AUD/CHF forecast for March 11, 2021

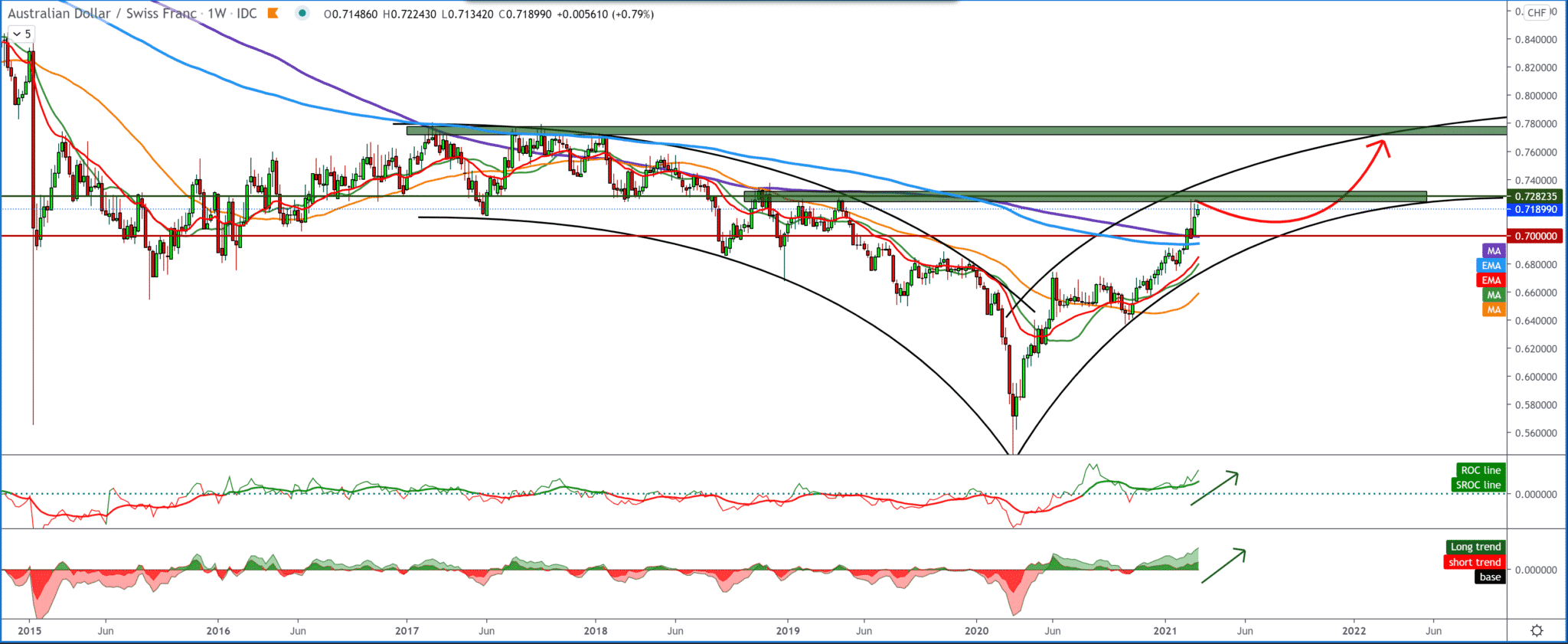

Looking at the chart on the weekly time frame, we see that the AUD/CHF pair is still testing the previous high from 2019 0.72850. The chart is still very bullish, but we can expect a smaller pullback here. It is important to us that the AUD/CHF pair made a break above MA200 and EMA200, and if there is a pullback, we expect it to be 0.70000. It all depends on the bullish trend’s strength, whether we will see a pullback or not. Based on this new state on the chart, we can see this pair in the zone between 0.73000-0.77000.

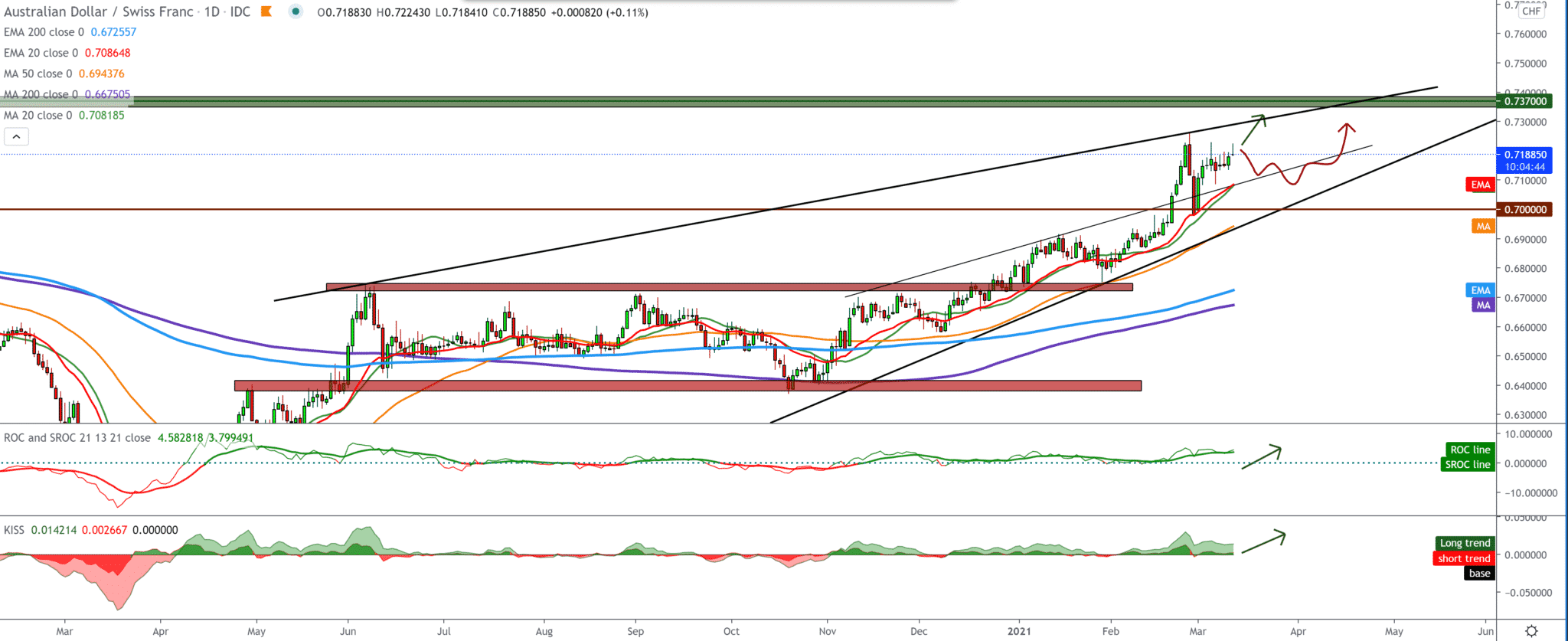

On the daily chart, we see that the AUD/CHF pair is moving in one rising channel, but that in the last few days, the Australian dollar is losing its strength and is making weaker progress now towards higher levels. The pullback that is possible, we can expect it up to moving averages MA20 and EMA20 first support from below. The MA50 is still below that and matches the bottom line of support.

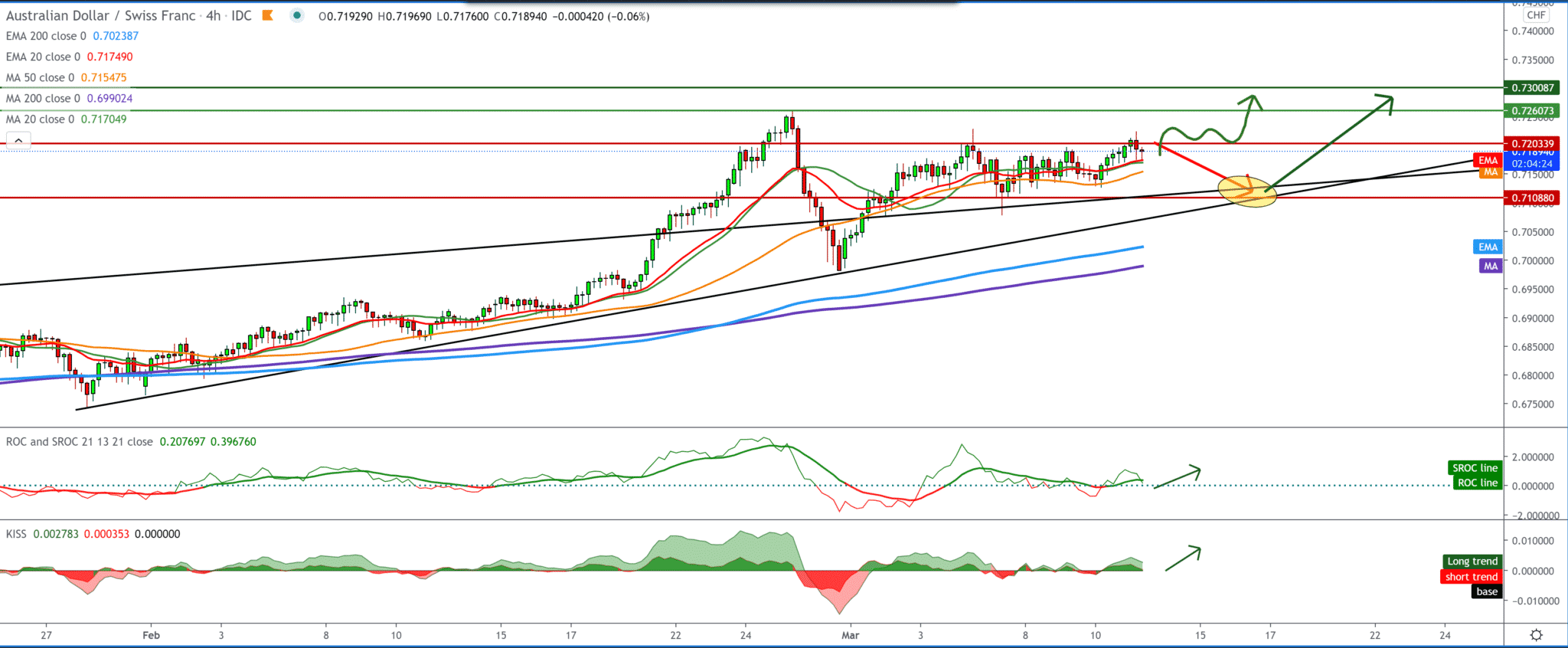

On the four-hour time frame, we see that the AUD/CHF pair consolidates above the moving averages of the MA20 and EMA20i. For now, there is solid support on the chart. Further growth on the chart is very evident, but it will be slowed down. We can expect a shorter pullback to 0.71000, where we support the bottom line of the trend.

From the news for this currency pair, we can single out the following: After contracting in the first quarter, the Swiss economy needs to recover rapidly by easing measures against coronavirus, the State Secretariat for Economic Affairs (SECO) said on Thursday.

Gross domestic product is projected to grow by 3 percent in 2021 and 3.3 percent next year. The projection for this year remained unchanged, while for 2022, it was revised by 3.1 percent. The economy is expected to shrink significantly in the first quarter of this year.

However, it seems that a collapse of a similar size as last spring is unlikely so far, SECO said. SECO expects that consumer prices will rise by 0.4 percent in 2021 instead of the 0.1 percent estimated earlier. Similarly, the projection for 2022 has been increased to 0.4 percent from 0.3 percent.

Employment is projected to rise significantly as the economy recovers and unemployment falls. The government has maintained its outlook on the unemployment rate. The unemployment rate this year is 3.3 percent, and next year 3 percent.

-

Support

-

Platform

-

Spread

-

Trading Instrument