Gold prices are declining while the dollar is strengthening

The combination of supply and demand governs the price of gold, a commodity that is traded on international markets. However, because it is a rare metal, demand greatly affects its price, while supply usually remains fairly consistent. There are many variables that affect the price of gold on the demand side. This includes the demand for jewelry (about 50% of the overall demand). Investment demand (about 30% of the whole demand). Demand from central banks (15% of the entire demand), and demand from industry (about 5% of the total demand).

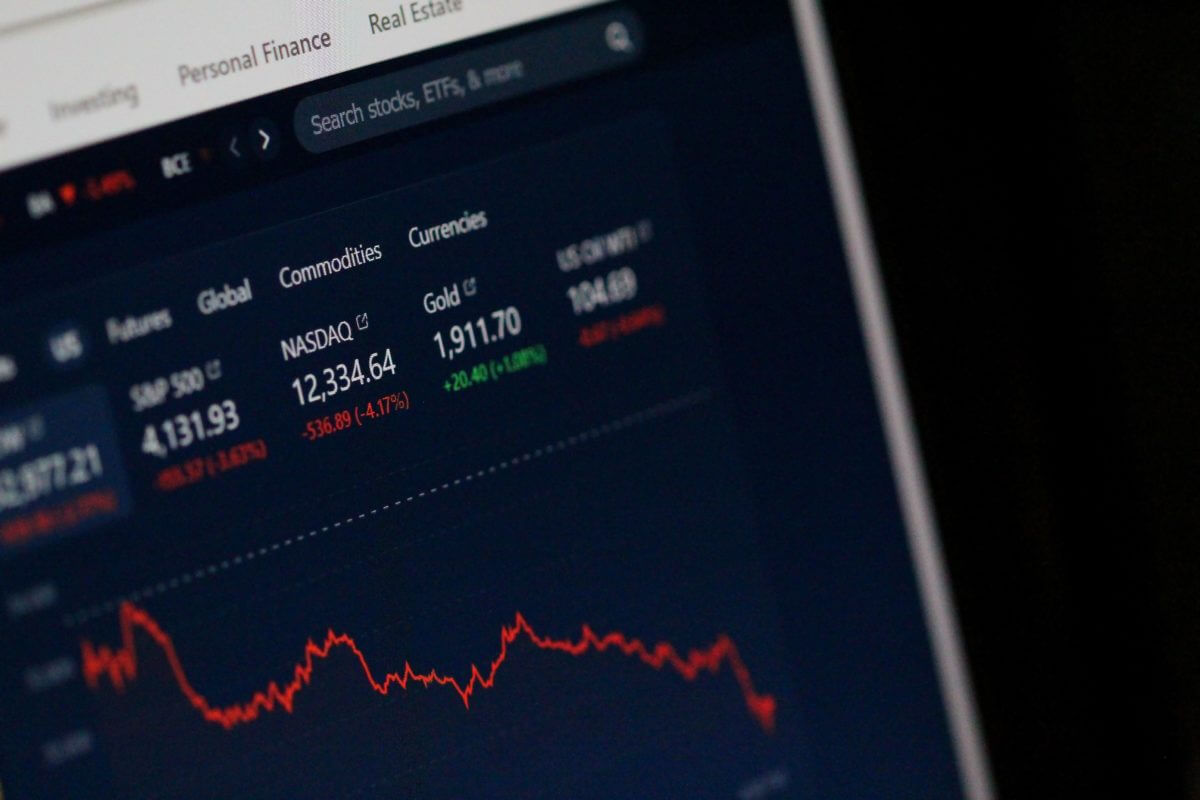

Today investors sought to reduce risk in preparation for the weekend. Gold prices fell for a fifth straight session as the dollar and bond yields rose. At last glance, the price of gold for December delivery was down $2.20 to $1,769.00 per ounce. With European stock markets largely declining and futures pointing to a lower opening for US markets, the decline occurs as investors flee to the shelter of the dollar. After briefly topping 108.08, the ICE dollar index increased to its highest level in a month and was last spotted up 0.47 points at 107.95.

Nearly half of all gold demand is made up of jewelry, which has a significant impact on gold prices. However, because individuals tend to buy more gold when prices are low and vice versa, the demand for jewelry is sometimes particularly sensitive to changes in gold prices. Because of this, when gold prices fall too much, jewelry demand tends to increase and provide a solid floor to the price (look at how jewelry demand increased in 2013 when gold prices fell).

Gold Prices: Deep Dive

Additionally, the demand for investments has a strong tendency to influence gold price (which includes buying gold bars and coins, investing in gold ETFs, exchange-traded derivative instruments on gold such as futures and options, etc.). In times of economic uncertainty and increased volatility, investors and money managers frequently increase the proportion of gold in their portfolios and vice versa. The price of gold is greatly impacted by this. In fact, although having a smaller share than jewelry demand. We would say that investment demand has a greater impact on deciding the direction of the gold price.

Bond yields are also rising, which is bad news for gold because it provides no interest. The US 10-year note’s current yield is 2.968%, an increase of 8.7 basis points. The forces influencing gold prices that appear to be on again And off again. They are actually the same themes that affect gold continuously and consistently. However, there are expectations that fluctuate regarding inflation, economic outcomes, and Fed policy. The back-and-forth means that gold prices alternate between headwinds and tailwinds.

Additionally, central banks frequently purchase gold on the market. The acts of central banks have an impact on gold prices as well because they frequently purchase in large quantities. Additionally, due to people acting in herds, central bank actions may have an indirect effect on the price of gold. Finally, during most of the day, the price of gold is significantly influenced by hedging and speculative actions in exchange-traded derivative instruments, such as gold futures and options contracts.