Admiral Markets Review 2020 – Is this broker good?

| General Information |

|

|---|---|

| Broker Name: | Admiral Markets |

| Broker Type: | Forex Broker |

| Country: | United Kingdom |

| Operating since Year: | 2001 |

| Regulation: | FCA, 595450, CySEC, 201/13, ASIC, 410681 |

| Address: | 16 St Clare Street, London, EC3N 1LQ UK |

| Broker Status: | Regulated |

| Customer Service | |

| Phone: | +44 20 35 140 756 |

| Email: | [email protected] [email protected] |

| Languages: | EN,ES,PT,IT,DE and others |

| Availability: | 24/5 |

| Trading | |

| Trading Platforms: | MT4, MT5, Web Trader, Mobile Trader |

| Trading Platform(s) Timezone: | GMT +2, GMT +3 |

| Demo Account: | Yes |

| Mobile Trading: | Yes |

| Web-based Trading: | Yes |

| Bonuses: | Yes |

| Other Trading Instruments: | Currencies, Indices, Shares, Commodities, Cryptocurrencies, Bonds |

| Account | |

| Minimum Deposit ($): | 100 USD |

| Maximum Leverage: (1:?) | 1:500 |

| Spread: | Variable |

| Scalping Allowed: | Yes |

Review Contents:

- Introduction to Admiral Markets Review;

- Regulation And Safety;

- Trading Products;

- Admiral Markets Trading Account Types;

- Trading Platforms;

- Deposits and Withdrawals;

- Admiral Markets Review Summary.

Introduction to Admiral Markets Review

If you’ve ever tried to search for blogs and articles that teach you about forex markets, you probably have read an article or two from Admiral Markets.

Founded in 2001, Admiral Markets is among the longest-running online brokerages in the world of forex. It’s the brand name of Admiral Markets Group. It has offices in the United Kingdom, Estonia, Cyprus, and Australia.

This broker is dedicated to expansion, turning into a truly global organization. There’s a lot that this broker has to offer too. So, let’s dig into it.

Admiral Markets Regulation and Safety

There’s no question about Admiral Markets’ legitimacy. It has investment firms that are publicly known for good reputation and services. The regulations also come from different authorities, such as:

- Financial Conduct Authority (FCA)

- Estonian Financial Supervision Authority (EFSA)

- Cyprus Securities and Exchange Commission (CySEC)

- Australian Financial Services License (AFSL)

- Australian Securities and Investment Commission

These regulators are among the top-tier regulating bodies, with the FCA and ASIC being tier-one regulators.

So, if you’re asking whether regulators know this broker and know what it’s doing with its client, you’re going to be satisfied with the regulatory status. Also, you can easily find the regulatory license numbers and registrations on Admiral Markets’ website.

As for the safety of funds, Admiral Markets keeps the client funds safe using a variety of policies. It also promises to protect investors from other similar risks.

The Funds

Funds are in segregated funds separate from the broker’s funds in compliance with FCA policies. This rule ensures that the broker cannot and doesn’t use the clients’ funds for any other purposes. There should be no mix-ups in funds.

At the same time, Admiral Markets also follows the Financial Services Compensation Scheme (FSCS). This policy compensates clients as much as 85,000 British pounds should the company stumbles upon tough financial times.

Then, there is also the negative balance protection that compensates Professional Clients for up to £50,000 per client.

In other words, Admiral Markets takes client protection seriously. It is less likely to lose money when trading with Admiral Markets.

Admiral Markets Trading Products

Online trading has made it easier for traders to access a ton of tradeable assets at the tip of their fingers. Admiral Markets ensures that its clients benefit from this feature of technology.

Admiral Markets is a forex and CFDs broker. Among the instruments you can trade are:

- Forex

- Cryptocurrency CFDs

- Index CFDs

- Share CFDs

- Bond CFDs

- Commodities CFDs

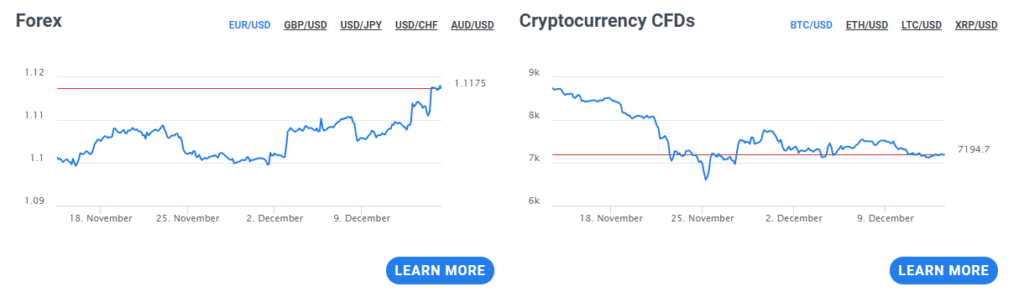

Its forex offering has more than 40 CFDs on currency pairs, with variable spreads and maximum leverage of 1:500. It offers all the major currency pairs, minor pairs, and even exotic ones. There are live updates that help you track the progress of your trades in real-time.

Admiral Markets is also a huge fan of cryptocurrencies. It lets its traders trade CFDs on various cryptocurrency pairs, such as:

- BTHUSD

- BTCUSD

- ETHUSD

- LTCUSD

- XRPUSD

Their cryptocurrency products have competitive leverage rates. It offers 1:5 leverage for Professional Clients, while 1:2 leverage is available for Retail Clients. You can also trade in any direction, whether long or short when you are trading crypto. But you don’t have to own real crypto assets, just CFDs. Please consider, that CFDs are complex instruments. There is high chance of losing your money when trading CFDs. So, trading CFDs, requires particular trading experience.

Volatility Protection Settings

Admiral Markets also know that while volatility is necessary for traders to profit, it can also be the ax that will cut their trading career short.

This online broker knows that traders need protection from so much volatility, so it created Volatility Protection Settings.

With this feature, Admiral Markets is widening your trading orders and settings. You can limit the maximum price slippage on the market and stop orders. If done right, you can even altogether avoid losses on pending orders into price gaps.

In short, this feature lets you use a ton more functions with your orders. You gain more control of your trade.

What can we say about this? Admiral Markets knows what it’s doing when it comes to client protection. That’s the tea.

Admiral Markets Trading Account Types

Admiral Markets offer different sets of account types depending on the region where you are trading.

If you’re in London, under FCA, you can choose:

- Admiral.MT5 Account

- Admiral.Invest Account

- Admiral.Markets Account

- Admiral.Prime Account

If you’re under the ASIC and CySEC jurisdiction, you get access to:

- Admiral.MT5 Account

- Admiral.Markets Account

- Admiral.Prime

Admiral MT5 Account

MT5 is the newest generation of the MetaTrader platform, coming after the MetaTrader4 platform, which is highly popular for forex traders.

With the Admiral.MT5 account, traders enjoy featured-filled trading. Moreover, MT5 has a lot more features than MT4, and it also improved on the perceived weaknesses of its predecessor, namely that it was only mainly used for forex trading. The MT5 can be for many other markets.

With this account, traders can use the leverage of up to 1:30 (1:500 for Professional Clients), with spreads from 0.5 pips. The minimum deposit is $200.

Admiral Markets Account

This account is among those that use the MT4 platform, which, as we’ve mentioned, is the most popular platform for forex traders.

It offers forex and CFDs on various instruments for a minimum deposit of $200. The maximum leverage for Professional Clients is 1:500 and 1:30 for Retail Clients. Spreads start at 0.5 pips.

Admiral Invest

Now, Admiral Markets know that the forex market isn’t the only financial market in the world. The Admiral Invest account offers stock and ETF trading in this account. It allows traders to invest in these assets using the MT5 platform.

Unfortunately, though, this account doesn’t offer any leverage. The minimum deposit at $500 is also more than twice the amount for the other accounts. The spreads start at 0.0 pips.

Admiral Prime

This account is for active traders who want to trade forex and CFDs. The minimum deposit for this account is the highest: $1000. Retail Client leverage is 1:30, while Professional Clients can use as high as 1:500 leverage. Spreads start at 0.0 pips. This account runs on the MT4 platform, which is also highly popular among active traders.

Overall, Admiral Markets have a pretty good selection of trading accounts, covering various types of traders. Of course, they also offer demo accounts for those who want to practice trading.

Trading Platforms

Apart from the variety of trading accounts, Admiral Markets also offers a variety of trading platforms. And while we’ve given you a gist of both the MT4 and MT5, it’s worth going through their features again to let you see just how good they are.

MetaTrader5

As we have mentioned, MT5 is the newest trading platform from MetaQuotes, which is famous for creating the industry standard MT4.

MT5 works miracles on trading. It offers the trader access to thousands of markets, superior charting capabilities, trading robots, level II pricing, and VPS support, among many other features.

MT5 is available on Android, iOS, Windows, and Mac. So, you can trade using it anytime and anywhere.

Offering this platform is a good move for Admiral Markets. Unlike other brokers that offer only the MT4 platform, Admiral Markets shows that it is willing to expand and adapt to the changing technological environment. This quality is a plus point for the broker.

MetaTrader4

But even if the MT5 is gaining stronger footing with broker and trader demands, the MT4 is still the most widely used trading platform in the world. It’s easy to see why.

The MT4 has been around for years, and through that time, it has improved on a lot of things.

Traders have also been familiarized with its features so much that switching to another platform may not be so practical for them if they can still use MT4.

The MT4 is super user-friendly, flexible, secure, customizable, and fast. It’s also famous for its automated trading and advanced charting features. It doesn’t fail to satisfy traders who use it.

Similar to the MT5, the MT4 can be on any mobile device and mainstream operating systems.

Traders can use it anytime they want and anywhere they are.

Of course, you can also use the MetaTrader WebTrader, which doesn’t require any download and is compatible with any OS.

MetaTrader Supreme Edition

Now, if you are bored with the usual MT4 and MT5 stuff, you can choose the MetaTrader Supreme Edition, where you can access a truckload more features to your trading.

The supreme edition is free for live and demo accounts so that you can test it for free at admiral markets. You can perform technical analysis with Trading Central and Trader Insight, which uses superb technical analysis on every financial instrument.

There are also the Global Opinion widgets — powerful add-ons that ensure better and more efficient trading. You also have the Mini-Terminal, Tick Chart Trader, Trade Terminal, Indicator Package, and many more.

In fact, Admiral Markets wants you to have everything.

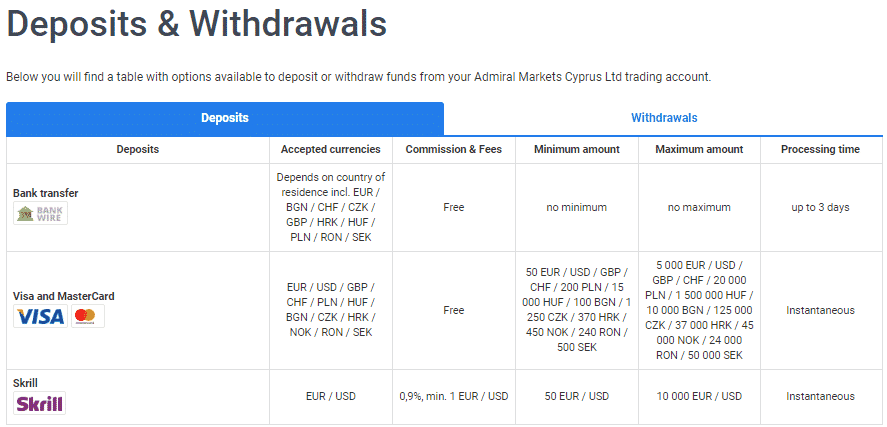

Admiral Markets Deposits and Withdrawals

The Admiral Markets also offers a ton of ways to deposit and withdraw funds. The methods include:

- Bank Transfers

- Visa and MasterCard

- eWallets

Minimum deposits and withdrawals are different for each method (some a free), while your location may also affect the charges you will pay.

More importantly, there have been no issues in regard to the funds of clients in this broker.

Admiral Markets Review Summary: Is it Good?

With a ton of features, a wide variety of account types fit for many kinds of traders and investors, and fully packed trading platforms, it is challenging to deny Admiral Markets the chance to prove it’s a good broker.

It’s not only a good broker—it’s an excellent one, according to other reviews we’ve seen so far. This forex and CFDs broker ensures that traders have control over their trades and trading career.

Is it Good Broker?

If you’re a trader who wants variety and flexibility, as well as superb customer care, Admiral Markets is more than worth the shot.

All in all, we can say that Admiral Markets is a stable platform for trading. Their customer service is available 24/7 for live chat.

Thus, for MetaTrader enthusiasts looking for the entire MetaTrader platform suite, numerous trading tools, and add-ons, Admiral Markets is the right choice. It finished in first place for education. Moreover, Admiral Markets was voted number one in Best in Class Broker MetaTrader in 2020, out of all MetaTrader brokers. The company offers numerous additional tools for trading and a competitive range of tradeable products.

As already said, it has regulatory licenses across continental Europe, Estonia, Cyprus, the United Kingdom, and Australia.

-

Support

-

Platform

-

Spread

-

Trading Instrument

Bad withdrawal process

The withdrawal process is really very annoying. Aside from those tons of documents asked for, waiting takes longer time than usual.

Did you find this review helpful? Yes No

Scammers

Do not trust them. They are scammers.

Did you find this review helpful? Yes No

Slow withdrawals

Frustrated that I have to wait long enough for my withdrawals. They ask me to wit every time I do a follow-up call.

Did you find this review helpful? Yes No

Poor trading company

Poor trading company. Do not deal with them.

Did you find this review helpful? Yes No