AUD/CAD forecast for December 16, 2020

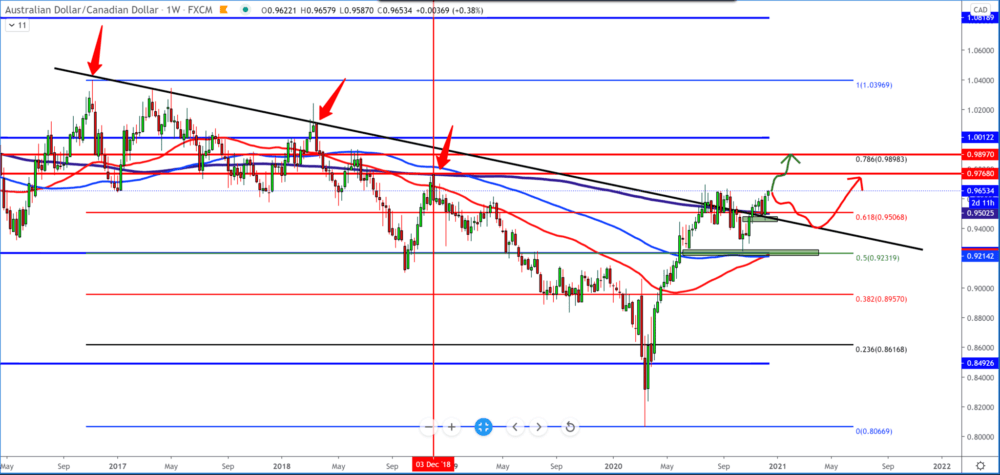

Looking at the chart on the weekly time frame, we see a strong bulls trend, and the AUD/CAD pair after the break moving averages MA50 and MA100 have now made a break well above MA200 with the support of Fibonacci levels of 61.8%.

If the trend continues, we can expect the pair to exceed 0.97000 and continue towards the next Fibonacci level of 78.6%, where we can expect stronger resistance technically. The couple can then make the jump above the previous high from December 2018.

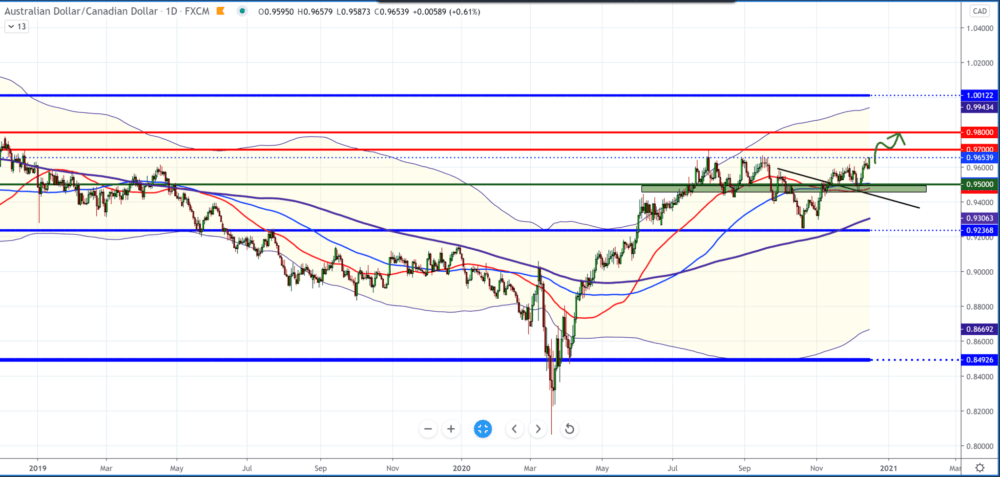

On the daily time frame, we see that after falling in March 2020, we see that the AUD/CAD pair finds support at 0.92350 in October and continues upwards to higher levels. From the bottom, it is supported with all three moving averages MA50, MA100, and MA200, as well as zones above 0.95000 where a retest to that level was made. The bullish scenario is still very likely, and we can expect the pair to climb above 0.97000 and even to 0.98000 levels from June 2018.

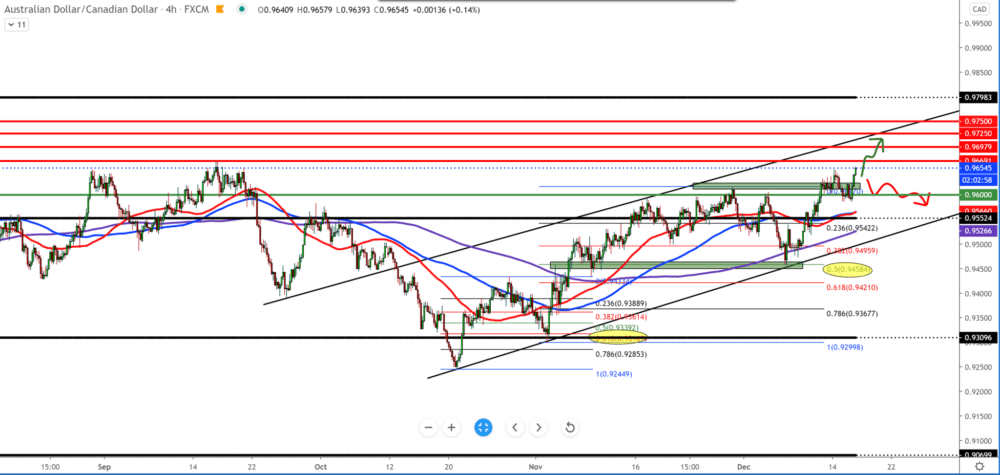

We have an ascending parallel channel in which the pair supports all three moving averages at different lower levels on the four-hour time frame. The previous high may be our trading targets as potential next resistance above 0.97000. We can base our bullish scenario on a parallel channel. We can see if the AUD/CAD falls below 0.96000 to 0.95500 of the channel’s lower edge for the bearish scenario within the channel.

The economic news for the pair this week is as follows: Australia’s manufacturing sector continued to expand at a faster pace in December, according to the latest Markit Economics survey on Wednesday with a five-month high PMI score of 56.0.

Individually, new orders’ growth reached a maximum of 25 months, and employment expanded at the fastest rate in just under three years. The report also showed that PMI service rose from 55.1 to 57.4, and the composite rose from 54.9 to 57.0 – both also five-month highs.

The six-month annual growth rate in the Westpac Melbourne Institute’s leading index, which indicates the probable pace of economic activity about the trend from three to nine months in the future, rose to 4.38 percent in November from 3.77 percent in October. The growth rate of the leading index has climbed an extraordinary 8.79 percentage points since June. The Core Consumer Price Index (CPI) report awaits us for the Canadian dollar this afternoon.

-

Support

-

Platform

-

Spread

-

Trading Instrument