AUD/NZD analysis for May 4, 2021

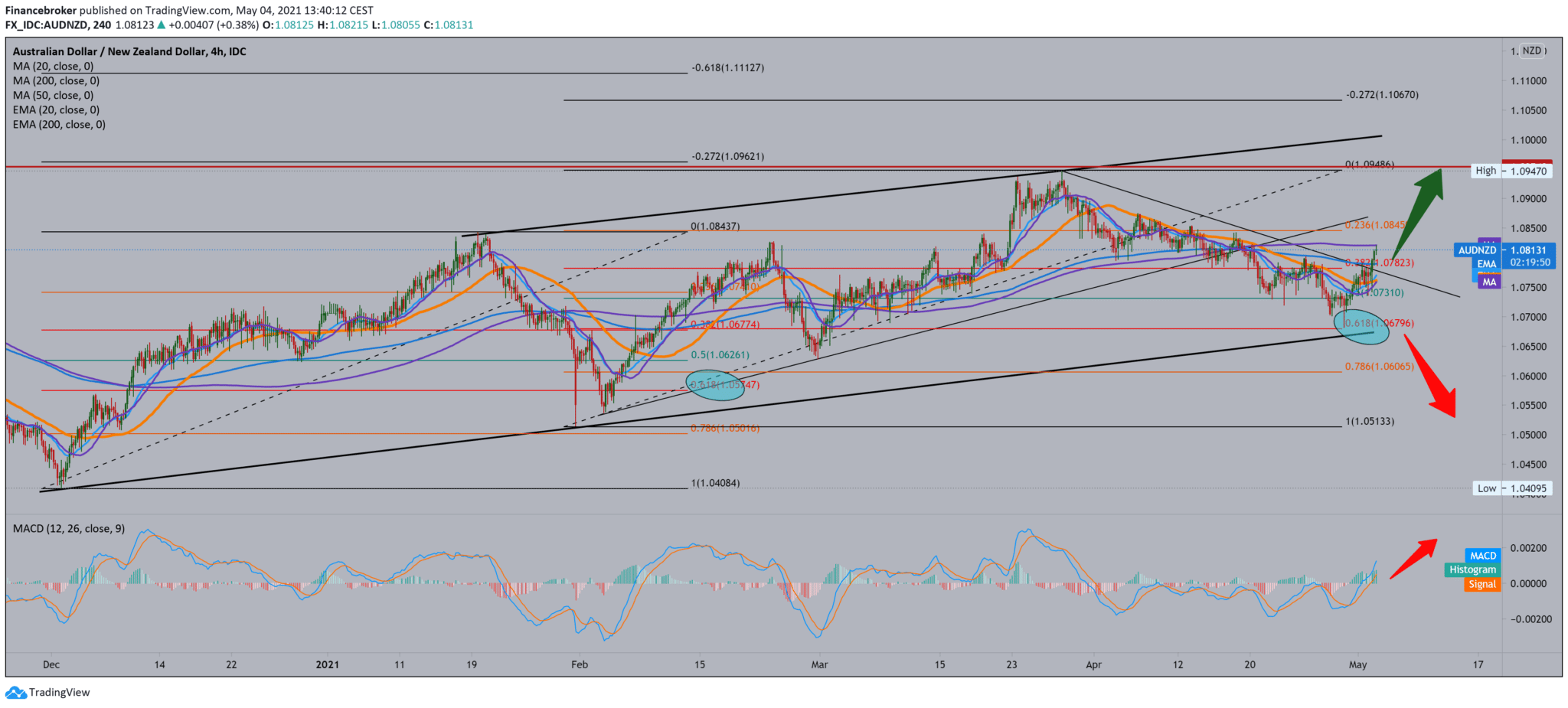

Looking at the graph on the four-hour time frame, we see that the AUD/NZD pair bounced off the channel’s bottom line at exactly 61.8% Fibonacci level at 1,068000, almost the same as in the previous pullback where we also bounced off the bottom support line. The AUD/NZD pair now has moving average support in MA20, EMA20, and MA50, while we are now testing the MA200 and EMA200 and a 38.2% Fibonacci level at 1.078230. Consolidation was good, and after that, we see a bullish momentum.

Now we can expect a break above MA200 to continue up, first towards 1.08450 at 23.6% Fibonacci level, and then towards the previous high at 1.094700. If we consider the bearish option, we need to drop below 50.0% Fibonacci level 1.073100, then test 61.8% Fibonacci level to 1.068000 and break below the bottom support line for a more serious bearish scenario with the first target at 78.6% Fibonacci level at 1.06000 and the maximum target of the previous lower low at 1.051330.

Looking at the MACD indicator, we see that the blue MACD line has crossed over the signal line, giving us a bullish signal supporting the current state on the chart.

The Australian central bank decided to maintain its current policy settings, as expected, on Tuesday.

The Australian Reserve Bank’s policy committee, headed by Governor Philip Love, has decided to leave its cash rate unchanged at a record low of 0.10 percent. The central bank kept the target yield on three-year Australian government bonds at around 0.1 percent and kept the Term Funding Funds parameters and the government bond purchase program. The bank reiterated that it would not increase the cash rate until real inflation is kept within the target range of 2 to 3 percent. For that to happen, the labor market will have to be strong enough to generate wage growth that is materially higher than it is at the moment, bank representatives said. That is unlikely to be the earliest by 2024.

-

Support

-

Platform

-

Spread

-

Trading Instrument