ADAO and $EPRINT tokens are trending. What about ARKN?

ADADAO is an interesting Defi protocol. The founder team created it on the Cardano blockchain. The latter facilitates the creation of fully collateralized stable coins. The company decided to start with ADA tokens only. However, the community members can determine if they want to add more assets.

ADADAO functions as a DAO, and it offers all the advantages of such a platform. ADAO is the network’s utility and governance token. It allows customers to decide how the protocol functions and gives them a share of the fees raised through the protocol.

Even though the ADADAO foundation is taking care of the project’s initial development, it plans to offload its duties to the Governance gradually. ADAO and AUSD are Cardano Native Tokens. Thus, users need to have a supported Cardano wallet to receive it. Token holders will also be able to trade them in various exchanges.

According to the team, the AUSD stable coin is a soft-pegged cryptocurrency. It is decentralized, unbiased, and collateral-backed. Users can store it in wallets or use it on platforms. Moreover, ADADAO Vaults are non-custodial and permissionless protocols. The team ensures that all generated stablecoins are backed on-chain by excess collateral.

The ADADAO Protocol allows customers to earn AUSD by placing collateral assets into ADADAO Vaults. Token holders can access liquidity, while others can acquire AUSD by buying it from brokers or cryptocurrency exchanges.

Investors can use AUSD exactly like any other cryptocurrency. They can send the tokens to others, use them to pay for goods and services, or buy more ADA for creating a leveraged position.

The company backed every AUSD in circulation with extra collateral. It means that the collateral is worth more than the AUSD loan. Besides, traders can see all AUSD transactions on the Cardano blockchain.

What about the platform’s features?

The ADADAO Protocol offers many exciting features. For example, it has a stable fee. The company calculates a percentage on top of the amount of AUSD generated against the collateral of a Vault. Customers can use only AUSD to pay the fee, transferring it to the ADADAO Buffer. However, this is a one-time fee. It does not depend on the duration of the loan.

Furthermore, if the Liquidation Ratio is low, ADADAO Governance expects low price volatility of the collateral; But if the Liquidation Ratio is large, then the Governance expects considerable volatility. The team noted that the Liquidation Ratio would be different for every asset. It starts with only ADA collateral, but later the community will determine the liquidation ratio through a governance proposal.

There is also a Liquidation Penalty. The latter is a fee added to a Vault’s total outstanding generated AUSD when a Liquidation occurs. The platform charges this penalty to incentivize users to always keep their positions over collateralized. ADADAO Vaults also have a limit on how long Collateral auctions can last.

How can traders use the Vaults?

A user will be able to fund a Vault with a certain type and amount of collateral. The company will use these funds to generate AUSD via the ADADAO web app. The platform deems a Vault collateralized after the user funds it.

Suppose a customer wants to create a certain amount of AUSD in exchange for keeping their collateral locked in the Vault. In that case, they must conduct a transaction and subsequently confirm it in their unhosted cryptocurrency wallet.

While owning a Vault offers many advantages, the owner must pay down or totally pay back the AUSD they generated, along with the Stability Fee on the AUSD outstanding, to reclaim a portion or all of the collateral. The Vault remains vacant until its owner chooses to make another deposit after returning all AUSD and collecting collateral.

The company decided to launch its native ADAO token on February 7, 2022. The sale will end on February 10, 2022. 20,000,000 ADAO will be available for purchase, which is only 4% of the total supply. The token price will be $0.025000 during the initial coin offering. The team aims to raise $500,000 with the sale, and it will accept USDT and BUSD in exchange for its tokens.

The EverPrinter will also start its ICO soon

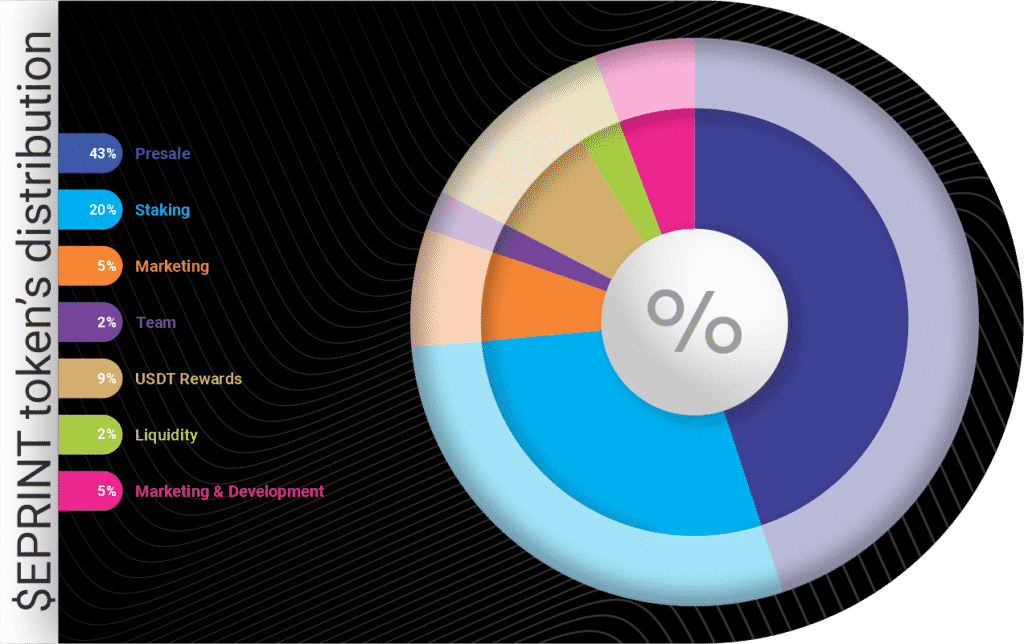

Everprinter is a high-dividend-rewarding token. The creator company based it on the Binance Smart Chain. Its team is very experienced, and it created a solid code. Everprinter plans to launch its $EPRINT native token on February 8, 2022. The sale will end on February 9, 2022.

Currently, there is approximately $200 billion locked in various DeFi protocols and apps, generating passive income for investors and traders. But many of these applications are difficult to use. Besides, some of those apps pose a huge risk in proportion to their potential upside.

That’s why EverPrinter decided to introduce its new Defi project. Based on the Binance Smart chain, this project focuses on bringing a plethora of rewards to its users.

The team has built this token with security and ease of use in mind. Investors will be able to purchase EPRINTs easily with either BNB or by FIAT.

What about MATICPAD and ARKN tokens?

The Matic Launchpad will start its ICO sale on February 10, 2022. This platform will support all Major Blockchain Networks, including Ethereum, Binance Smart Chain, Avax, Polygon, and Solana. The team announced that Phase 1 would bring projects on Ethereum, Binance Smart Chain, and Polygon chain. However, Phase 2 will enable to add projects on Polkadot, Avax, and KCC Network.

Matic Launchpad will provide promising Crypto projects the platform to raise capital. It will allow crypto enthusiasts to become part of amazing crypto projects from an early stage.

According to the team, 466,666,666 MATICPAD tokens will be available for purchase. That is 9% of the total supply. The token price will be $0.001500 during the initial coin offering. The company aims to raise $700,000 with the sale, and it will accept BNB in exchange for MATICPADs.

Meanwhile, Ark Rivals decided to launch its native token ARKN on February 16, 2022. The total supply of this BEP-20 token is 1,000,000,000. Its price will be 0.05 USD during the ICO sale. Ark Rivals is a Sci-fi action strategy NFT game with great potential. The token is high-ranked as well.

-

Support

-

Platform

-

Spread

-

Trading Instrument