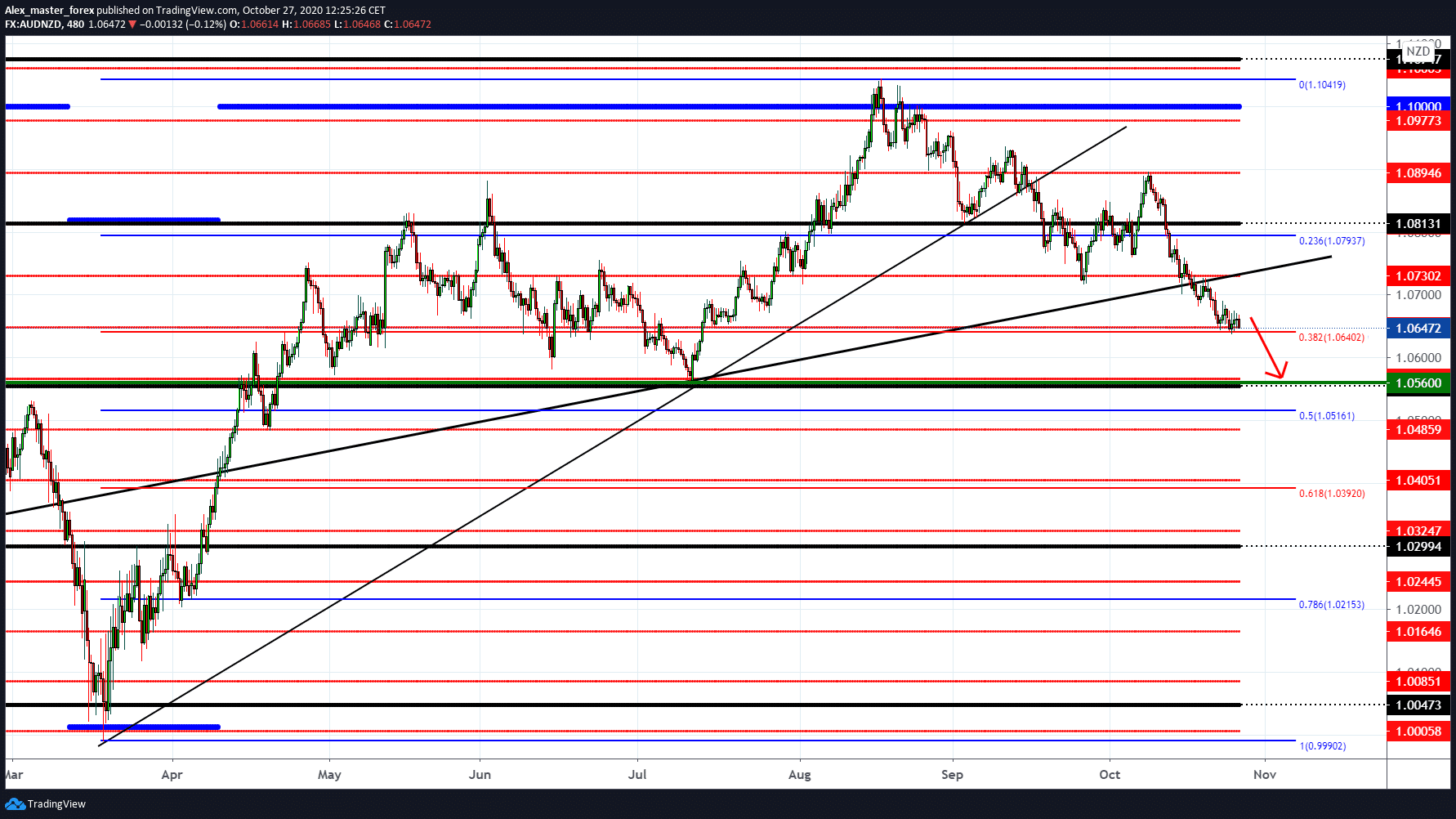

AUD/NZD 1.05500 as Possible Support

Annual prices showed a drop from 2.2% to -0.3%

AUD initially dropped to its intraday lows before it traded higher as traders favoured risky assets ahead of the FOMC statement.

Analysts see a 1.4% price growth in Q3 2020, with annual prices ticking up by 0.6%. Quarterly PPI (00:30 GMT) could record 0.7% growth after falling 1.2% in Q2 2020

Annual PPI could recover from -0.4% to -0.1%

The NAB’s quarterly business confidence (October 29, 00:30 GMT) last reached -15 and marked the fourth quarter in negative territory. The Australian Reserve Bank (RBA) prints its policy statement next week, with markets recording a rate cut in November. This week’s issues are likely to weaken or strengthen analysts’ speculation.

The Chinese PMI (October 31, 01:00 GMT) is expected to show a slight decline in production (from 55.9 to 55.2) and an improvement in the services sector (from 51.5 to 51.8)

Coronavirus updates (number of cases, incentives, lock, vaccine) will continue to affect intra-weekly high-yield currency trends.

NZD has been strengthening across the board lately, making it more vulnerable than its other high-yielding peers in case risk sentiment turns sour. Pandemic-related updates (rising number of cases, lockdowns, stimulus, vaccine) will continue to affect global risk-taking. Top-tier reports from other major economies such as Australia’s quarterly inflation; France, Germany, and U.S.’GDPs, and China’s PMI reports can influence the demand for high-yielding currencies.

Brexit and stimulus negotiations, in particular, will attract market players ’focus for the week. On the chart, we can see that the value is currently at the Fibonacci level of 38.2%. It will likely continue down to the Fibonacci level 50.0% in the zone from 1.05200-1.05600. Realistically, another 100 pips will fall to more serious support.

-

Support

-

Platform

-

Spread

-

Trading Instrument