AUD/JPY forecast for December 2, 2020

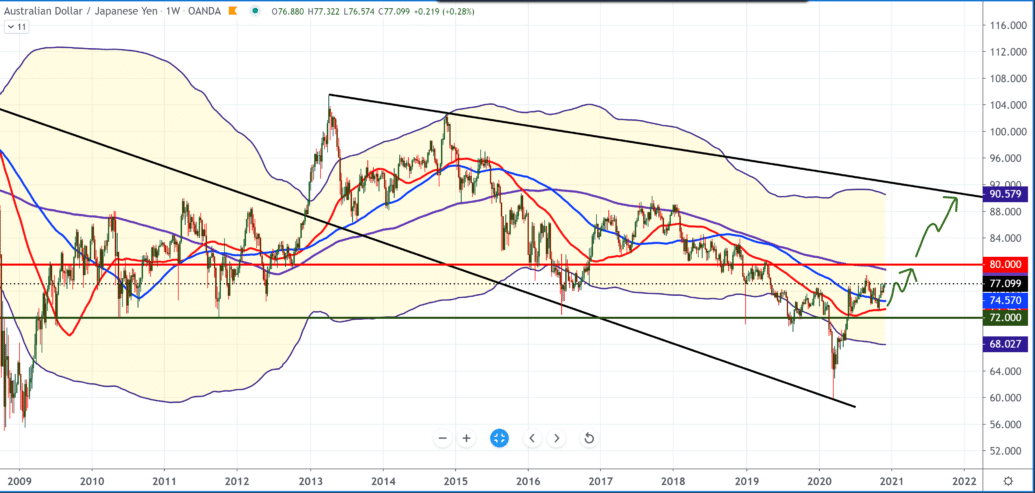

If we look at the chart on the weekly time frame, we will see that the AUD/JPY pair in early November was our support for the moving average of MA50 when pharmaceutical companies’ news about discovering the vaccine was published.

Following the chart below, we can see that a break was made above the MA100 and that we can look for the next target and higher resistance above on the MA200 around 79-80.00. The continuation of the bullish scenario is very probable in the following period due to the reduction of the risk with vaccines’ arrival.

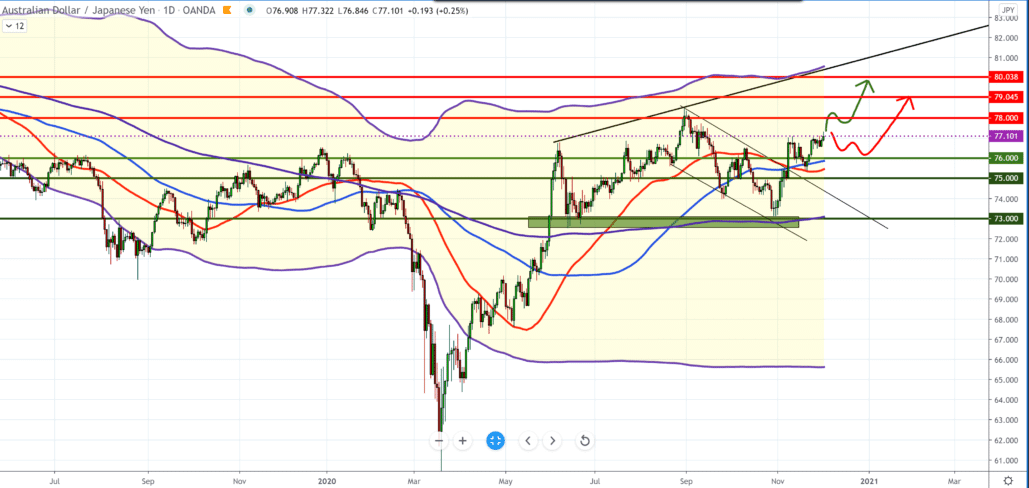

On the daily time frame, we notice that the trend is bullish with certain pullbacks. As bigger support on the daily chart, we have a moving average of MA200, followed by MA50 and MA100. On the upper side, our first target is 78.45 previous high from September, and that the chart makes a potential FLAG pattern, and we can expect some bigger movement on this pair soon.

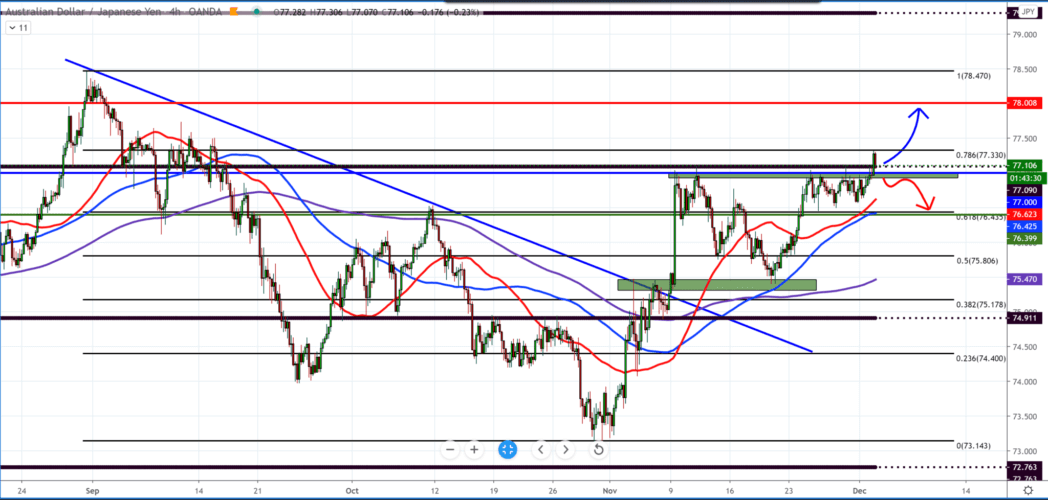

Our picture is much cleaner on the four-hour time frame, and you can see the support for moving averages MA50, MA100, and MA200. By setting Fibonacci, we see that at certain levels, the AUD/JPY pair found support at 61.8% 76,435, with some resistance at the level of 78.6% 77,330.

From the news for these two currencies, we can single out the following: The Bank of Japan (BOJ) will not hesitate to implement additional mitigation measures if necessary, Deputy Governor Masayoshi Amamiya said on Wednesday.

The current mitigation is having an anticipated effect on the economy. The extension of the duration of COVID response measures may be extended beyond the March deadline as needed, given the pandemic’s impact on the economy.

Australia’s economic recovery will be uneven and uneven, Australian Reserve Bank Governor Philip Lowe said on Wednesday.

Economic growth should be solidly positive in the third and fourth quarters; Lowe told a parliamentary committee. Data released earlier in the day showed that the Australian economy emerged from the third quarter recession. GDP grew 3.3 percent after falling 7 percent in the second quarter.

-

Support

-

Platform

-

Spread

-

Trading Instrument