AUD/NZD forecast for December 04, 2020

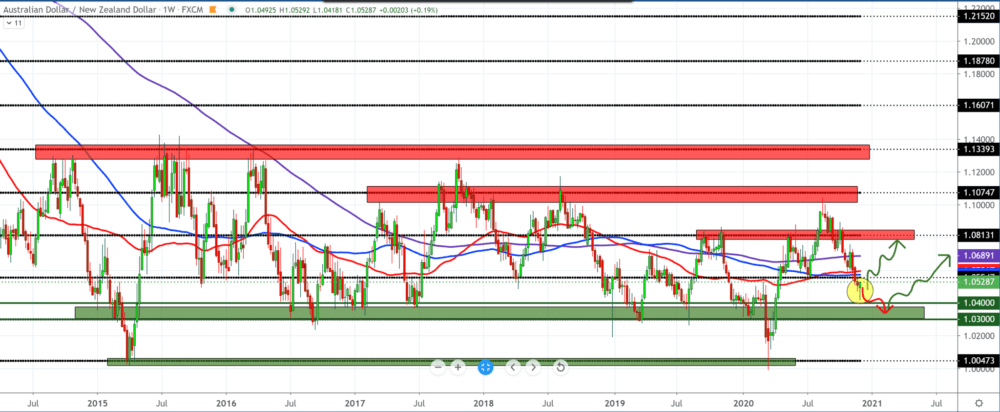

Looking at the chart on the weekly time frame, we see that we have one large support zone from which the AUD/NZD pair bounces upwards from the bottom. The last candlestick on the chart tells us that there is a likelihood of a trend reversal soon and that the AUD/NZD currency pair will turn into a bullish scenario.

Moving averages tell us that the price has no major oscillations and is moving in the sideways channel.

Candlestick is on a weekly time frame, so it’s best to wait for it to close and open next week.There is always a chance that the couple will test the lower zone once again.

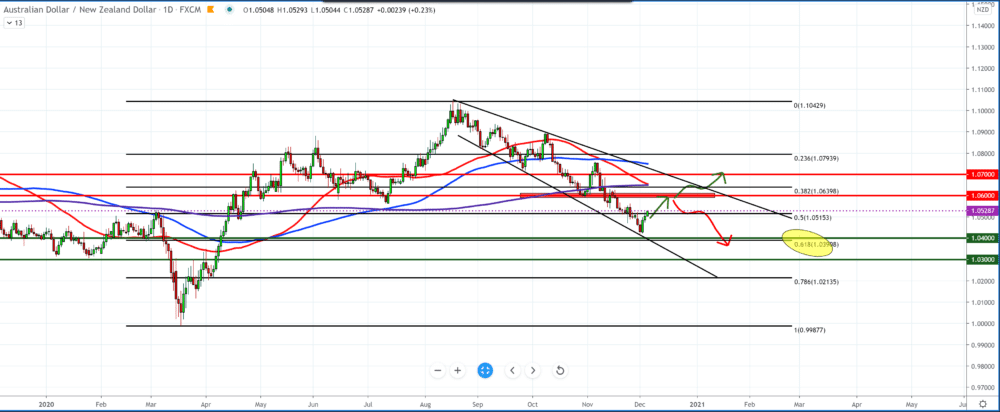

The chart on the daily time frame tells us that we are in a downward channel since August 2020 and that the AUD/NZD pair have now found support at the Fibonacci level of 61.8%, is currently testing the 50.0% level and is now likely to see the AUD/NZD pair at a higher level around the Fibonacci level 38.2% where they will meet the moving averages MA50 and MA200.

We have confirmation of the last three candlesticks that a bullish pullback is possible in the short next period. Our bullish target is a zone around 0.6000 on a daily time frame.

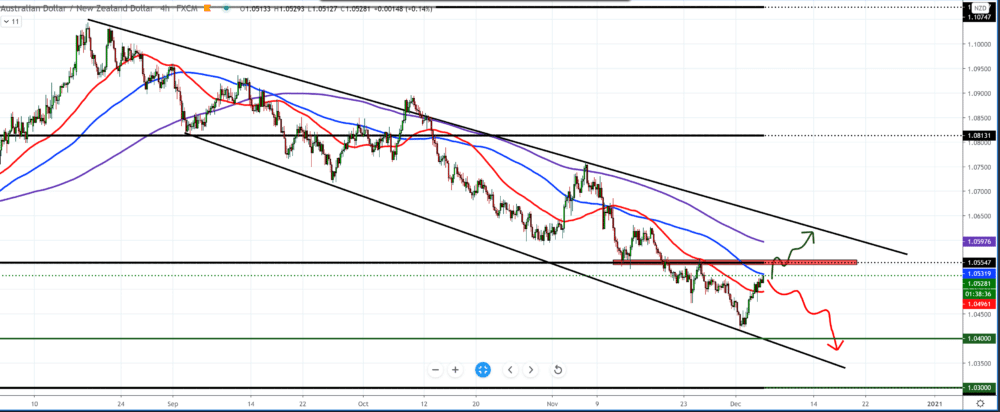

On the four-hour time frame, we see that the AUD/NZD pair made the first break above the moving average of the MA50 and going towards the next moving average of the MA100.

We can expect the above resistance at 1.05500, where a previous break was made when the price was falling, and the final target within this channel is our target at 0.60000.

Otherwise, if the Australian dollar falls to move into the bullish scenario, we go back down again to confirm the zone from the daily and weekly chart 1.0300-1.04000.

From the news today, we can single out: The total value of retail sales in Australia increased seasonally adjusted by 1.4% in October, the Australian Bureau of Statistics announced on Friday, which amounted to 29.552 billion US dollars.

That was less than expected for the 1.6% growth forecast, after falling -1.1% in September.

-

Support

-

Platform

-

Spread

-

Trading Instrument