AUD/CAD analysis for April 6, 2021

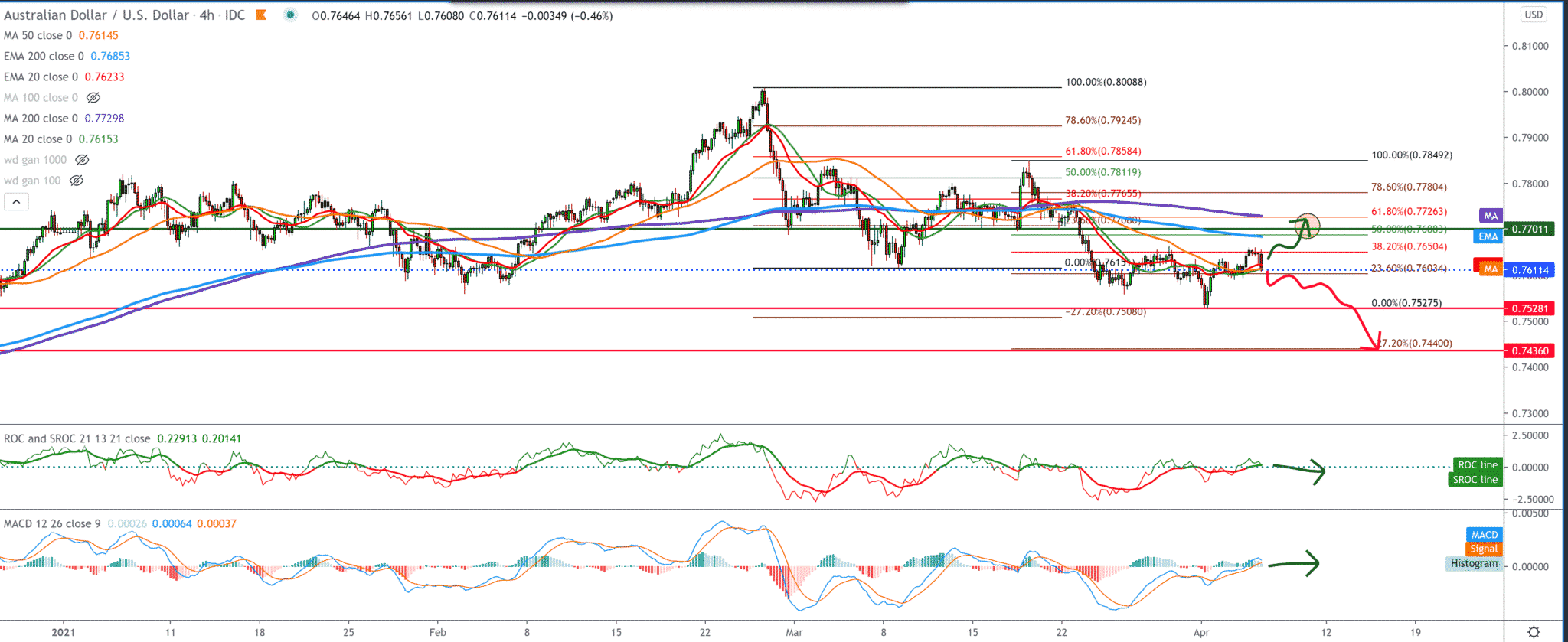

Looking at the chart on the four-hour time frame, we see that the AUD/CAD pair is in a downward trend. After reaching a maximum at 0.80000, we see a pullback after that to the current 0.76250. The AUD/CAD pair is now testing moving averages of MA20, EMA20, and MA50, and if it gets their support, then we are climbing towards MA200 and EMA200. As an aid, we can also use Fibonacci retracement levels, and if we look at the previous drop and pullback, we see that the pullback ended at 61.8% Fibonacci level.

When we set the Fibonacci level in this new pullback, we see support at 23.6% level, at 0.76000, but also resistance at 0.76500 at 38.2% level. A break above this leads us to a zone between 50.0-61.8% Fibonacci levels in the zone of 0.76800-0.77260. For the bearish scenario, we first need a pullback back below the 23.6% Fibonacci level of 0.76000; after that, our targets are the previous low, and the maximum target for the bearish is -0.272% level at 0.74360.

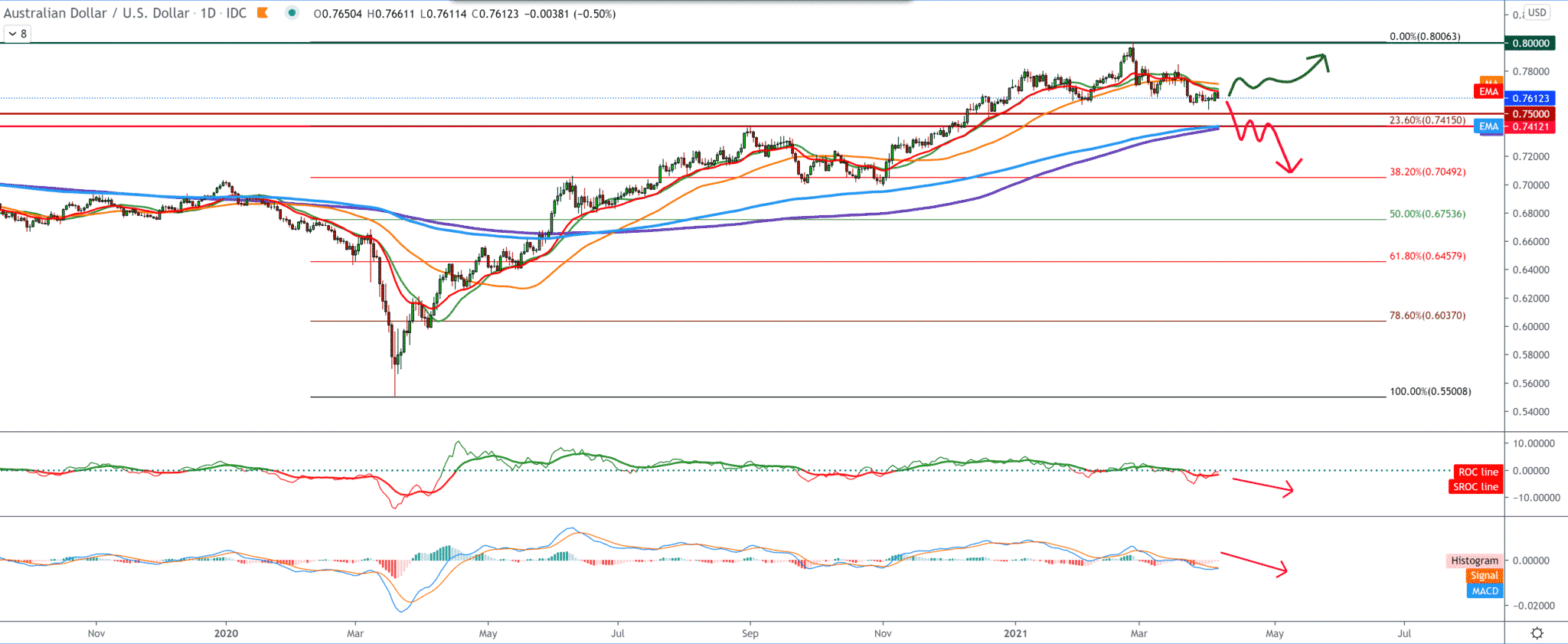

On the daily time frame, we see that the AUD/CAD pair is under the pressure of moving averages from the top, and if he wants to continue further to the bullish side, we need a break above them. Otherwise, we go down to the psychological level at 0.750000 and the first Fibonacci retracement 23.6% level to 0.74100. that zone coincides with the previous higher high of September 2020, and there is a likelihood of some support.

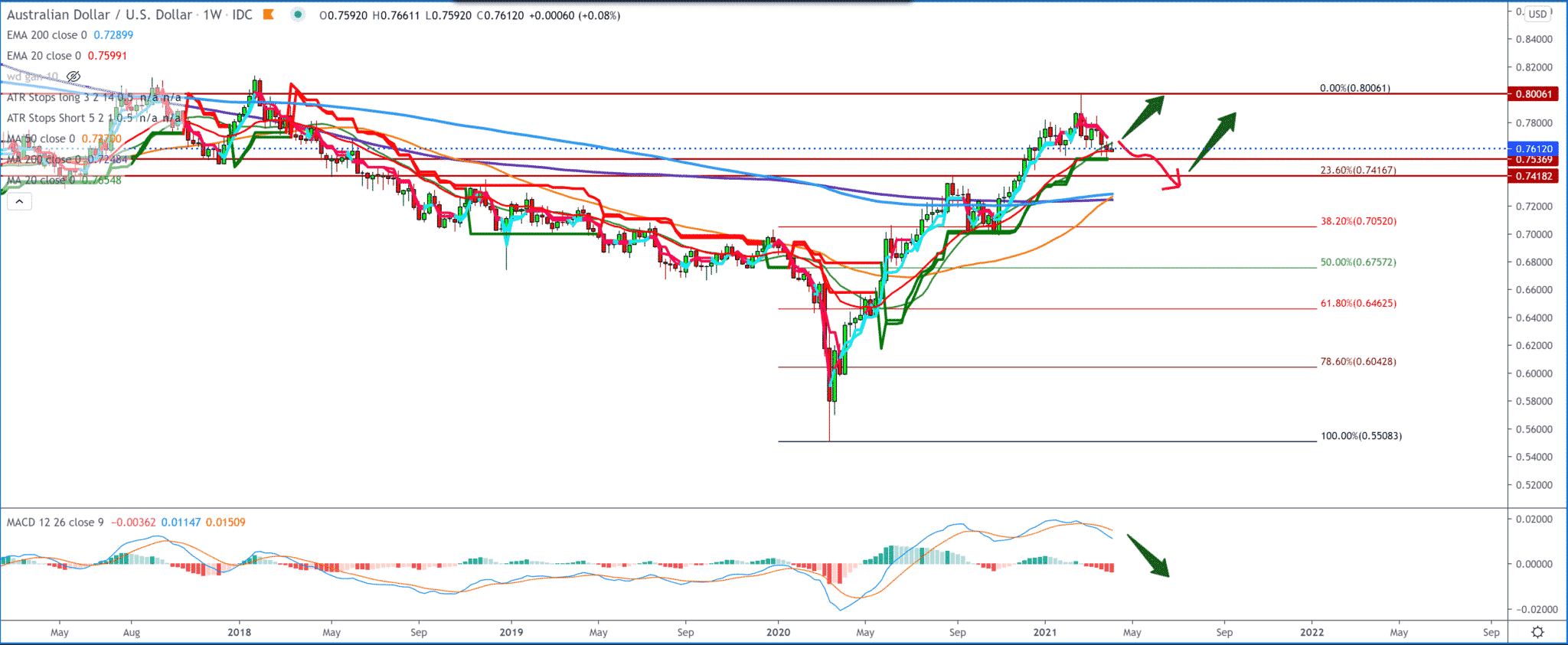

On the weekly time frame, we see the AUD/CAD pair retreat after reaching the previous high at 0.80000, testing the currently moving averages of MA20 and EMA20. The zone supports us at 0.75350 and the Fibonacci 23.6% level at 0.74180. We are expected to see a decline in the coming period as the dollar strengthened against other currencies in the basket. Looking at the bigger picture, we are still in a bigger bullish trend, and this is just a pullback.

-

Support

-

Platform

-

Spread

-

Trading Instrument