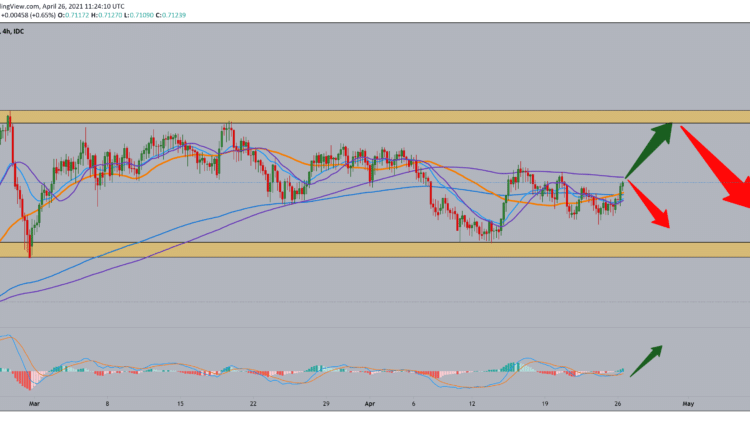

AUD/CHF analysis for April 26, 2021

Looking at the graph on the four-hour time frame, we see a lateral movement in the zone between 0.70000-0.72500. The current consolidation tells us that there is a probability that the AUD/CHF pair will climb to the top line of this consolidation zone again. We support moving averages MA20, EMA20, and MA50, and we see lower possible resistance on MA200. But we can expect to overcome that and move on. We need a pull below moving averages for the bearish option, and after that, we expect a drop to the bottom line fathers drive to 0.70000. Looking at the MACD indicator, we see that the signal is purely bullish, and based on that, we expect a further continuation of the growing trend.

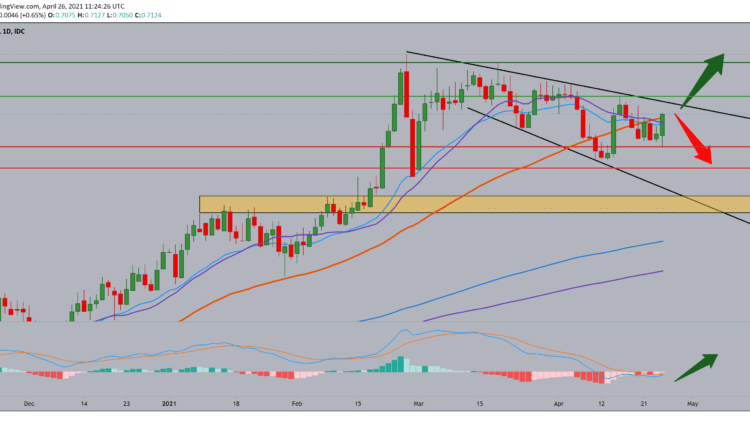

On the daily time frame, we see that we have a pullback of the last two months within this big upward trend, forming a smaller downward pullback channel. Moving averages are currently being tested, and a larger break or pull is expected to give us a cleaner signal to continue the trend. Looking at the MACD indicator, we see that the bearish trend is coming to an end and that we can expect a turn towards the bullish option in the next longer period.

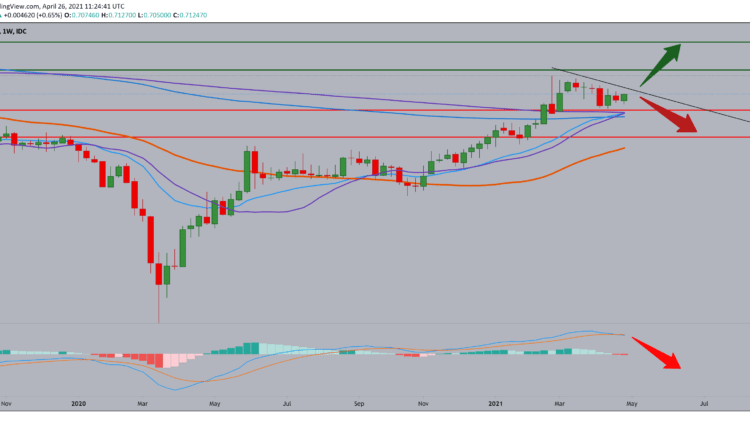

On the weekly time frame, we see that the AUD/CHF pair has excellent support for moving averages and that we are now waiting for a stronger momentum to break above the upper resistance line. If that happens, then we look at the previous high at 0.725990 as the next bullish target, then at 0.73000, then .74000. We need a pullback below the moving averages for a possible bearish scenario, which will be a stronger confirmation of our potential further continuation. Looking at the MACD indicator, we see that the MACD is leaning towards the bearish side, but the signal is not yet so strong that we can be sure that the bearish trend will continue.

-

Support

-

Platform

-

Spread

-

Trading Instrument