Ascending Triangle Pattern: Trading Strategy Guide (Part 1)

Trading with an ascending Triangle pattern is great, yet it is not that easy. In this post, you’ll learn a strategic guide to trade with an ascending triangle pattern.

Ideally, an ascending triangle indicates that as traders get stopped out, they are helping to push the market further. And to tell you, it is in your favor. Why? As they push they do stop orders on the losing trades, and those will be your profits.

Ascending Triangle Pattern:

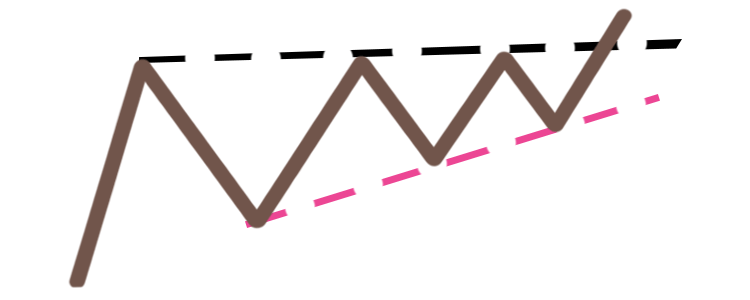

Ascending Triangle indicates a bullish pattern wherein it signals an incline movement in the market. Below you’ll see how this pattern looks like in a market chart.

In an ascending triangle pattern, you’ll notice a few higher lows approaching the resistance. Ascending triangle pattern mainly indicates three things. One, the buyers are keen to buy even at higher prices. Two, there is no selling pressure. Three, the buy stop orders are gathering over the resistance.

In an ascending triangle pattern, you’ll notice a few higher lows approaching the resistance. Ascending triangle pattern mainly indicates three things. One, the buyers are keen to buy even at higher prices. Two, there is no selling pressure. Three, the buy stop orders are gathering over the resistance.

We’ll further explain each, continue reading so you could fully understand the opportunities for you when this pattern occurs.

Buyers are keen to buy even at higher prices

Take note of the things we’ll be explaining now. This will logically be critical in some ways. Every time the buyers don’t have the interest to purchase at higher prices, higher lows are not to approach the resistance. Fact is, the market could have a series of higher lows. But with the ascending triangle, indicates an existing demand even with the continuous incline on the price.

There is no selling pressure

Meanwhile, if there are strong selling pressure, the price must not stay at resistance longer. Rather, it must move downward fast. However, when the price still moves closer to the resistance, it indicates that there is no selling pressure even if it’s in the conquering level.

The buy stop orders are gathering over the resistance

Now, as the price re-test Resistance, traders are to look short in the market and soon decide to stop loss over the resistance. However, there are instances that it breaks out higher. The stop order will then trigger, pushing further price advance.

Common mistakes in ascending triangle pattern

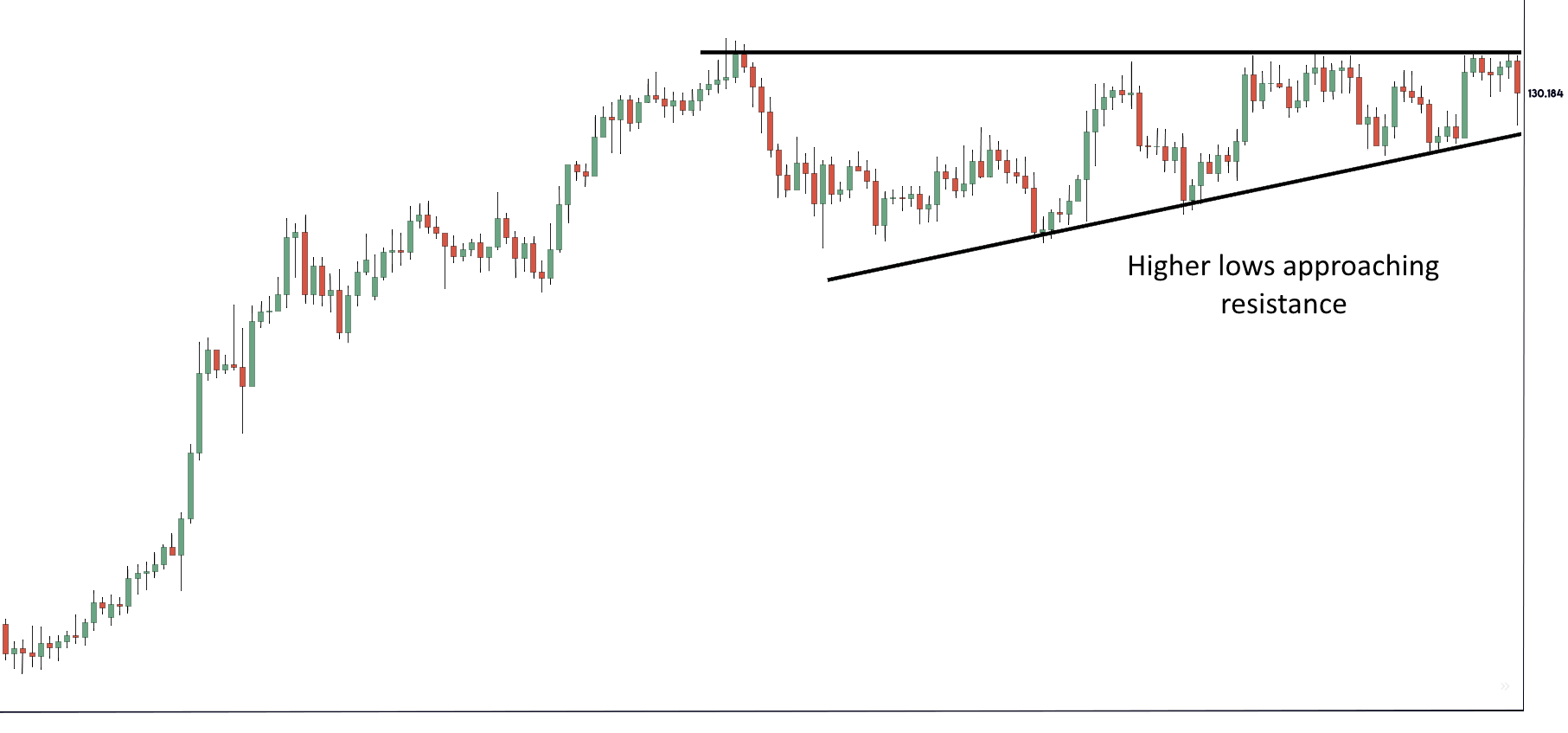

Most traders are to tell you to go short whenever the price is within the resistance. Yet, you should take note, not all resistance levels means for you to go short. Mainly because the price moves towards it. Look at the sample chart below to further understand the point.

Now would that be the best time to go short? You should learn that the higher lows coming to resistance is a great sign of strength. It somehow means that the market is about to have a breakout higher. Therefore, going short is not the choice at all times in these scenarios.

Now would that be the best time to go short? You should learn that the higher lows coming to resistance is a great sign of strength. It somehow means that the market is about to have a breakout higher. Therefore, going short is not the choice at all times in these scenarios.