AUD fluctuates on stronger dollar

At the June meeting, the Reserve Bank of Australia (RBA), as expected, decided to leave the current policy settings, including 10 basis point targets for both the cash rate and yield on three-year Australian government bonds, as well as term funding and program parameters. Purchases of government bonds.

Today’s statement is similar to the one in May, where the Committee is committed to maintaining monetary conditions that support a high level of support for the return of full employment in Australia and inflation in line with the target. It will not increase the cash rate until real inflation is kept within the target range of 2 to 3 percent. For that to happen, the labor market will have to be strong enough to generate wage growth that is materially higher than it is currently. That is unlikely to be the earliest by 2024.

The RBA stated that at its July meeting, the Board would consider whether to keep the April 2024 bond as the target bond for the three-year yield target or move on to the next maturity, the November 2024 bond. The board is not considering changing the 10-point target. At its July meeting, the Board will also consider future bond purchases following the completion of another $ 100 billion purchase under the government bond purchase program in September. Returning to full employment remains a high priority.

The strong US manufacturing PMI confirmed the Fed’s narrowing expectations, increasing the dollar’s attractiveness to investors. Investors reject the willing Fedspeak because economic optimism requires the normalization of monetary policy.

On the AUD side of the story, the feeling is still very unstable with the seven-day extension of the blockade in Australia’s second-most populous state, Victoria. Severe troubles overshadow the positive impact of optimistic GDP data for the first quarter. The Australian economy grew by 1.8% in Q1, beating expectations of 1.5% growth and + 3.2% recorded in the previous quarter.

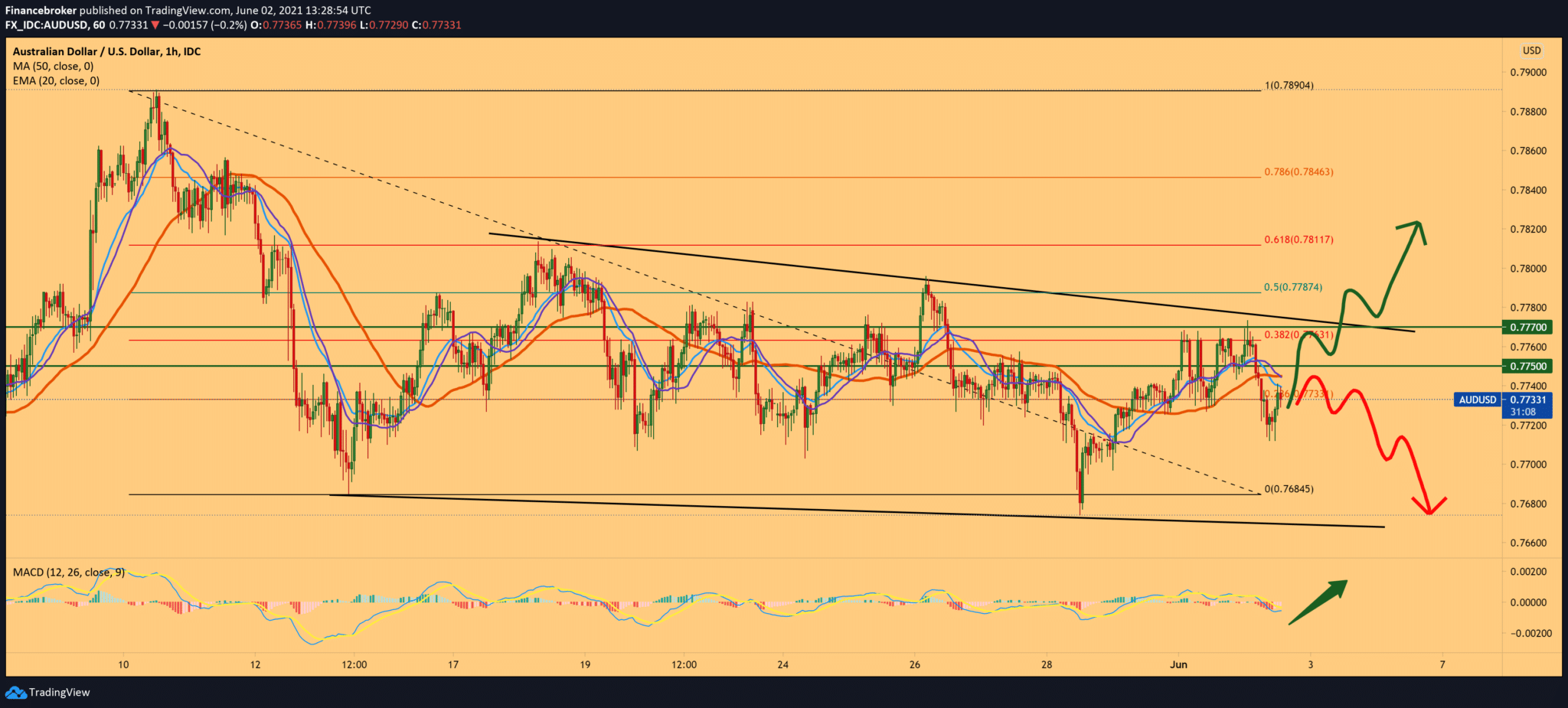

Looking at the chart, we see that the AUD/USD pair moves in the range of 0.76800-0.78000. By setting the Fibonacci level, we see the current resistance at 38.2% Fibonacci level at 0.77630. To continue the bullish trend, we need a break above that level, and if that doesn’t happen, we go back down testing again in the zone around 0.76800; a pullback is always likely. The MACD indicator is in the bearish territory with signs of weakening of the same bearish trend moving sideways on the chart, and for now, we can say that it is indeterminate.

-

Support

-

Platform

-

Spread

-

Trading Instrument