, and so we can expect a continuation of the decline to 1.075000 and even 1.07200 to a Fibonacci level of 38.2%.

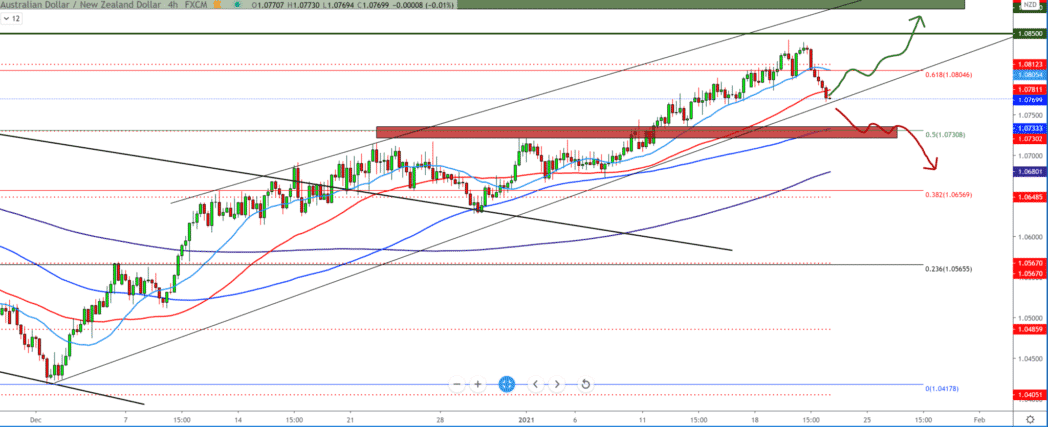

On the four-point time frame, we see a pullback in the last two days, a drop below the moving averages of the Ma20 and MA500, with a tendency to continue the decline even lower. The AUD/NZD pair is currently testing the bottom line of the channel, and we can track whether it will bounce up or make a break below continuing to the bearish side. Below we have support on the Fibonacci level of 50.0% retracement to 1.07300.

From the important news for the AUD/NZD pair, we can single out the following: Australian Prime Minister Scott Morrison said he would like to study the business data before commenting further. This comes after the South Asian state added 50,000 full-time jobs in December. The unemployment rate fell more than expected to 6.6%, while the labor market continues to recover from the coronavirus pandemic’s early impact.

-

Support

-

Platform

-

Spread

-

Trading Instrument