AUD/CHF forecast for February 23, 2021

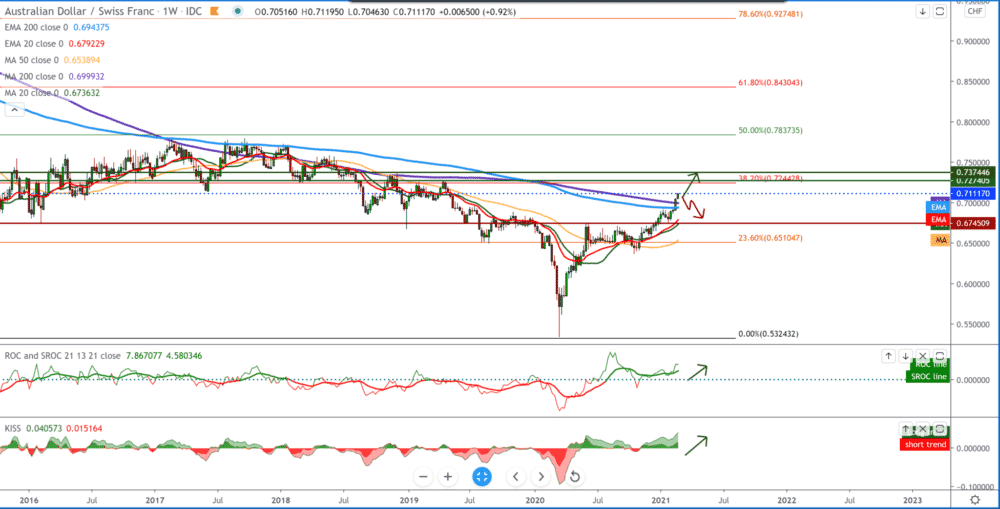

Looking at the chart on the weekly time frame, we see a strong bullish trend. After a long time, the AUD/CHF pair managed to make a break above the moving averages of the MA200 and EMA200. We can now look at the previous high from April 2019 at 0.72700. By setting the Fibonacci retracement level on the chart, our target is 38.2% at 0.72440. Potential pullback if we see it; we seek support in moving averages. Global vaccination of the population against Coronavirus boosts values such as the Australian dollar and separates investors from the Swiss franc as trading risks are reduced.

On the daily time frame, we also see a strong bullish trend from certain smaller pullbacks. First, we see the AUD/CHF pair chant a break above the resistance zone at 0.68000 and later the psychological zone at 0.70000. We can still expect the trend to continue, and our first technical target is 0.71500, followed by 0.72000. If we look at the pullback from the position where we are now, our target is a 0.70000 large zone of current support. Moving averages are on the bullish side, and based on them, and we can conclude the continuation of bulls trends.

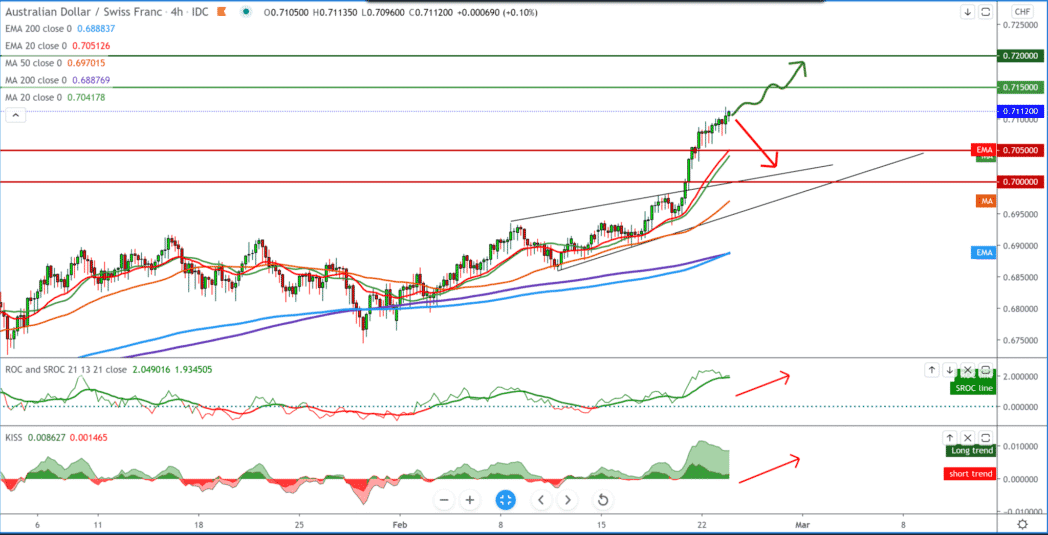

We see a bullish trend in the four-hour time frame, but we can say that the AUD/CHF pair growth is a bit slower now than last week. Moving averages are still on the bullish side and, for now, support this growing trend. For a potential pullback to better support, we need to first break below MA20 and EMA20, which would push the AUD/CHF pair closer to 0.70000 psychological level.

From the news for these two currencies, we can single out the following: Australian exports fell in January mainly due to falling iron ore deliveries, preliminary data from the Australian Bureau of Statistics showed on Tuesday. Exports fell 9 percent in January from a month. Shipments of metal ores fell 10 percent and meat 39 percent. At the same time, coal exports fell by 8 percent. Imports fell by 10 percent compared to the previous month. The data showed that road vehicles’ imports dropped by 23 percent, which is the first drop since May. Imports of general industrial machinery fell 16 percent, while imports of various products fell 13 percent.

-

Support

-

Platform

-

Spread

-

Trading Instrument