Financial Industry: transformation via Cognitive Computing

Cognitive Computing (AI)

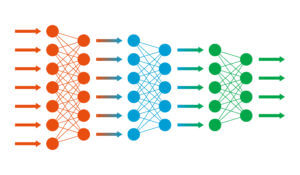

Even though the term Cognitive Computing is not as well known to the masses as AI (Artificial Intelligence). It is a branch of computer science, and it solicits to give machines the ability to think and behave like humans. It may sound very similar to AI. Both of these programs aim to emulate human behavior, but they are different. Artificial intelligence, mostly, deals with making machines efficient in decision-making and data analyzing based on given information.

Cognitive Computing analyzes data and makes decisions freely, without human interference. It acts in close accordance with human behavior. Cognitive intelligence works on human interaction and problem identification.

Its main analytical resources are not statistically based, but more of a bilateral nature. It is built on the AI system, but with the added capability to grasp the situational context. Cognitive Computing is just AI having significantly high levels of analysis, more advanced algorithms.

Humanized Fintech: Cognitive Technology in Finance

Banking and financial institutions aim for efficiency in customer service. That is why they were quick to adopt technologies that automate their processes. Notably, adopting modern technology contributes to more competent and capable financial services.

These activities include basic banking services like money withdrawals, payments, and transfer of funds, bank statement printing, resolving transaction-related issues, and solving account-related queries.

Advantages of Cognitive Computing in finance:

- CC Performs detailed customer analysis from various data and sources.

- It provides better and more efficient customer service, through conversationally adept chatbots.

- CC contributes to the balance between security and convenience.

- Implements Smarter Access Management.

- It Analyzes unstructured data instantly.

The use of cognitive technology in finance will make banking and finance more dynamic and competent. Additionally, the CC system will provide in the following ways:

Detailed Customer Analysis

Most of the systematic tools cannot make sense of unstructured data. Majority of all the data that are generated through sources social media content, customer feedback, and communications.

The main reason for that misunderstanding is the fact that all of the mentioned above is transcribed in natural language. Cognitive computing with advanced natural language processing capabilities will enable businesses to gather insights from such sources and make decisions based on highly detailed information.

ChatBots and CC: Contextualized Customer Service

Combining cognitive computing and Chabot can help in improving customer communication functionality and evolution in artificial problem-solving queries. It will adapt to answering customer questions.

Also, it provides customers with adequate and relevant data.

Improved Identity and Security Management

Furthermore, Cognitive computing will minimize the risk of illegal transactions. It will also make existing multiple-step customer identity verification and security system more safe and flexible. By gathering information on usual customer transaction and activity, thus easily tracing unusual actions.

In conclusion, Artificial Intelligence is constantly evolving. Numerous Financial institutions, both banking and non-banking ones, are already using AI-based systems. We can only imagine what will future technologies offer.

-

Support

-

Platform

-

Spread

-

Trading Instrument