A slight recovery in Ethereum prices

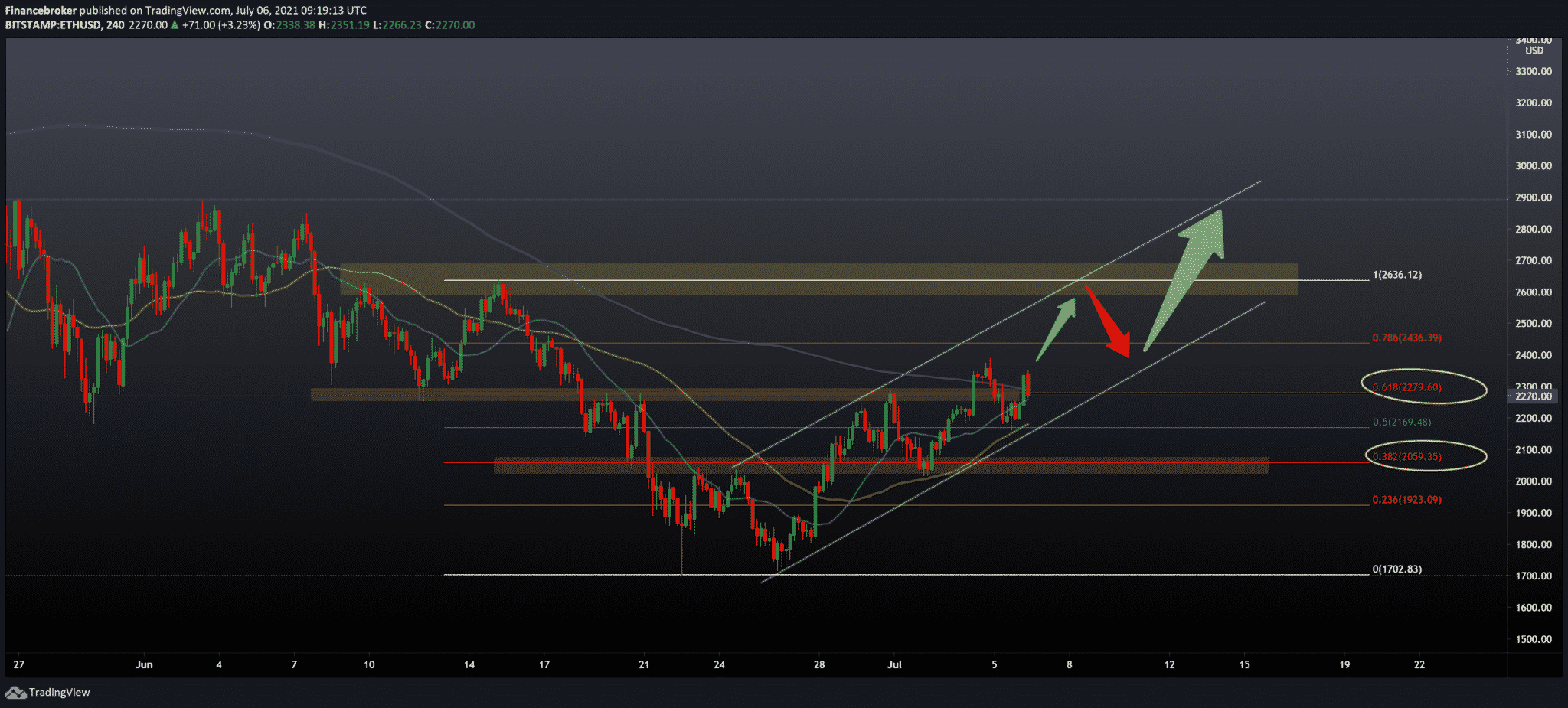

Ethereum’s price has set three higher highs and three lower lows since June 24th. By connecting these oscillating points using trend lines, we can create a certain growing parallel channel.

This technical pattern predicts a drop of $ 2030 to $ 1,720, determined by measuring the distance between the first high and low swing and adding a breakout point to $ 2,245. However, the decline could be halted in the demand zone ranging from $ 2,292 to $ 2,022. Therefore, investors can expect ETH to break from this area to bring down the average value of the range to $ 2,280 at the Fibonacci 61.8% level. If this were to happen, the price of Ethereum could increase further by 25% to bring the range high to $ 2,880 after crossing the middle barriers to $ 2,436 and $ 2,636. If sales pressure increases enough to break through the demand zone stretching from $ 2,160 to $ 2,280, ETH is likely to move toward its projected $ 2,000 target.

In the extremely bearish case, the price of Ethereum could eventually reach the lowest range of $ 1,720.

The two main upgrades via the London hard fork relate to changes to the network transaction fee model and changes to the time bomb with difficulties. EIP-1559: Changing the fee market is the most significant element. It includes a new deflation mechanism that will burn the basic fee, leading to greater scarcity and increased long-term sustainability of the Ethereum network.

Currently, customers are bidding to pay a fuel surcharge. This encourages miners to give priority to transactions based on the added fee.

According to EIP-1559, each block will instead have a fixed, linked fee, making a more predictable and equitable mining mechanism. With one eye on ETH 2.0 and moving from proof of performance to proof of role, EIP-3228 will apply a heavy time bomb, which means that the blocks will become more difficult to exploit over time, which will gradually make the process unprofitable. There will come a time, estimated at K2 2022 when mining becomes so unprofitable that miners will have no choice but to stop mining on Ethereum 1.0.

-

Support

-

Platform

-

Spread

-

Trading Instrument