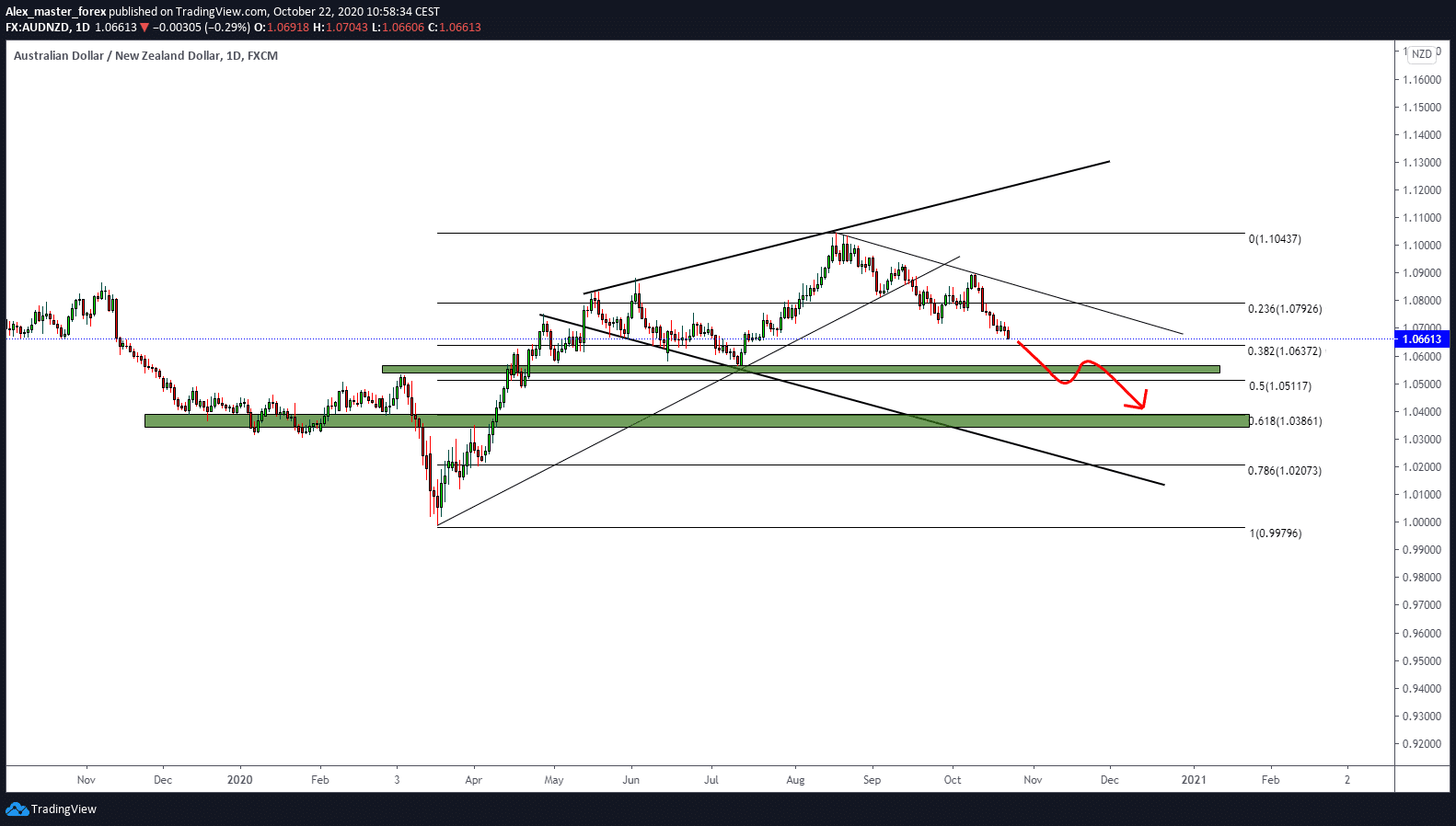

AUD/NZD Continuation of the Bearish Scenario

Looking at the chart since October 9, we have a sharp drop in the Australian dollar against the New Zealand dollar. Then, the price recorded a lower maximum and dropped, which coincides with the RBA’s statement on the reduction of interest rates in the negative zone.

Dovish RBA expectations undermined Aussie and increased sales bias. There are the fewest coronavirus cases, while the country is still blocked, tourism does not exist, and this industry is under the greatest pressure. Putting more money into circulation as a stimulus to the economy is of great help, but it weakens the domestic currency, unlike facilitating business.

New Zealand is also blocked, but the market is smaller than Australia and has fewer consequences. According to the latest reports, there is no tourism; the number of tourists has been reduced by 95%, which is a total disaster for this industry.

Whatever the incentives, there is no help for tourism this year. In New Zealand, Crown cases have risen from 1 infected on October 20 to 25 infected on October 21. A huge jump in the number of infected within 24 hours will result in the new introduction of measures if this trend continues.

As for the chart level, the price is currently at the Fibonacci level of 32.8% at 1.06370 if it breaks that support next down at the Fibonacci level of 50.0% at 1.05100.

The downward trend continues

-

Support

-

Platform

-

Spread

-

Trading Instrument