Another Taper Mirage Comes and Goes

S&P 500 succumbed to the bears – partially. The ADP figures lifted the dollar and put Treasury yields under pressure, which equals encouraging speculation that taper is coming. Rest assured, it isn‘t in practice, apart from communication exercises otherwise known as forward guidance, all happening during a week when the Fed injected $32bn into the markets. Today‘s non-farm payrolls can modestly boost that fata morgana, but it‘s a taper bridge too far. They can‘t meaningfully tighten, and they know it – look what happened last time Powell emphatically insisted (Dec 2018).

But the market reaction is what matters, and yesterday‘s session in (not only tech) stocks, precious metals and commodities, highlights the degree to which the transitory inflation story has been swallowed hook, line and sinker, dialing back the inflation commodity trades meaningfully (sideways). Should the transition into a higher inflation environment be appreciated for what it is, the dive in gold, silver and copper wouldn‘t have been that steep. On the other hand, the sharpest moves tend to be the countertrend ones – yes, I‘m still of the opinion that the current reflationary period with reopening rush (more juice left in value over growth trades) is conducive to higher stock market and commodity prices. Including precious metals, naturally.

For more proof, look at the barely budging inflation expectations (TIP:TLT rather than RINF which got spooked a bit too much – similarly to tech yesterday), and have a read of my extensive Wednesday and Thursday analyses, well worth it each but best when combined for your daily dose of countenance in the markets. What‘s new now, are the taper starting date (as if the discussion was initiated in the first place at all) considerations:

(…) what‘s holding stocks then? Neither uncertainty about the Fed policy, nor surging inflation cutting into P&L, nor crashing bonds – what we‘re seeing is run of the mill volatility as stocks move both into a structurally higher inflation environment, and await Fed moves which are much farther down the time line than the markets appreciate. Heck, even the option traders keep undergoing the earlier announced shift to complacency.

Yes, the taper talk has dialed back the inflation trades to a degree, but hasn‘t knocked them off in the least. In a reflation, both stocks and commodities do well, and we‘re still far away from worrying about weakening GDP growth rates (today‘s ADP and unemployment data are a good proof thereof) – in my view, worries about inflation not retreating nearly enough during this Treasury market lull (taking up this summer) would come into the picture first.

Moreover, the taper talk and market reaction to it, are exposing a key vulnerability in the Treasury market. The Fed is well aware that its ample support is a condition sine qua non, and that rising yields (rising real rates) aren‘t in the largest borrower and real economy‘s interests. Financial repression has to come into the picture, and that‘s one of the reasons why precious metals have been on a tear lately. We‘re also a long way from inflation breaking the back of stock market bulls:

(…) we‘re undergoing stock market and commodities‘ gyrations as we‘re settling into the new reality of higher inflation including expectations, which isn‘t yet putting the stock market to test. Neither the 10-year yield rising way over 2.5% would derail the sttock bull run – but the associated volatility would be keenly felt already at the 2% level. We‘re very far from that, meaning I am not worried about the stock market leadership baton passing exlusively over to tech (growth) stocks. That would equal panic.

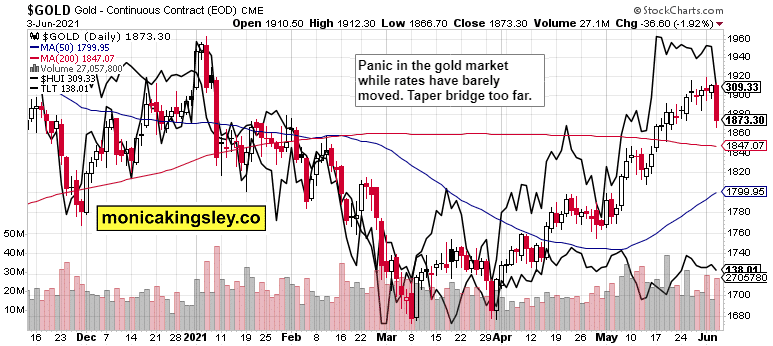

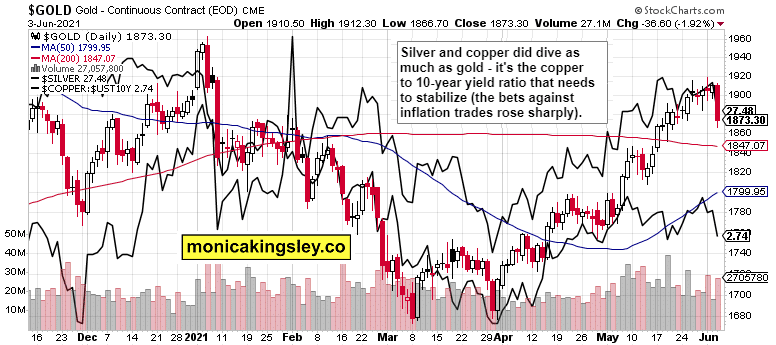

Gold got spooked, and the PMs dive bore signs of panic, but like it or not, the weakness has been consistent with the commodities retreat. While gold is the ultimate currency, real money in the JPM‘s own admission, it‘s sensitive to real rates moves – and expectations thereof. These took a hit yesterday, and it was as I warned earlier, more readily apparent in silver. Quoting yesterday‘s comment at my own site:

(…) ADP data came in positive, dollar rose and so did yields as the market (incorrectly) thinks that taper is closer. And tomorrow’s strength in non-farm payrolls would only reinforce that. The truth is though that the Fed can’t withdraw some liquidity, raise rates or even slow down the monetary expansion. Gold and commodities beyond copper (not oil though) are reacting, and miners don’t offer clues that this daily setback would be over. The taper smoke and mirrors game got a new lease on life, but the inflation trades aren’t over.

In other words, we have a way to go in stabilizing the metals, but these prices would prove a buying opportunity – not a selling one.

Oil is a different cup of tea – rising but not yet exerting enough pressure to sink the GDP growth story. Elevated, but supported by the oil index. A breather next would not be unimaginable – it would be welcome.

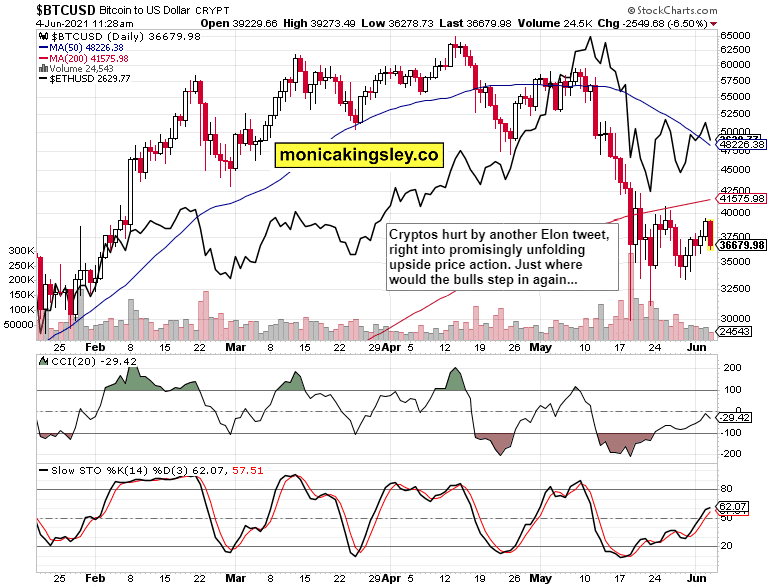

Cryptos got hit by the broken heart emoji Elon tweet, well what can I say about such tweets. Doge to the moon next? The bulls need to regain footing, and rather fast.

Let‘s move right into the charts (all courtesy of www.stockcharts.com).

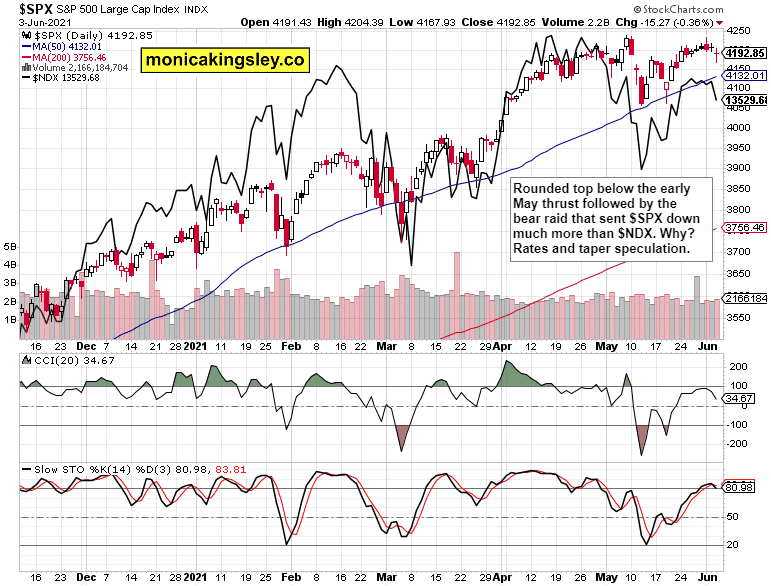

S&P 500 and Nasdaq Outlook

S&P 500 took a smaller hit than Nasdaq, and the volume in either isn‘t consistent with a reversal storyline. As said yesterday, I am looking for the bears to ultimately fail.

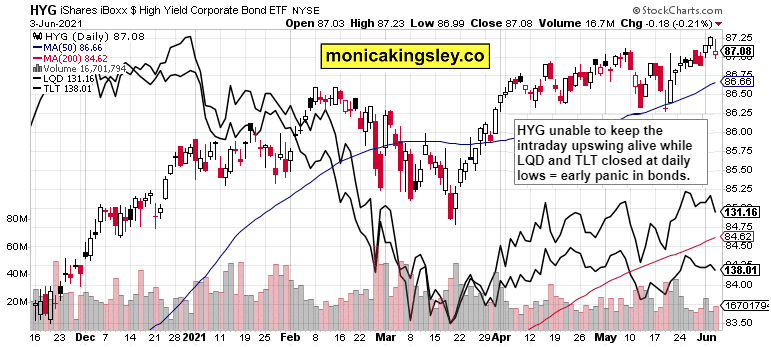

Credit Markets

High yield corporate bonds intraday reversal is equally worrying as the long-term Treasuries dive to its daily lows.

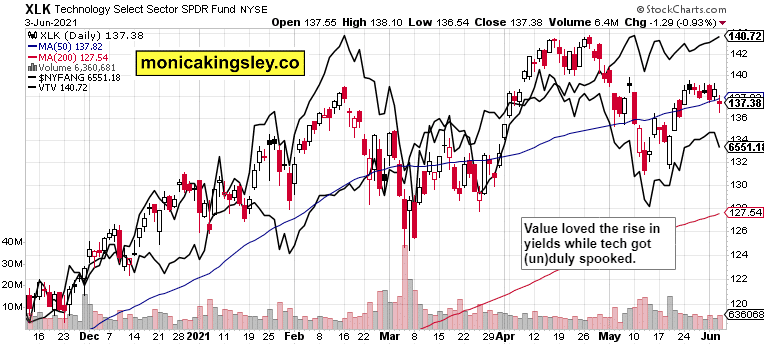

Technology and Value

Technology including $NYFANG overreacted in my view – but value continued to cheer the rise in yields. That‘s one more reason why stocks aren‘t dipping anywhere far.

Gold, Silver and Miners

Gold plunge doesn‘t reveal weakness through miners leading to the downside, and while respectable, the volume could have been bigger. The plunge seems overdone when nominal yields are concerned.

Silver and copper have been the missing pieces in the puzzle of gold‘s steep move yesterday. Note however that the copper to 10-year Treasury yield ratio isn‘t breaking down in any way.

Bitcoin and Ethereum

Bitcoin and Ethereum plunged on the headline, but would likely recover as the unrealistic taper expectations are dialed back.

Summary

S&P 500 bears served us the raid yesterday, but I am looking for a swift recovery of the ground lost. The taper myth isn‘t simply to be taken seriously.

Gold and silver remain well bid, and not even yesterday‘s plunge was a chart game changer. Dips remain to be bought, and the bull run is very far from over. As I wrote yesterday, the bears might come out from hibernation – only to be repelled though. Look for copper to stabilize as a precondition, with miners not falling through the floor.

Crude oil is relentlessly rising, and as long as other commodities join in the party, a meaningful correction isn‘t favored. In other words, today‘s price action won‘t almost definitely see one.

Bitcoin and Ethereum aren‘t as weak as the chart would suggest, and once yet another Elon disappointment is worked off (high hopes, disappointment, new hopes – wash, rinse, repeat), no thinking about thinking about talking taper would support the crypto bulls.

Thank you for having read today‘s free analysis, which is available in full at my homesite. There, you can subscribe to the free Monica‘s Insider Club, which features real-time trade calls and intraday updates for all the four publications: Stock Trading Signals, Gold Trading Signals, Oil Trading Signals and Bitcoin Trading Signals.

Thank you,

Monica Kingsley

Stock Trading Signals

Gold Trading Signals

Oil Trading Signals

Bitcoin Trading Signals

www.monicakingsley.co

[email protected]

* * * * *

All essays, research and information represent analyses and opinions of Monica Kingsley that are based on available and latest data. Despite careful research and best efforts, it may prove wrong and be subject to change with or without notice. Monica Kingsley does not guarantee the accuracy or thoroughness of the data or information reported. Her content serves educational purposes and should not be relied upon as advice or construed as providing recommendations of any kind. Futures, stocks and options are financial instruments not suitable for every investor. Please be advised that you invest at your own risk. Monica Kingsley is not a Registered Securities Advisor. By reading her writings, you agree that she will not be held responsible or liable for any decisions you make. Investing, trading and speculating in financial markets may involve high risk of loss. Monica Kingsley may have a short or long position in any securities, including those mentioned in her writings, and may make additional purchases and/or sales of those securities without notice.

-

Support

-

Platform

-

Spread

-

Trading Instrument