AUD/CHF analysis for April 20, 2021

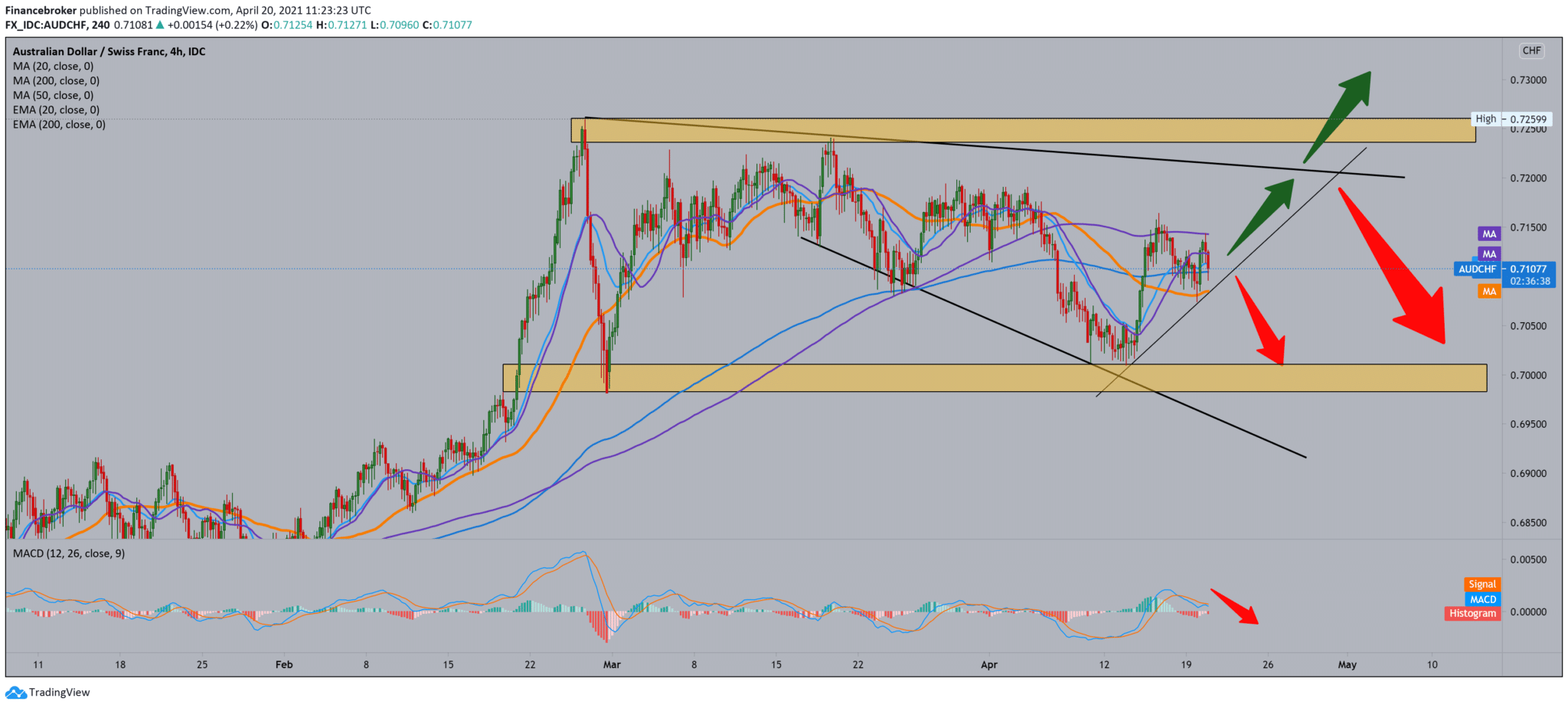

Looking at the chart on the four-hour time frame, we see that the AUD/CHF pair is in declining consolidation, where the AUD/CHF pair has found support at 0.70000. After that, we again have a slight increase to the current 0.71000. We are also between moving averages, and it is a bit uncertain where the AUD/CHF pair will move within this consolidation. We can draw a smaller trend line that can be short-term support and an obstacle to the continuation of the bearish trend. The MACD indicator is still pulling us down, and it is another indication that the bearish trend is stronger and prevalent.

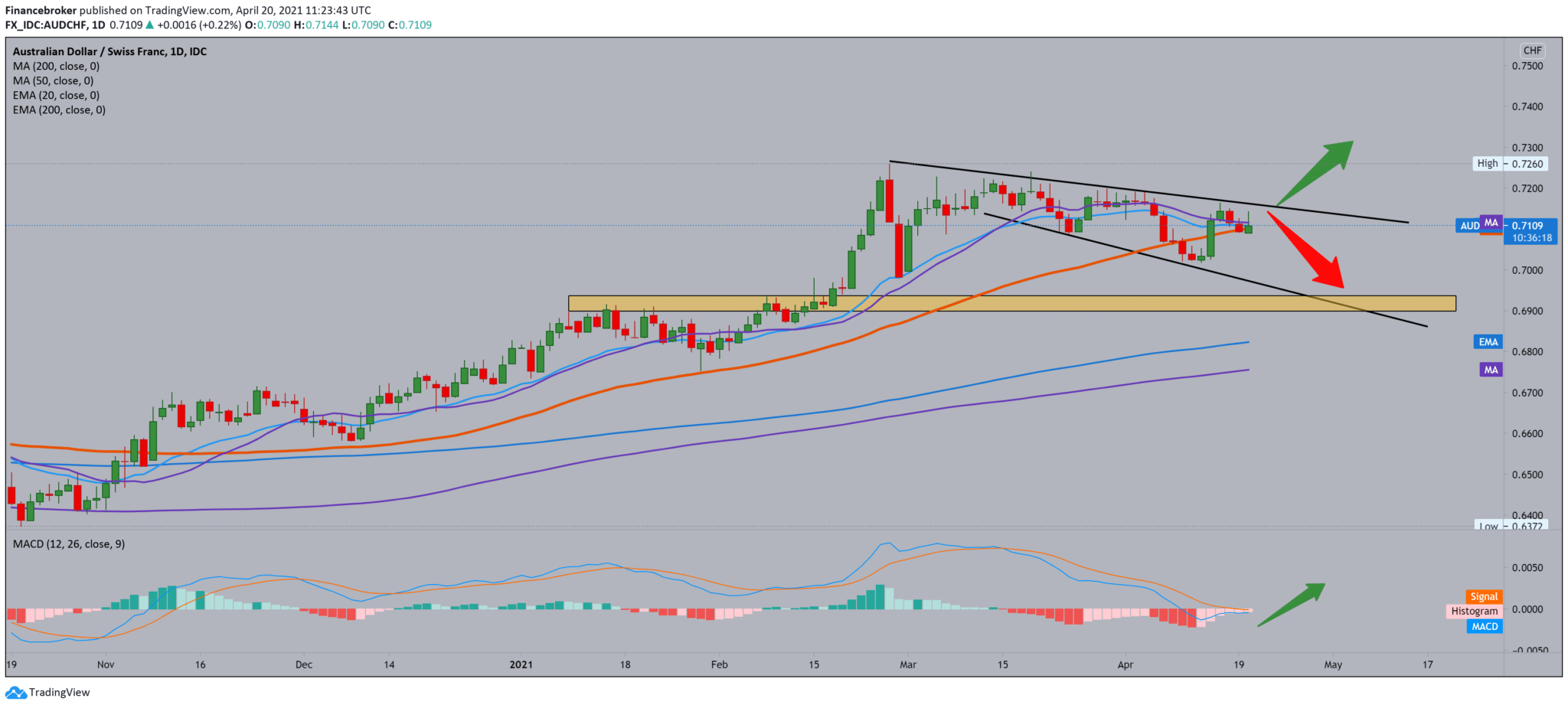

On the daily time frame, we see that we are moving in a falling channel and that based on that, we can expect a further continuation of the bearish trend. Following the moving averages, we see that they are still on the bearish side, making pressure and lowering a couple lower on the chart. We have stronger support at the psychological level at 0.70000. Looking at the MACD indicator, we see that the bearish option is weakening. The movement of the indicator is lateral, with a possible probability of switching to a bullish trend.

On the daily time frame, we see that we are moving in a falling channel and that based on that, we can expect a further continuation of the bearish trend. Following the moving averages, we see that they are still on the bearish side, making pressure and lowering a couple lower on the chart. We have stronger support at the psychological level at 0.70000. Looking at the MACD indicator, we see that the bearish option is weakening. The movement of the indicator is lateral, with a possible probability of switching to a bullish trend.

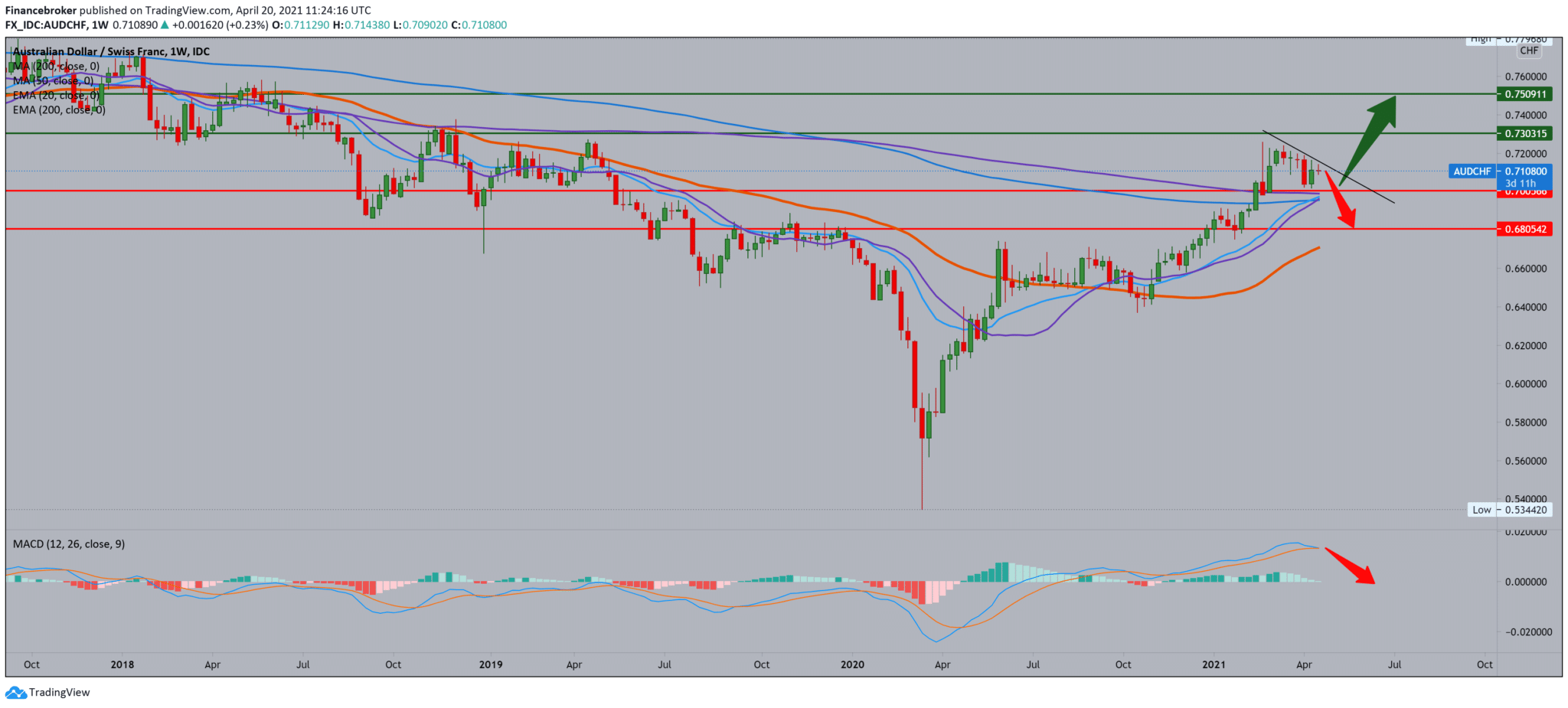

On the weekly time frame, we see the AUD/CHF pair slow down from 0.72000. Based on that, we look for support on the moving averages MA200 and EMA200, and that the break below them leads us to 0.68000 looking for better support on the MA50. For the bullish option, we need to first break above the upper resistance line, and after that, we can expect a further continuation of the globally larger bullish trend. The MACD indicator is at the beginning of the bearish trend, and based on it, bullish is a more relevant option.

-

Support

-

Platform

-

Spread

-

Trading Instrument