AUD/NZD forecast for January 19

Looking at the chart on the weekly time frame, we see that the pair has been very bullish for the last two months and that this year a break has been made above the moving averages that are now on the support side towards higher levels. The pair is currently in the essential zone at 1.08000-1.08300, which was also a resistance zone in previous periods. To continue the bullish trend, we need a break above that zone, and then we can see the pair at 1.1000. Otherwise, the fall below that zone brings us back down first to moving averages, and below that, the support zone is at 1.05000-1.05500.

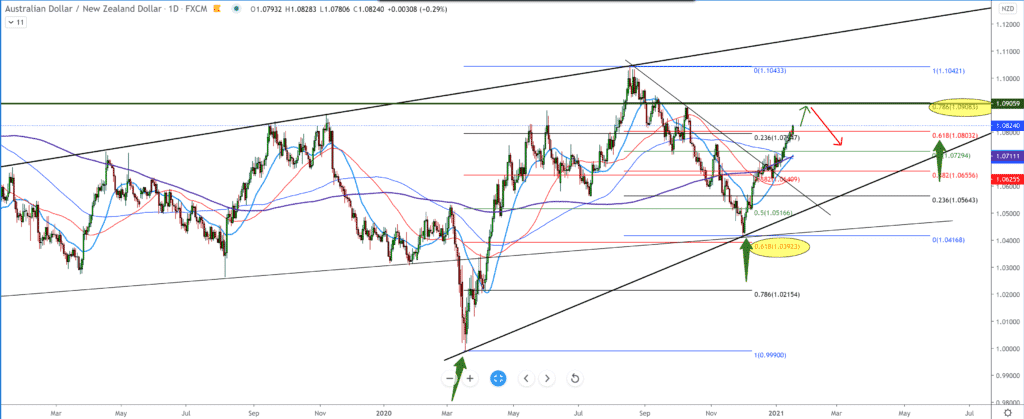

On the daily time frame, we see that here that we can use Fibonacci retracement levels. The pair made a previous pullback to 61.8% and bounced up. By setting the trend line, we see that a growing channel has been formed and that the pair is bouncing off the upper trend line by default. Now again, we have a bullish momentum that has made a break above moving averages. When we set the Fibonacci to previous high and previous low, we see that the pair has crossed the level of 61.8% and that now the pair is going towards the level of about 78.6% at 1.09000.

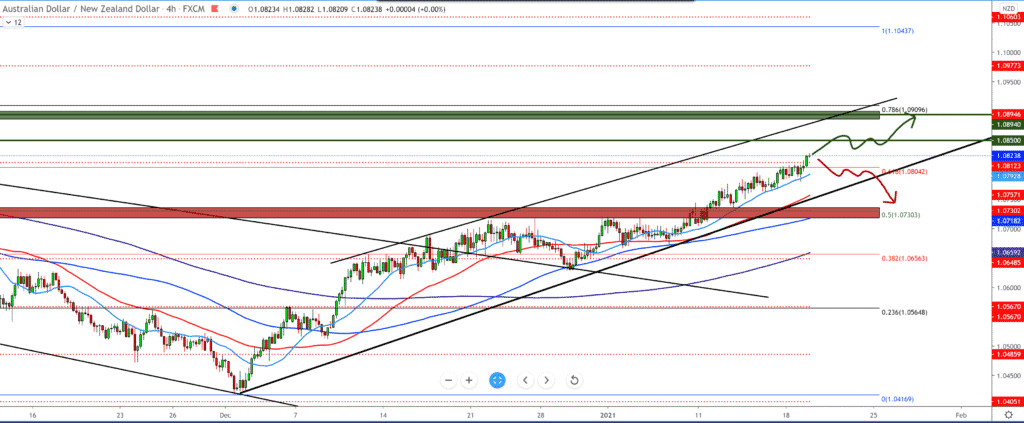

In the four-hour time frame, we see that the pair moves in an upward channel with the support of moving averages from below. In the next period, we can expect further growth to 1.08500. For a more specific bearish scenario, we need a break below the moving averages and then the lower trend line to change the trend.

From today’s news, we can single out the following: The growth of consumption of New Zealand retail cards accelerated in December, driven by higher consumption of groceries, furniture, and electronics, statistics from New Zealand reported on Tuesday. Total spending on retail cards rose 3.5 percent year-on-year, faster than the 1.4-year growth seen in November. Simultaneously, the actual consumption of cards using electronic cards rose by 4.3 percent or 20 billion New Zealand dollars.

-

Support

-

Platform

-

Spread

-

Trading Instrument